Non Wage Compensation Examples

Description

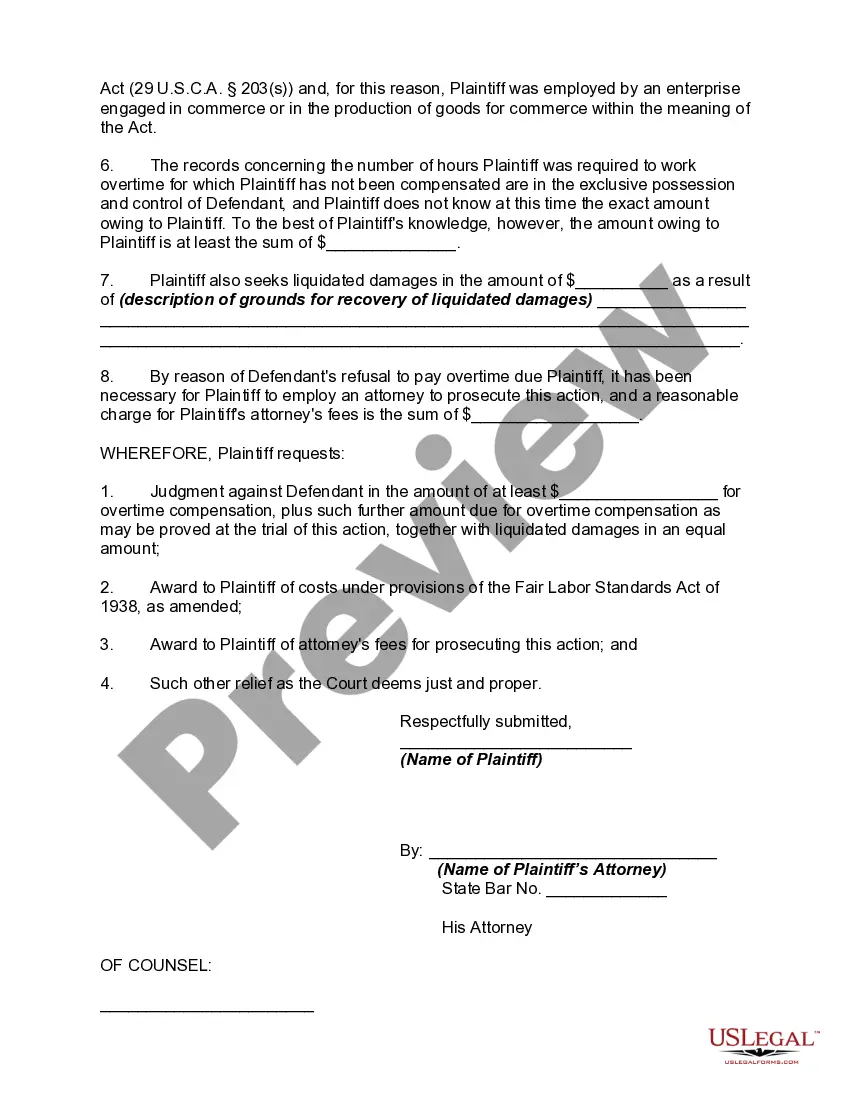

How to fill out Complaint To Recover Overtime Compensation Or Wages In State Court Under Section 16(b) Of Fair Labor Standards Act?

Managing legal documents can be exasperating, even for experienced experts. When searching for examples of non-wage compensation and lacking the time to seek out the correct and current version, the tasks may become overwhelming. A comprehensive online form database could revolutionize how individuals handle these scenarios efficiently.

US Legal Forms stands as a frontrunner in the realm of digital legal documents, offering more than 85,000 state-specific legal forms accessible at any time.

Tap into a valuable repository of articles, guides, and materials pertinent to your circumstances and needs.

Save time and effort in locating the documents you require, and leverage US Legal Forms’ advanced search and Preview feature to discover non-wage compensation examples and download them. If you hold a subscription, Log In to your US Legal Forms account, search for the document, and download it. Check your My documents section to review the documents you have previously downloaded and manage your files as you see fit.

Enjoy the US Legal Forms online catalog, backed by 25 years of experience and trustworthiness. Improve your daily document management with a seamless and user-friendly approach today.

- Verify it is the correct document by previewing it and reviewing its details.

- Confirm that the example is sanctioned in your state or county.

- Click Buy Now when you are prepared.

- Select a monthly subscription option.

- Choose the format you require, then Download, complete, eSign, print, and dispatch your documents.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any requirements you might have, ranging from personal to corporate paperwork, all in one convenient location.

- Utilize sophisticated tools to complete and manage your non-wage compensation examples.

Form popularity

FAQ

When dealing with nonemployee compensation, it is important to accurately track and report these payments for tax purposes. Nonemployee compensation examples include payments made to independent contractors or freelancers for services rendered. You should ensure that you provide the necessary tax forms, such as the 1099-NEC, to these individuals. Utilizing platforms like US Legal Forms can streamline this process, making it easier to manage your records.

Nonemployee compensation includes payments made to individuals who are not classified as employees but provide services for a business. This can consist of payments for freelance work, contract labor, or consulting services. Common examples of non wage compensation examples include fees for services or commissions earned. Using platforms like US Legal Forms can simplify the process of managing and reporting these types of payments, ensuring compliance and clarity.

Non-salary compensation refers to benefits or payments that are not part of an employee's regular salary. This can include bonuses, commissions, and perks such as health insurance or retirement contributions. Non wage compensation examples also encompass payments to independent contractors, which are reported on forms like the 1099-NEC. Understanding these forms of compensation can help both employers and employees clarify total compensation packages.

The primary difference between a 1099 and a 1099-NEC lies in the type of income being reported. The 1099 form encompasses various types of income, while the 1099-NEC specifically focuses on nonemployee compensation. If you are operating as a freelancer or independent contractor, you will likely receive a 1099-NEC for reporting non wage compensation examples. Using the correct form ensures accurate reporting and compliance with tax regulations.

You would receive a 1099-NEC if you are an independent contractor or freelancer who earned at least $600 from a business during the tax year. This form reports nonemployee compensation, which includes payments for services rendered. Understanding the implications of this form can help you accurately report your income and manage your taxes effectively. For non wage compensation examples, consider payments for consulting, freelance work, or other contractual services.

Nonemployee compensation includes payments made to individuals who are not classified as employees. This typically covers independent contractors, freelancers, and other service providers. Common non wage compensation examples include fees for services, commissions, and bonuses. Understanding these classifications can help you accurately report income and ensure compliance with tax regulations.

Examples of non-monetary compensation include work flexibility, experiential rewards, and additional time off, but more on that later.

How to design an employee compensation plan? Define the company's compensation philosophy. Research and analyze the job market. Decide whether you want to implement salaries or hourly wages. Defining employee salaries. Define employee hourly wages. Bonus tips: Calculating commissions. ... Select the benefits you'll offer.

Even if the employer is unable to provide the salary amount you want, they may be able to offer other forms of compensation. For example, you may be able to negotiate more stock options, extra vacation days or additional work-from-home days to combat a lengthy commute. Do not be shy about asking for alternatives.

For example, the employer may offer health insurance, dental insurance, life insurance, short- and long-term disability insurance and vision insurance. Employee retirement plans, like 401(k) plans, are another common form of indirect compensation. Equity-based programs are another compensation offering.