Bail Application Format In High Court

Description

How to fill out Motion To Release Defendant And Set Reasonable Bail?

Whether for professional intentions or for private affairs, everyone must confront legal issues at some point in their life.

Filling out legal documents requires meticulous care, starting with choosing the correct form template.

With an extensive US Legal Forms collection available, you do not have to waste time searching for the correct template on the internet. Utilize the library’s user-friendly navigation to find the appropriate form for any circumstance.

- For instance, if you choose an incorrect version of the Bail Application Format In High Court, it will be rejected upon submission.

- Thus, it is essential to obtain a reliable source of legal documents such as US Legal Forms.

- If you need a Bail Application Format In High Court template, follow these straightforward steps.

- Locate the template you require using the search bar or catalog navigation.

- Review the form’s details to ensure it is appropriate for your circumstance, state, and county.

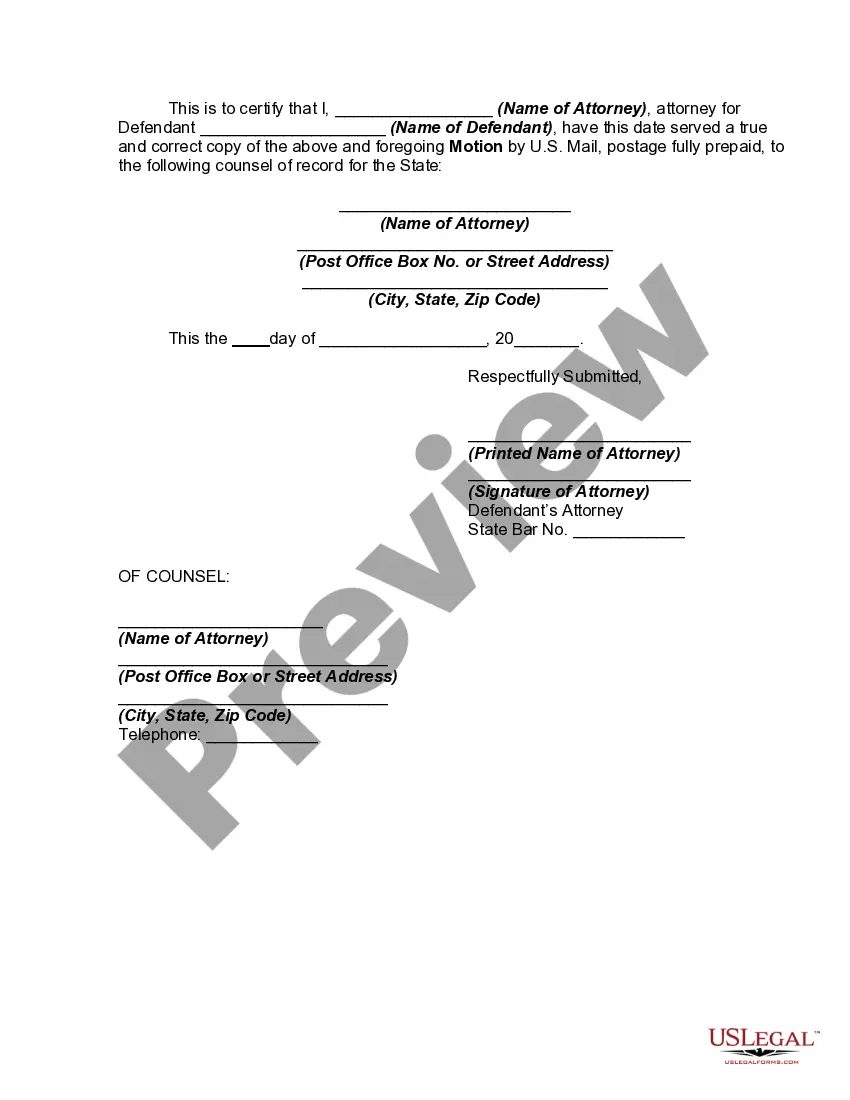

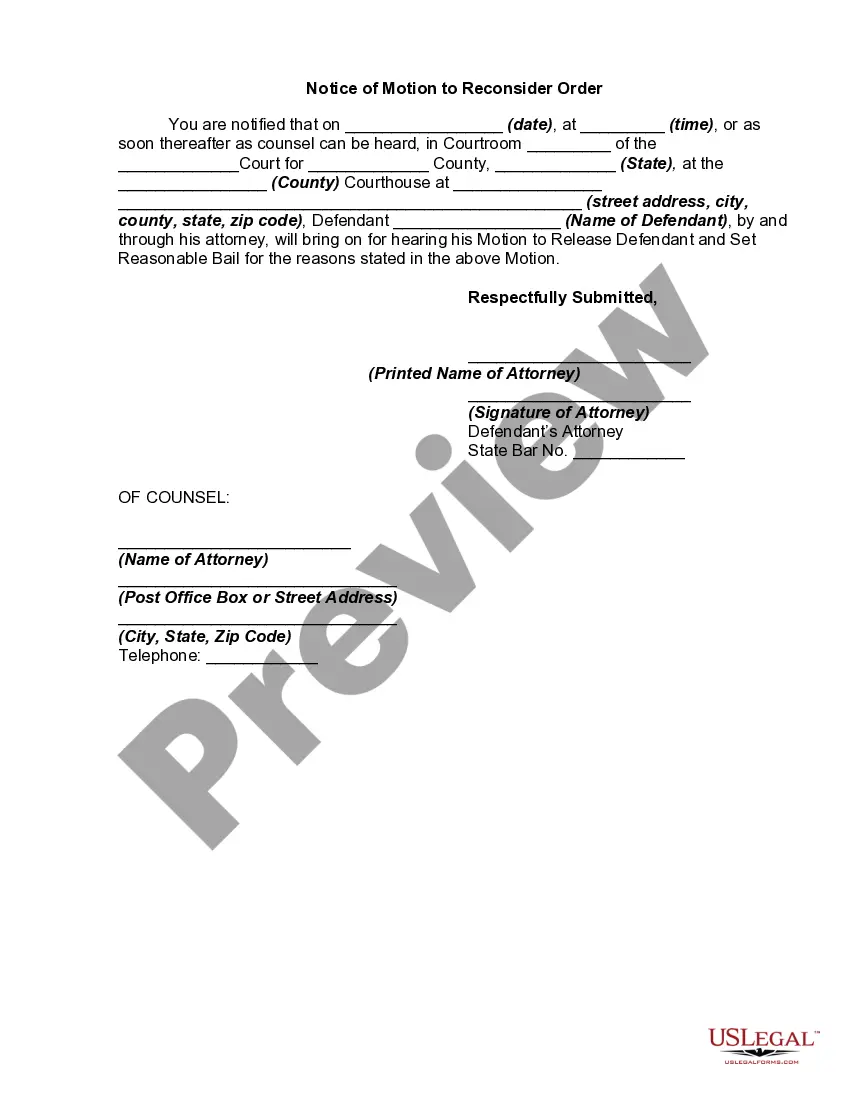

- Click on the form’s preview to view it.

- If it is not the correct form, return to the search function to find the Bail Application Format In High Court template you need.

- Download the template when it aligns with your requirements.

- If you already possess a US Legal Forms profile, click Log in to access any previously saved documents in My documents.

- If you haven’t created an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you want and download the Bail Application Format In High Court.

- After it is downloaded, you can fill out the form with editing software or print it and complete it manually.

Form popularity

FAQ

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

For salaried individuals* Latest salary slips. Bank account statements of the previous three months. PAN card/ Form 60 of all applicants. ID proof. Address proof. Document of the property to be mortgaged. IT returns. Title documents.

Again, the loan transaction consists of two main documents: the mortgage (or deed of trust) and a promissory note. The mortgage or deed of trust is the document that pledges the property as security for the debt and permits a lender to foreclosure if you fail to make the monthly payments.

An English mortgage transaction is a lawful sale in which the mortgagor conveys the property to the lender with the legally enforceable promise that, upon the lender's receipt of the money on a specific date, the lender would re-transfer the property to the mortgagor.

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateMarylandYYMassachusettsYMichiganYYMinnesotaY47 more rows

Navigating the Mortgage Process in Five Simple Steps Get pre-qualified. Before you go house hunting, it's important to get a strong sense of what you can afford. ... Submit your loan application. ... Lock in an interest rate. ... Get your loan approved. ... Close the deal.

Mortgage documents include a promissory note, which says that you promise to pay your loan back, and the mortgage or security instrument, which says that the lender can foreclose on your home if you don't make your payments.

Lenders need to look at your income, assets, credit, and debt before qualifying you for a mortgage. Be prepared to provide pay stubs, W-2s, tax returns, bank statements, and any other documentation proving you have the ability to repay the loan.