Release By Individual Withholding

Description

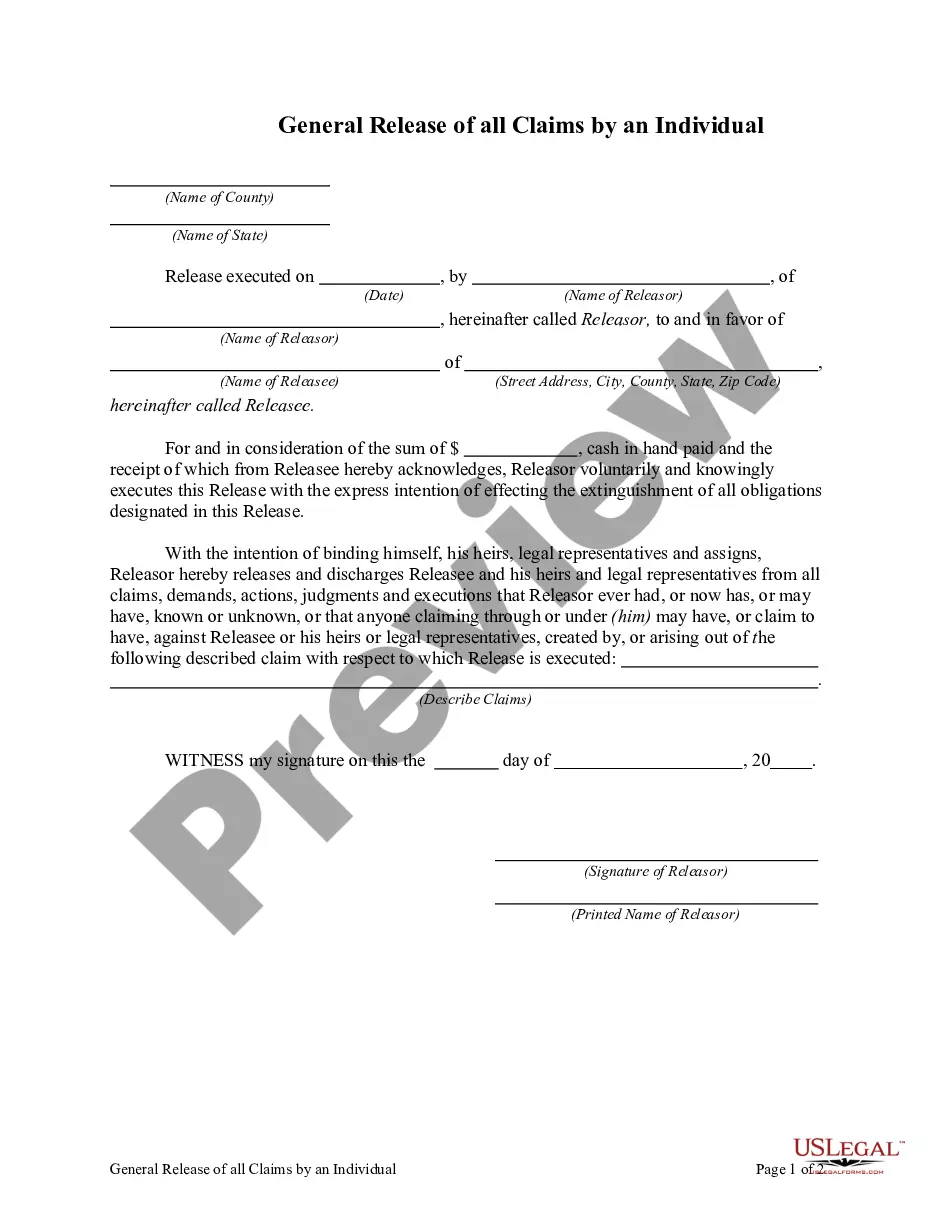

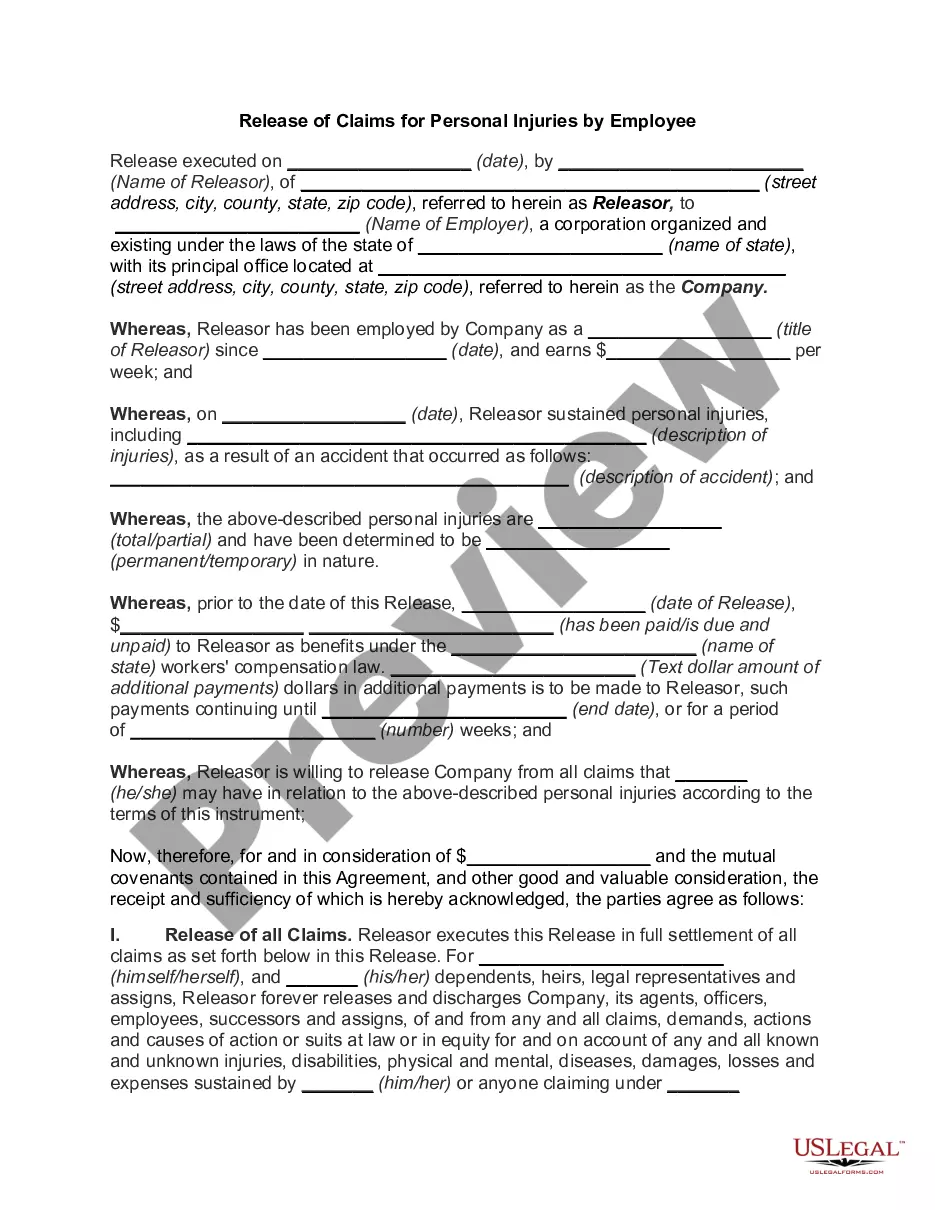

How to fill out General Release Of All Claims By An Individual?

Bureaucracy requires exactness and correctness.

Unless you handle completing forms like Release By Individual Withholding daily, it could lead to some confusion.

Choosing the appropriate sample from the outset will ensure that your document submission will proceed smoothly and avert any complications of re-submitting a document or repeating the same tasks from the start.

Finding the correct and updated samples for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate the bureaucracy uncertainties and simplify your paperwork.

- Locate the template using the search box.

- Ensure the Release By Individual Withholding you’ve found is applicable for your state or district.

- Review the preview or examine the description that includes the details on the application of the sample.

- If the result meets your request, click the Buy Now button.

- Select the appropriate option among the suggested pricing plans.

- Sign in to your account or create a new one.

- Complete the purchase with the assistance of a credit card or PayPal payment method.

- Receive the form in the file format of your preference.

Form popularity

FAQ

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

If the IRS determines that an employee does not have enough federal income tax withheld, what will you ask an employer to do? If we determine an employee does not have enough withholding, we'll send you a lock-in letter stating the maximum number of withholding allowances permitted for the employee.

When you file as exempt from withholding with your employer for federal tax withholding, you don't make any federal income tax payments during the year. (A taxpayer is still subject to FICA tax.)

Q11: How can you be released from the Withholding Compliance Program? A11: You must continue to file returns and pay your taxes due. If you timely meet all your filing and payment obligations for three consecutive years, you can request that we release you from the Withholding Compliance Program.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.