Staging Contracts For Business

Description

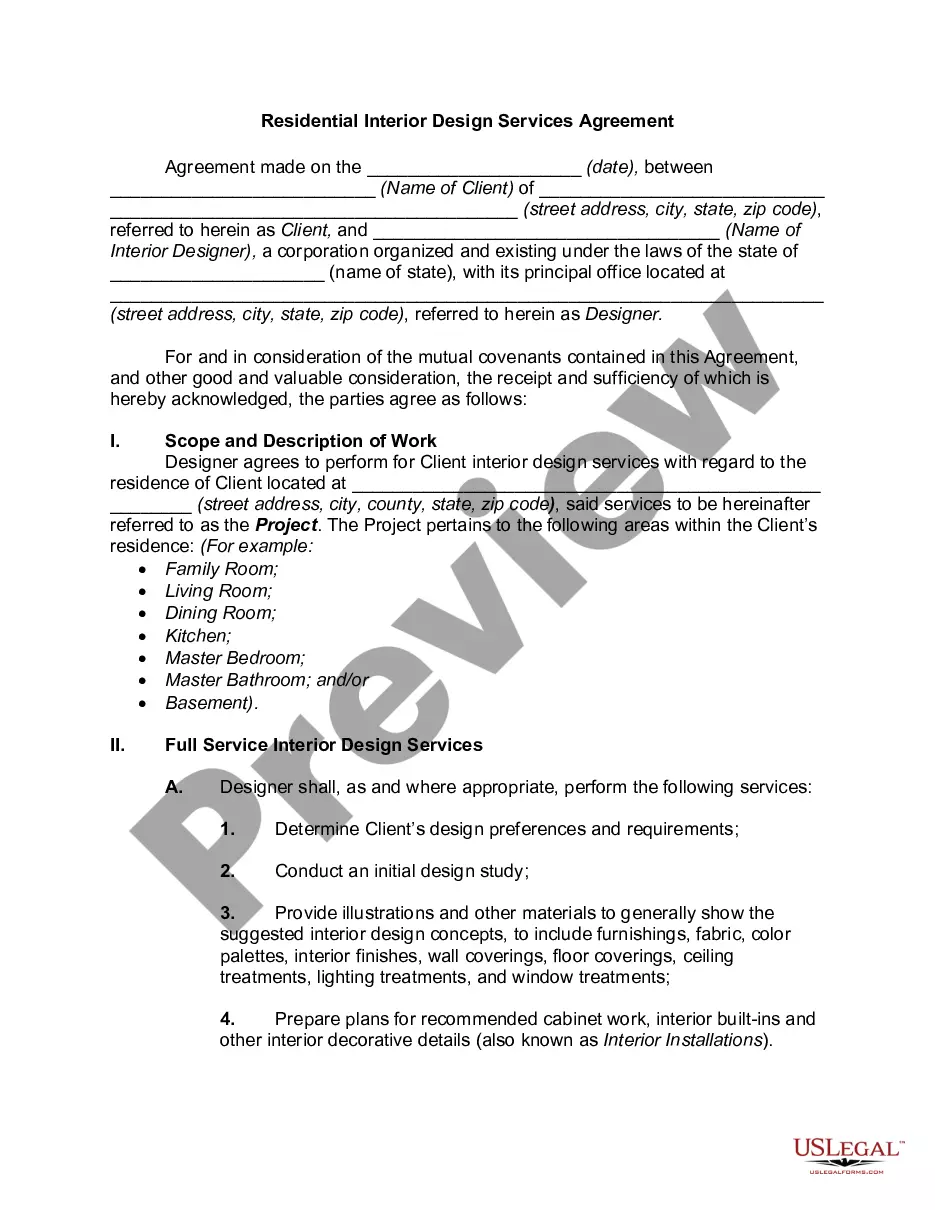

How to fill out Agreement For Home Staging Services?

Utilizing legal document examples that comply with federal and state regulations is essential, and the web provides numerous choices to select from.

But what’s the purpose of spending time searching for the appropriate Staging Contracts For Business example online when the US Legal Forms digital library has such templates gathered in one location.

US Legal Forms is the largest online legal repository with more than 85,000 fillable templates prepared by attorneys for various professional and personal situations.

Review the template using the Preview feature or through the text outline to verify it meets your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts stay updated on legislative changes, ensuring you can trust that your documentation is current and compliant when acquiring a Staging Contracts For Business from our platform.

- Obtaining a Staging Contracts For Business is swift and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document example you require in the correct format.

- If you are new to our site, follow the steps below.

Form popularity

FAQ

If you are claiming a refund on behalf of a deceased taxpayer, you must file Form NH-1310. Mail forms to the New Hampshire Department of Revenue Administration, Taxpayer Services Division, PO Box 3306, Concord, NH 03302-3306.

Although your state does not tax earned income, they do tax interest and dividends. You are required to file Form DP-10 if you received more than $2,400 (single filers) or $4,800 (married filing jointly) of interest and/or dividends.

Does New Hampshire have a sales tax? No, there is no general sales tax on goods purchased in New Hampshire. How do I get a sales and use tax exemption certificate? The Department has no authority to issue a certificate.

To request forms, please email forms@dra.nh.gov or call the Forms Line at (603) 230-5001. If you have a substantive question or need assistance completing a form, please contact Taxpayer Services at (603) 230-5920.

The Bureau of Elderly and Adult Services (BEAS) State Registry is a database containing information on founded reports of abuse, neglect or exploitation of vulnerable adults by a paid or volunteer caregiver, guardian, or agent acting under the authority of a power of attorney (POA) or any durable power of attorney ( ...

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers).

Contact the DHHS Customer Service Center toll-free at 1-844-ASK-DHHS (1-844-275-3447) (TDD Relay Access: 1-800-735-2964), Monday through Friday, a.m. to p.m. ET. Contact your local District Office.