Bail Petition Format

Description

How to fill out Motion To Release Defendant And Set Reasonable Bail?

Finding a reliable source to obtain the latest and suitable legal templates is part of the challenge of navigating bureaucratic processes.

Identifying the correct legal documents requires accuracy and meticulousness, which is why it's essential to acquire Bail Petition Format samples solely from trustworthy providers, such as US Legal Forms.

Simplify your legal documentation tasks. Explore the extensive US Legal Forms library to locate legal templates, evaluate their applicability to your needs, and download them immediately.

- Utilize the catalog navigation or search bar to find your template.

- Access the form's details to determine if it meets the standards of your state and county.

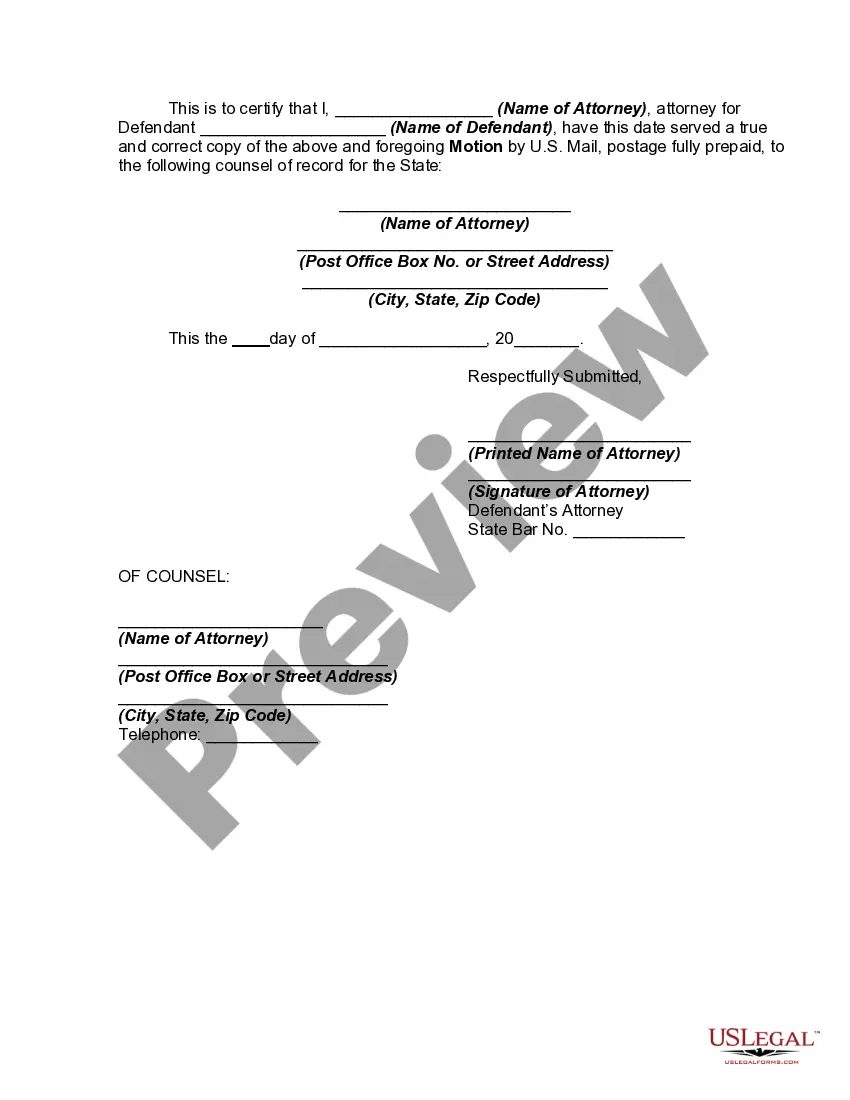

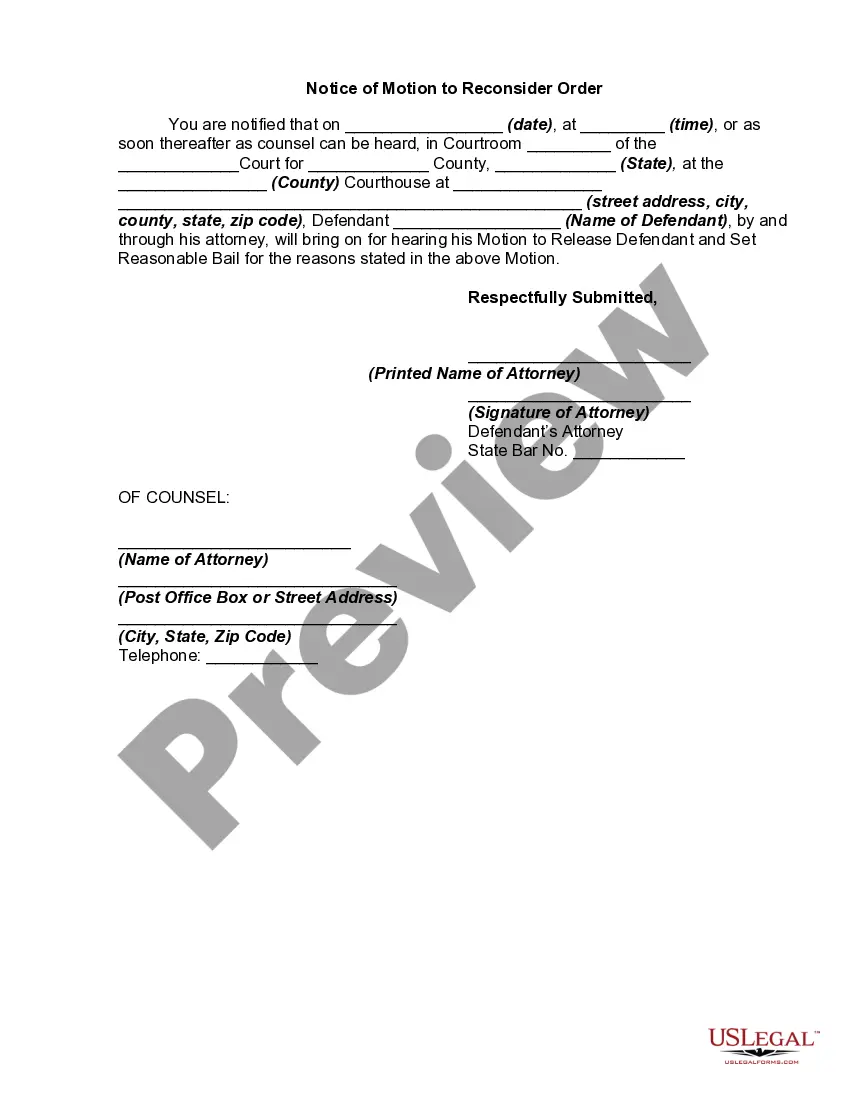

- Preview the form, if an option, to confirm that it is the desired template.

- Return to the search if the Bail Petition Format does not fulfill your criteria.

- Once you are confident about the form's appropriateness, download it.

- If you are a registered user, click Log in to verify your identity and access your selected templates in My documents.

- If you haven't created an account yet, click Buy now to purchase the form.

- Choose the pricing plan that best fits your requirements.

- Proceed to registration to complete your transaction.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Bail Petition Format.

- After obtaining the form on your device, you can modify it using the editor or print it to complete manually.

Form popularity

FAQ

Form IT-2104-E, Certificate of Exemption from Withholding.

Under the Military Spouses Residency Relief Act, income earned by military spouses in New York State may be exempt from New York State personal income tax. To obtain this exemption, the spouse must be: considered a nonresident of New York State; and.

Verification of Military Service Please use the Defense Manpower Data Center's (DMDC) Military Verification service to verify if someone is in the military. The website will tell you if the person is currently serving in the military.

The spouse must complete Form NC-4 EZ, Employee's Withholding Allowance Certificate, certifying that the spouse is not subject to North Carolina withholding because the conditions for exemption have been met.

Overview. There are three different property tax exemptions available to Veterans who have served in the United States Armed Forces. The exemption applies to county, city, town, and village taxes. Exemptions may apply to school district taxes.

Documents you may need Documentation verifying marriage. For example, a marriage certificate. A copy of your spouse's active military orders. DD-214. Certificate of Release or Discharge from Active Duty. ... DD 1300. Report of Casualty.

Service members are subject to local taxes on property such as homes. Only one state can collect income taxes from military personnel ? the state of legal residence. That does not have to be the state in which the service member is stationed. Military family members are not covered by this law.

Military pension payments received by retired military personnel or their beneficiaries are totally exempt from New York State tax. Benefits paid to, or on account of, a veteran or beneficiary under the laws relating to veterans, are treated the same for New York State tax purposes as for federal tax purposes.