Time Share With With Us

Description

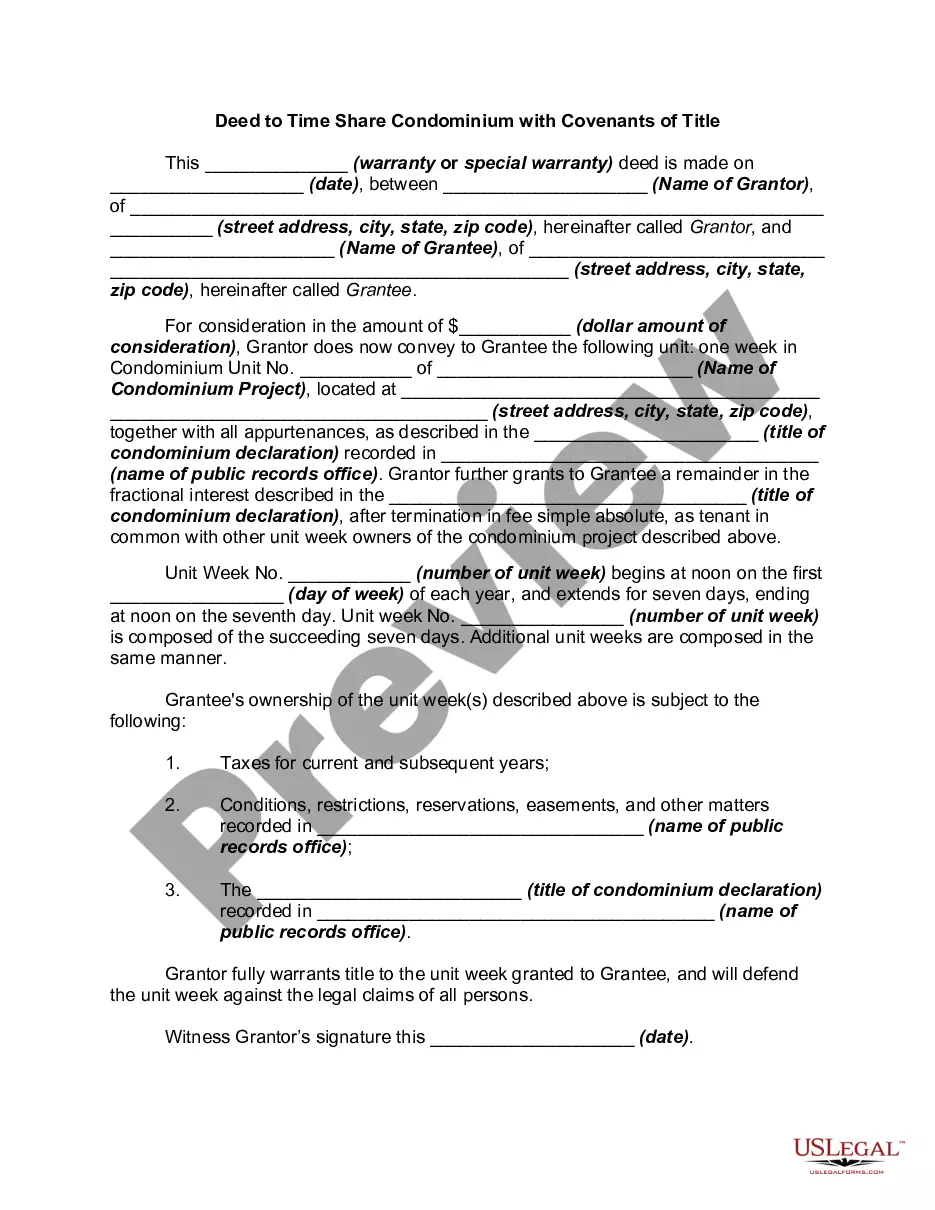

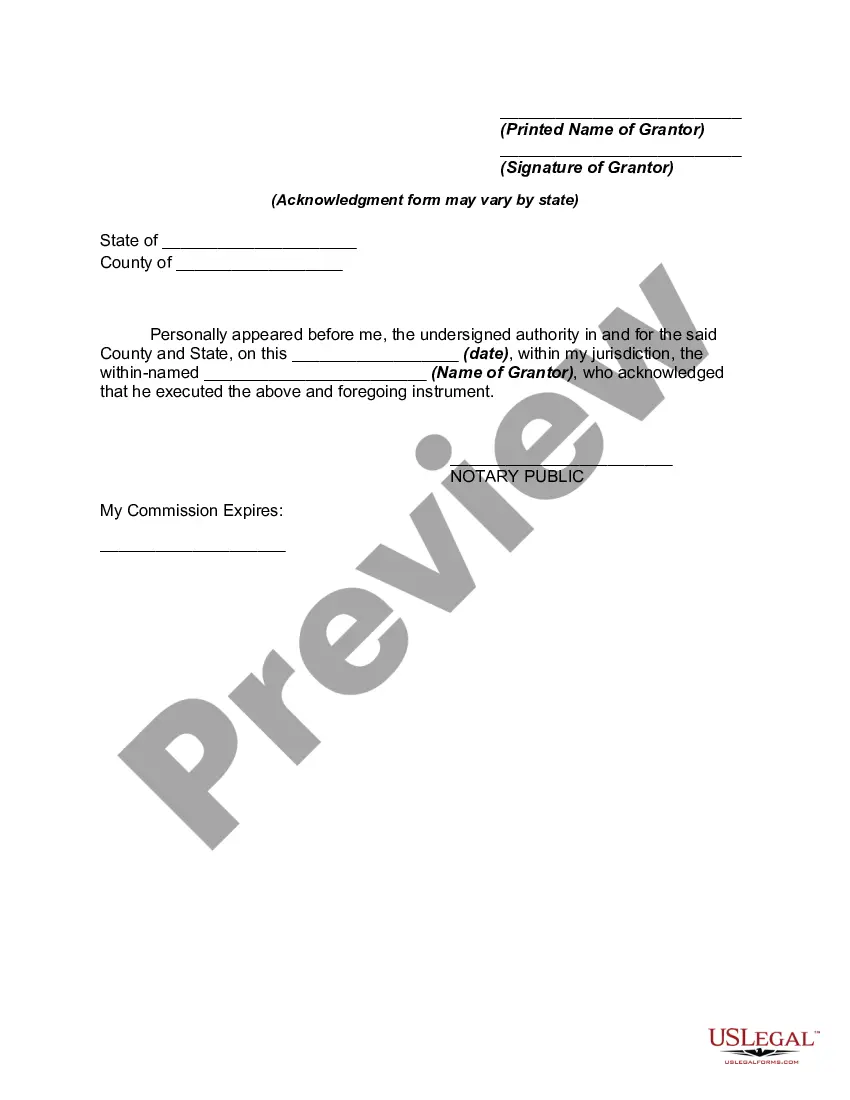

How to fill out Deed To Time Share Condominium With Covenants Of Title?

- Log in to your account if you're a returning user to download your desired form template directly. Remember to verify your subscription status before proceeding.

- Browse the Preview mode to assess the form description. Confirm that it aligns with your requirements and adheres to your local jurisdiction regulations.

- If necessary, utilize the Search tab to find alternative templates. Ensure the selected form meets your needs before moving forward.

- Proceed to purchase your document by clicking 'Buy Now'. Choose a suitable subscription plan and create an account to unlock the extensive library.

- Complete your purchase by entering your payment details. US Legal Forms accepts various payment options including credit card and PayPal.

- Once the purchase is finalized, download your form. You can conveniently access it later in the 'My Forms' section of your profile.

With the US Legal Forms service, you not only gain access to an extensive library but also the ability to consult with premium experts, ensuring your documents are accurate and legally sound.

Start your journey with us today and experience the convenience firsthand!

Form popularity

FAQ

Attending a timeshare presentation can be worthwhile for many individuals who are seeking vacation options. It often offers insights into how to maximize vacation experiences, not to mention potential savings on future trips. By engaging with representatives, you can learn about various packages and benefits that come with owning a timeshare. We encourage you to explore what it means to time share with us, as it might just open new doors to your travel adventures.

The average income of a timeshare owner often varies based on factors like location and type of ownership. Generally, owners tend to have a median income of around $85,000 per year. It’s important to note that owning a timeshare can provide opportunities for vacation savings, which ultimately leads to financial benefits. So, if you want to understand more about successfully managing timeshares, consider resources that can help you time share with us.

Generally, you need to report your timeshare if it generates rental income or if you claim related deductions. Even if you do not rent it out, it is essential to check if you can claim deductible expenses. With our platform, you can easily understand your obligations and rights regarding timeshare reporting with us.

To claim a timeshare on your taxes, you need to gather all related documents, such as your mortgage interest statements and property tax bills. You can then report them as deductions on your tax form. Partnering with our service can simplify the steps required for claiming your timeshare deductions while maximizing your benefits.

In TurboTax, you can report a timeshare under the 'Rental Properties' section if you received income from it. Just follow the prompts about rental expenses and income. If you need support, our platform can assist you in navigating TurboTax, ensuring smooth reporting of your timeshare with us.

You will report timeshare information on your personal tax return, usually on Schedule E if you rent it out. Even if you do not rent it out, there may be deductions available for your mortgage interest or property taxes. When you use our platform, we help ensure that your timeshare reporting remains compliant and accurate.

Reporting a timeshare typically involves reporting rental income or any other transactions related to that property on your tax return. If you rented out your timeshare, you will report that income just like any other rental property. With us, you can find detailed resources to easily navigate these reporting requirements.

To report a 1099-S on your tax return, you will need to include the amount shown on the form in the appropriate section of your IRS Form 1040. Make sure to check your tax software for dedicated sections. If you're unsure, our platform can help guide you through the process of reporting your timeshare with us.

Timeshares can be passed down to heirs by including them in your estate plan. It is essential to check your specific timeshare agreement for any rules regarding inheritance. When you're ready to time share with us, we can assist you in navigating inheritance options and ensuring your wishes are clearly communicated.

Transferring a timeshare ownership requires notifying the resort and fulfilling specific legal procedures. Each resort has its own rules about ownership transfers, so it is crucial to gather all necessary documents. To facilitate this process smoothly, consider choosing to time share with us, where we provide expert help throughout the transfer.