Resort Timeshare

Description

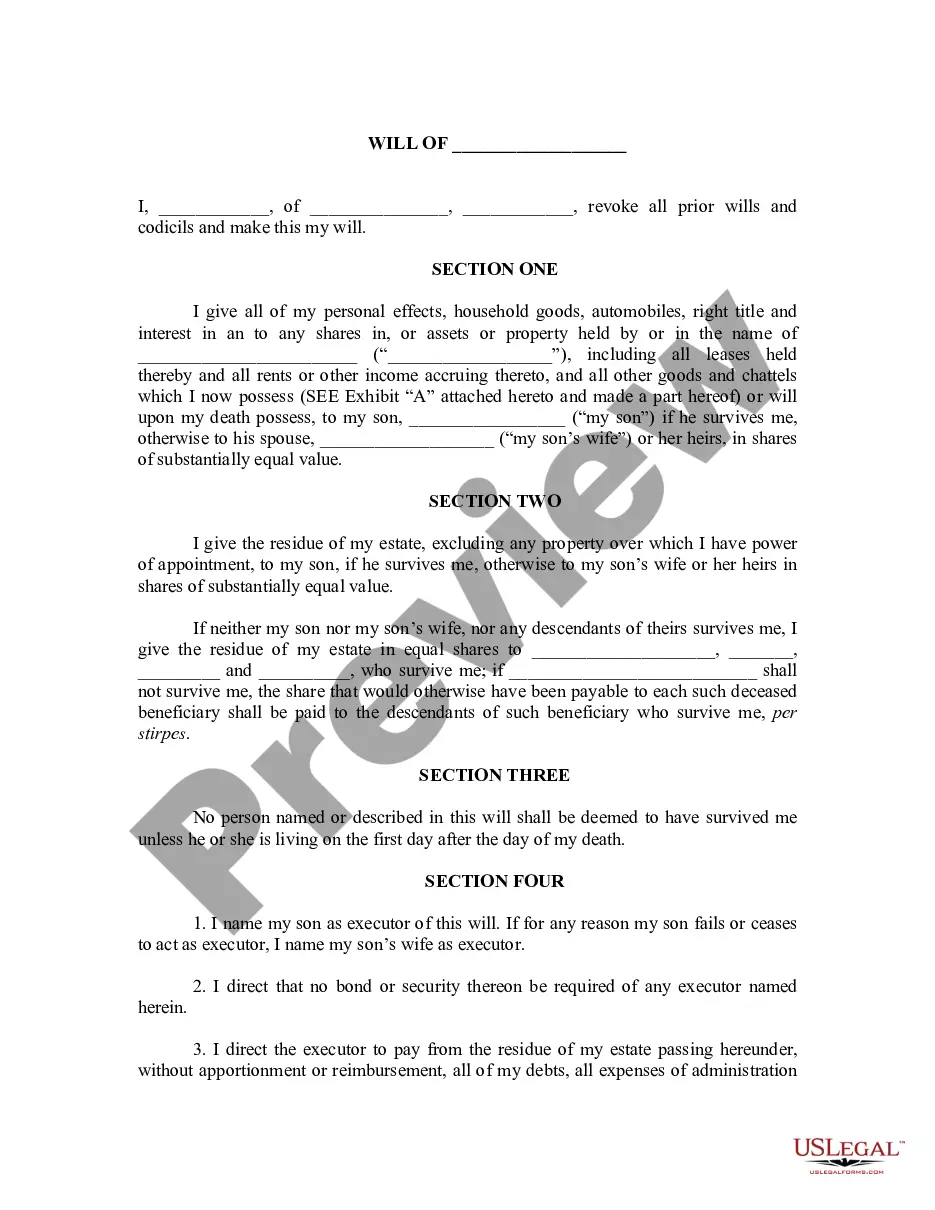

How to fill out Deed To Time Share Condominium With Covenants Of Title?

- If you're a returning user, log in to your account. Check your subscription status; if expired, renew it accordingly.

- For new users, start by reviewing the Preview mode and the form descriptions. Ensure you choose the correct document that aligns with your needs and jurisdiction.

- If necessary, use the Search tab to find alternative templates that better suit your requirements.

- Once you've identified the right document, click the Buy Now button and select your preferred subscription plan. You will need to create an account for access.

- Proceed with your purchase by entering your credit card information or using your PayPal account to finalize the transaction.

- Download your form to your device and access it anytime through the My Forms section of your profile.

By utilizing US Legal Forms, you can enjoy a robust collection of over 85,000 legal forms and packages, ensuring that you find the right documentation for your resort timeshare needs.

Take advantage of expert assistance for form completion to ensure accuracy and compliance. Start your hassle-free process today!

Form popularity

FAQ

Three main disadvantages of owning a resort timeshare include high maintenance fees, limited flexibility, and challenging resale options. Maintenance fees can escalate over time, impacting your budget. Additionally, booking during peak seasons may prove difficult. Finally, if you decide to sell, the resale market can be unappealing, further complicating ownership.

The 1 in 4 rule suggests that if you do not use your resort timeshare at least once every four years, it may not be a sound investment. This guideline highlights the importance of regular use to justify ongoing costs. If you're considering a timeshare, think about your travel plans to ensure you'll benefit fully from your investment.

Timeshares at resorts can be worth it if you frequently visit a specific location and enjoy spending time there. They offer potential savings on accommodations over time, especially for families. However, if you prefer flexibility or travel to various destinations, a resort timeshare may not be the best fit. Evaluating your travel habits can help determine value.

A timeshare resort is a property where multiple owners share the right to use it for specific periods each year. Typically, these resorts offer amenities such as pools, restaurants, and recreational activities. Owning a resort timeshare can provide a vacation experience in a desirable location each year. Understanding the details of ownership is crucial for maximizing the benefits.

Yes, many people do regret buying a resort timeshare. Common reasons include unexpected costs and the difficulty of booking desired dates. Additionally, some find the limitations on flexibility frustrating, especially if their travel needs change. As a result, it's important to thoroughly research before making such a commitment.

Yes, you typically need to report your resort timeshare on your taxes if you generate income from it or if you are claiming deductions. Filing taxes accurately not only meets legal obligations but also enables you to benefit fiscally. Carefully assess your financial situation and consult with an expert if you have questions about your specific circumstances.

To report a 1099-S on your tax return, you'll input the details from the form into the appropriate sections of your tax filing. This form indicates you received proceeds from the sale or exchange of a resort timeshare. Accurate reporting is vital, and it's wise to consult the IRS guidelines or a tax professional for clarity on handling this form.

To report your resort timeshare, you need to include it in your tax filings where you disclose property-held investments. You'll typically need to provide details regarding any income received or expenses incurred. Maintaining clear documentation will support your claims and help you avoid potential issues. Use available resources to guide you through this reporting process.

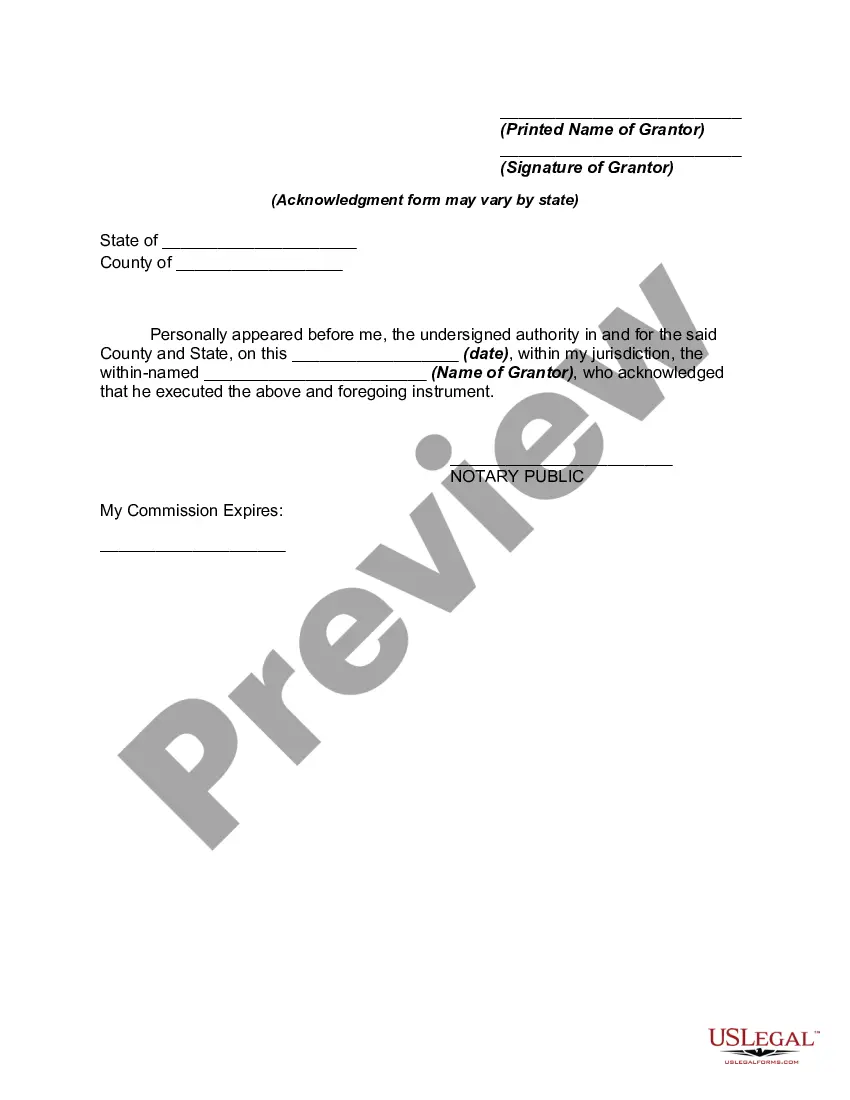

Yes, you can often deed your resort timeshare back to the resort, but it depends on their policies. Most resorts have a deed-back program that allows owners to surrender their ownership. Contact the resort's customer service for specific instructions and any necessary paperwork. This can be a relief if you feel overwhelmed by your ownership responsibilities.

When using TurboTax, you can enter your resort timeshare on the form related to real estate transactions. Look for the section dedicated to investments or property ownership. Follow the prompts to input your timeshare details accurately. If you're unsure, TurboTax provides helpful guidance throughout the process.