Foreclosure Eviction Process For Non-payment Of Rent

Description

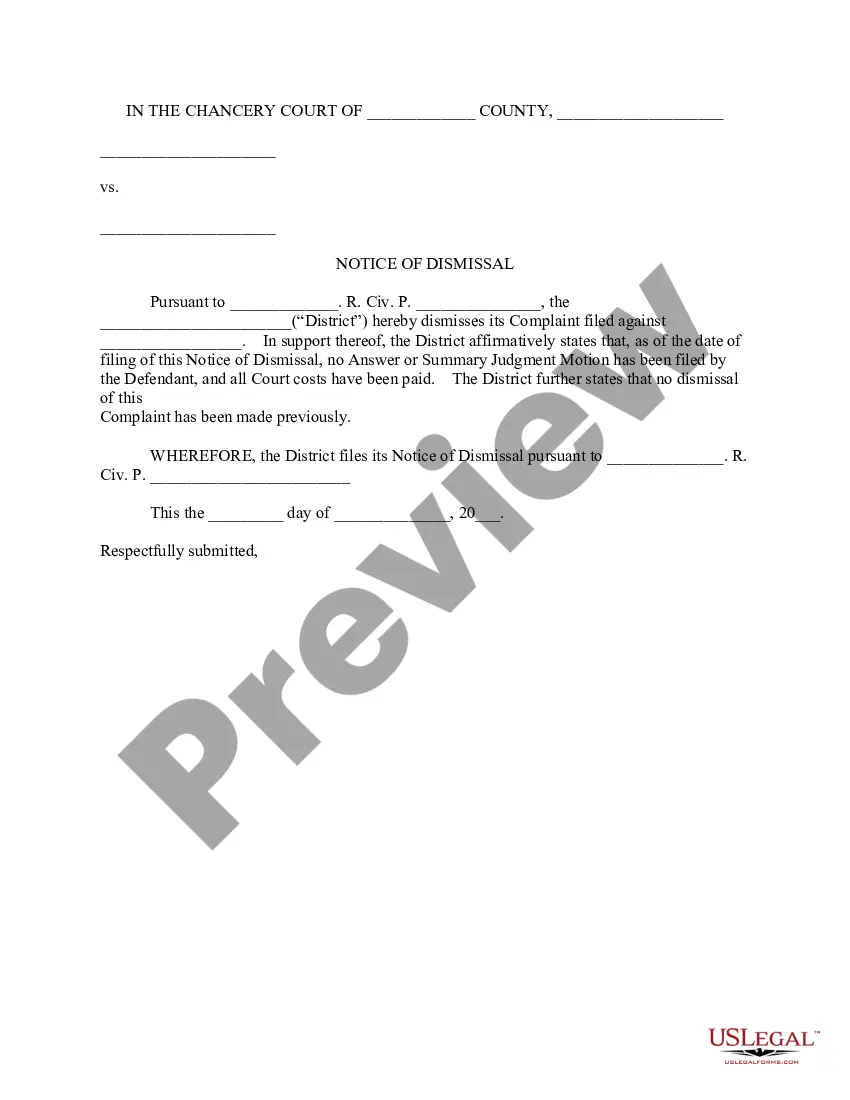

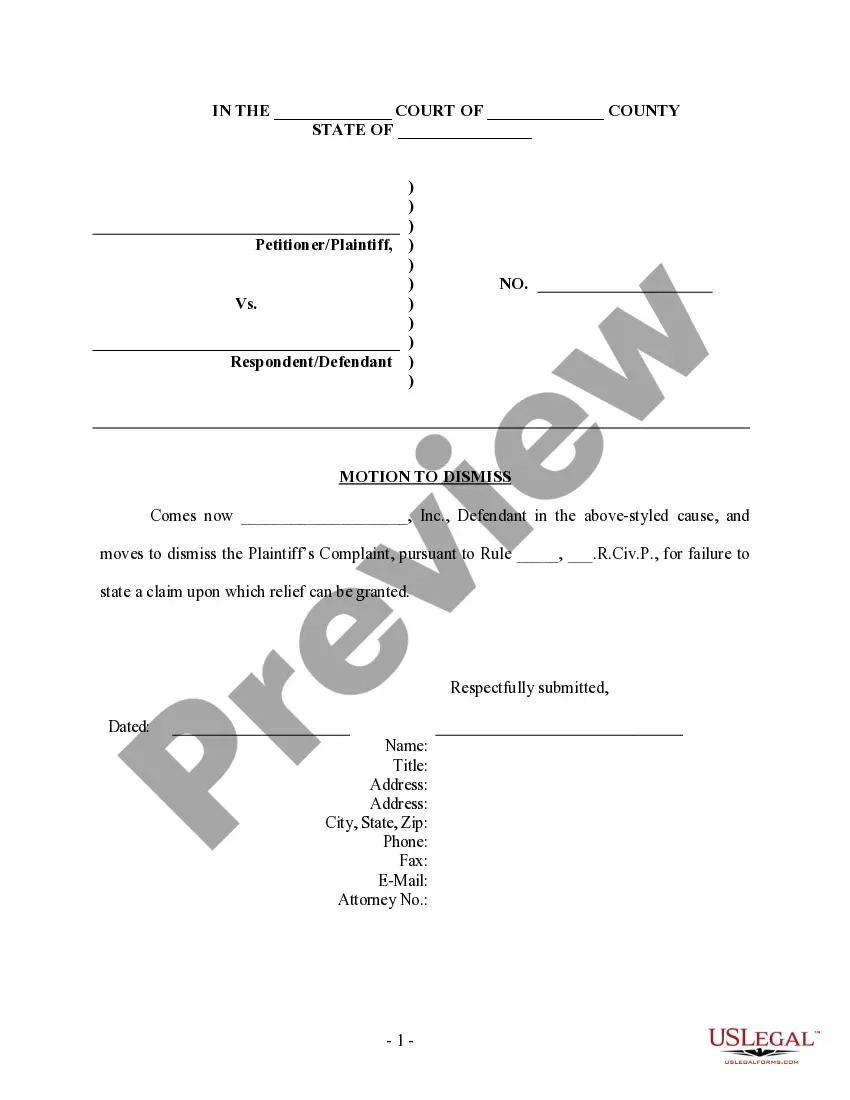

How to fill out Motion To Dismiss Foreclosure Action And Notice Of Motion?

Dealing with legal documents and protocols can be a labor-intensive extension to your schedule.

Foreclosure Eviction Process Due to Non-payment Of Rent and similar forms often require you to look them up and figure out how to fill them out accurately.

Consequently, if you are handling financial, legal, or personal issues, utilizing a comprehensive and user-friendly online directory of forms available will be immensely beneficial.

US Legal Forms is the leading online resource for legal templates, featuring over 85,000 state-specific documents and a variety of tools to help you complete your paperwork effortlessly.

Is this your first experience with US Legal Forms? Create and establish your account in a few minutes to access the form directory and Foreclosure Eviction Process Due to Non-payment Of Rent. Then, follow the steps below to complete your form.

- Browse the assortment of relevant files accessible to you with a single click.

- US Legal Forms provides state- and county-specific forms available at any time for download.

- Protect your document management processes with exceptional support that enables you to prepare any form in minutes without extra or concealed fees.

- Simply Log In to your account, find Foreclosure Eviction Process Due to Non-payment Of Rent, and download it immediately from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

When writing a letter to a tenant for non-payment, clearly state the amount owed and the due date. Begin by addressing the tenant politely, then explain the consequences of continued non-payment, including potential involvement in the foreclosure eviction process for non-payment of rent. Include a request for immediate payment and options for resolution, if available.

A domestic corporation that wants to dissolve in Michigan will need a tax clearance certificate after filing for dissolution. Within 60 days after submitting the certificate of dissolution to LARA, the business must request a tax clearance certificate from the Michigan Department of Treasury, Tax Clearance Division.

In Michigan, every LLC must file an annual statement each year. The Michigan Department of Licensing and Regulatory Affairs will send you a pre-printed annual statement form approximately three months before the due date.

To restore a Michigan LLC, you'll need to file the Certificate of Restoration of Good Standing with the Michigan Department of Licensing and Regulatory Affairs (LARA). You'll also have to fix the issues that led your Michigan LLC to lose its good standing.

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, phone, or in person, but we recommend faxing. Normal processing takes up to 10 days, plus additional time for mailing, and costs $16.00 for up to 7 pages, and $1.00 per additional page.

Filing Your Michigan Annual Report Go to the LARA Corporations Online Filing System. Enter your customer ID number and PIN. If you don't have either number, click the ?CID/PIN Recovery page? link to submit a request. Once you're successfully logged in, you'll immediately begin the filing process.

The Michigan Department of Licensing and Regulatory Affairs (LARA) doesn't administratively dissolve LLCs. However, it will take away your Michigan LLC's good standing if you fail to file annual reports. If your Michigan LLC has lost its good standing, you can still do business in Michigan.

Administrative dissolution is the taking away of the rights, powers, and authority of a domestic corporation, LLC, or other statutory business entity by the state administrator overseeing business entities, due to the entity's failure to comply with certain obligations of the business entity statute.

LLC ? An administratively dissolved Michigan LLC has to file a Certificate of Restoration of Good Standing with the Department of Licensing and Regulatory Affairs (LARA). You also have to submit delinquent annual statements and their corresponding fees. You can submit your documents to LARA by mail or in person.