Sworn Statement In Proof Of Loss With Insurance

Description

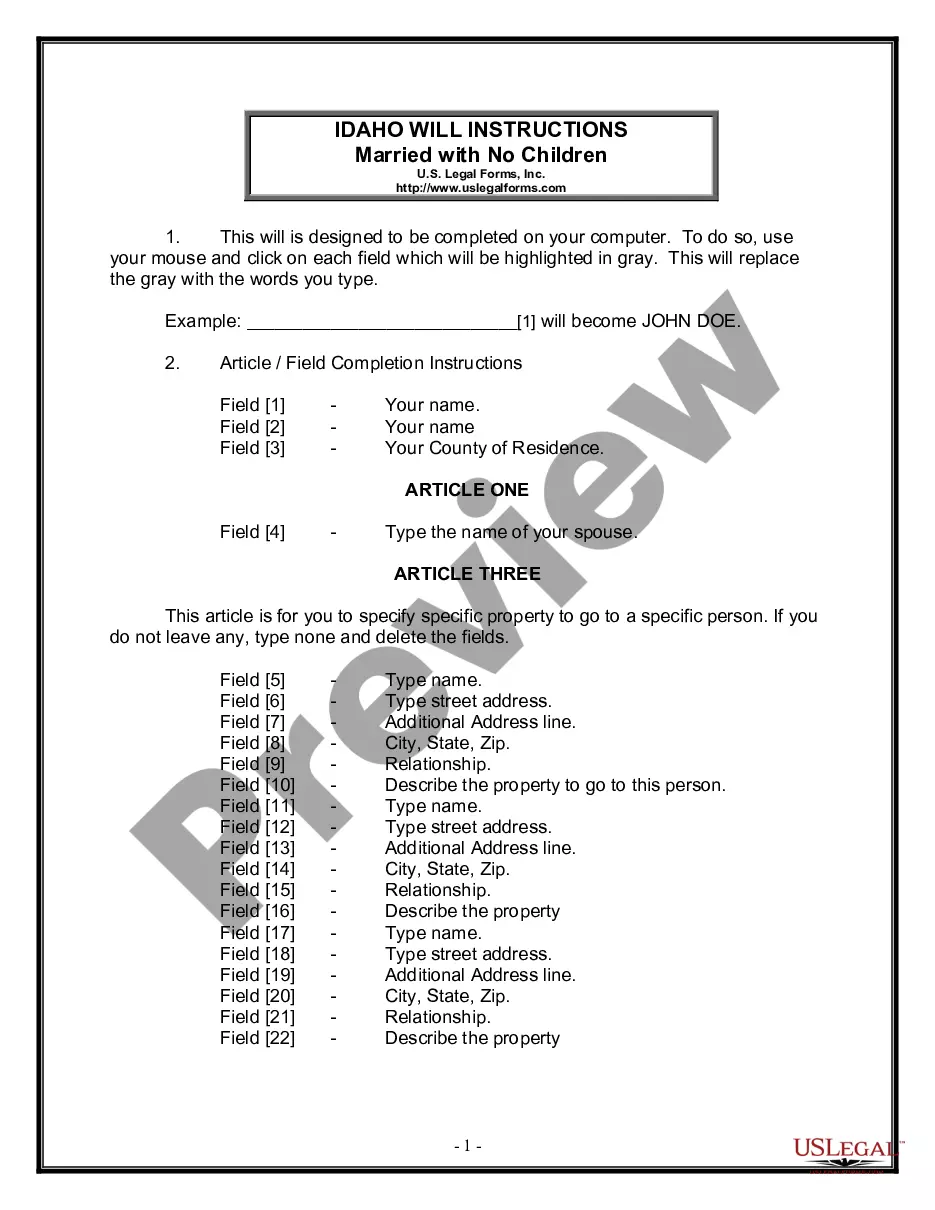

How to fill out Sworn Statement Regarding Proof Of Loss For Automobile Claim?

Handling legal documents and processes can be an arduous addition to your daily routine.

Affidavit In Evidence Of Claim With Insurance and similar forms typically necessitate that you search for them and grasp how to fill them out accurately.

Therefore, if you are managing financial, legal, or personal issues, possessing a thorough and accessible online repository of forms at your disposal will be highly beneficial.

US Legal Forms is the premier online source of legal templates, featuring over 85,000 state-specific documents and various tools that facilitate the swift completion of your paperwork.

Is this your first time using US Legal Forms? Register and create a complimentary account in just a few minutes and you’ll gain access to the form library and Affidavit In Evidence Of Claim With Insurance. Then, follow these steps to complete your document: Ensure you have located the appropriate form using the Preview option and reviewing the form description. Select Buy Now when ready, and choose the monthly subscription plan that suits you best. Click Download and then fill out, sign, and print the form. US Legal Forms has twenty-five years of experience helping clients manage their legal documentation. Acquire the form you need now and simplify any process without the hassle.

- Browse the collection of pertinent documents available with just one click.

- US Legal Forms provides you with state- and county-specific templates ready for download at any time.

- Safeguard your document management processes with a top-notch service that enables you to prepare any form in moments without additional or hidden fees.

- Simply Log In to your account, find Affidavit In Evidence Of Claim With Insurance, and download it instantly from the My documents section.

- You can also retrieve previously saved documents.

Form popularity

FAQ

If the satisfaction of mortgage isn't recorded, the property owner may have trouble when they try to refinance or sell the property. They'll have to chase down the discharge documents and get them recorded in order to clear the title. It can even cause a delay to the closing.

What is Satisfaction of Mortgage? A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

How do you get a Satisfaction of Mortgage? A Satisfaction of Mortgage is issued by the lender after they have received the final mortgage payment from the borrower. It's signed by the mortgagee (in the presence of a witness in some states and counties) and then notarized by a registered notary public.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property. In short, your home is finally all yours!

What is a Satisfaction of Mortgage? A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

A satisfaction of mortgage, also known as release, cancellation or discharge of mortgage, is a type of legal document that proves you paid your mortgage in full. As a result, it also certifies that the property's title is clear of any liens.

What is Satisfaction of Mortgage? A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

A mortgage discharge is a signed document from the lender indicating that the mortgage contract has been fulfilled. Discharging the mortgage ends the lender's legal claim to your property.