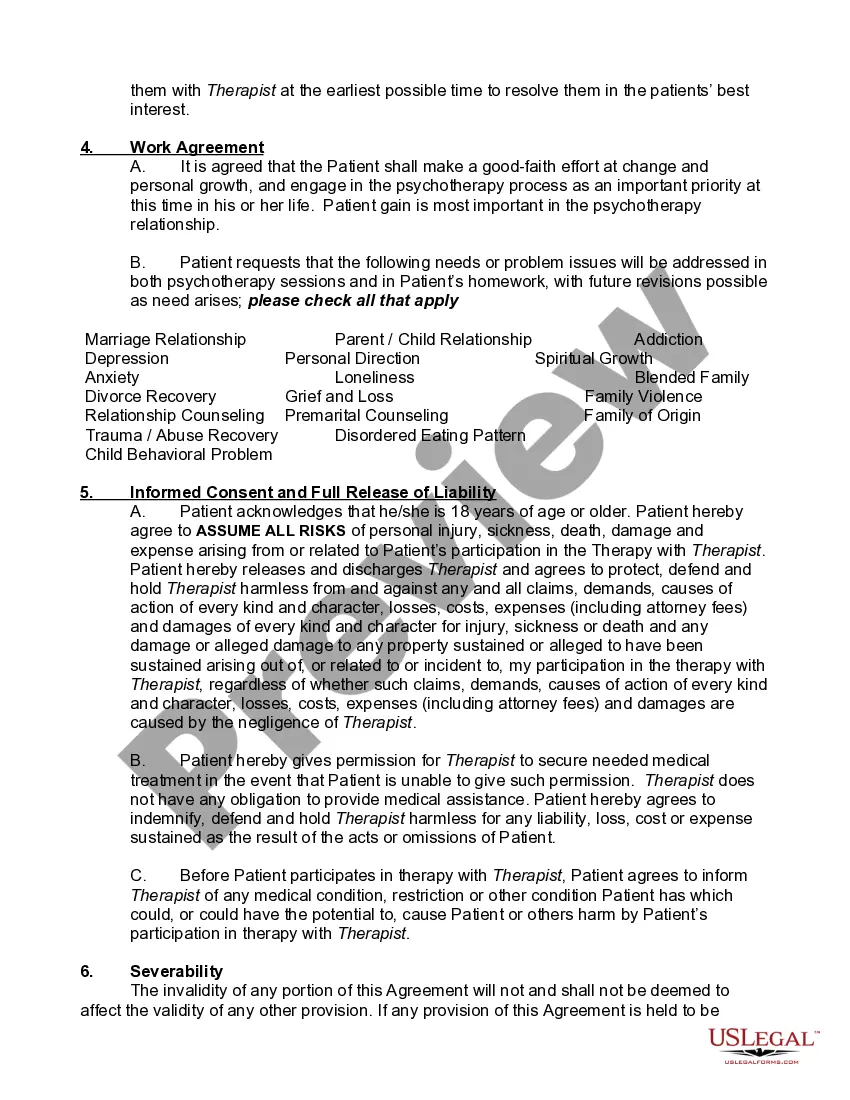

Psych Form 2

Description

How to fill out Agreement For Psychotherapy Services?

It’s clear that you cannot transform into a legal expert instantly, nor can you comprehend how to swiftly compose Psych Form 2 without the necessity of a distinct array of abilities.

Constructing legal documents is an elaborate venture that necessitates specific education and expertise.

So why not entrust the development of the Psych Form 2 to the specialists.

Preview it (if this option is available) and review the accompanying description to ascertain whether Psych Form 2 is what you’re looking for.

Initiate your search again if you require another template.

- With US Legal Forms, one of the most comprehensive legal template libraries, you can obtain anything from court documents to templates for in-office communication.

- We acknowledge how crucial compliance and adherence to federal and local regulations are.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s commence with our website and obtain the document you require in just minutes.

- Find the document you seek by utilizing the search bar at the top of the page.

Form popularity

FAQ

The articles of organization is a document that officially establishes your LLC by laying out basic information about it. Prepare articles of organization and file them with the Indiana Secretary of State Business Services Division. LLC properly.

How long does it take to get a certified copy of articles of organization or a certified copy of articles of incorporation from Indiana Secretary of State? Online processing: immediate. Normal processing: 3-5 business days, plus additional time for mailing.

Indiana articles of incorporation are filed to create a corporation. This guide provides instructions and tips when preparing and filing this legal document.

If you were a full-year resident of Indiana and your gross income (the total of all your income before deductions) was greater than certain exemptions*, you must file an Indiana tax return. Full-year residents must file Form IT-40, Indiana Full-Year Resident Individual Income Tax.

To obtain a copy of Articles of Incorporation, go to the Indiana Secretary of State Business Page: and complete the following steps. 5. Click on Certified Copies Request - Here you will have the option to print or download your Articles free of charge.

You may find the current year tax Indiana Individual forms online by going to .in.gov/dor/tax-forms/ and selecting the Individual Tax Forms download bar. To find individual tax forms online for prior years, go to .in.gov/dor/tax-forms/indiana-state-prior-year-tax-forms/ and select the year you need.

Obtaining a Certificate of Clearance Submit an Affidavit for Reinstatement (AD-19) and a Responsible Officer Information form (ROC-1) to the. Indiana Department of Revenue. ... Wait for the Certificate of Clearance to be mailed to you by the Department of Revenue. ... Process an Application for Reinstatement through INBiz.

The document required to form an LLC in Indiana is called the Articles of Organization. The information required in the formation document varies by state. Indiana's requirements include: Registered agent.