Foreclosure Como Funciona

Description

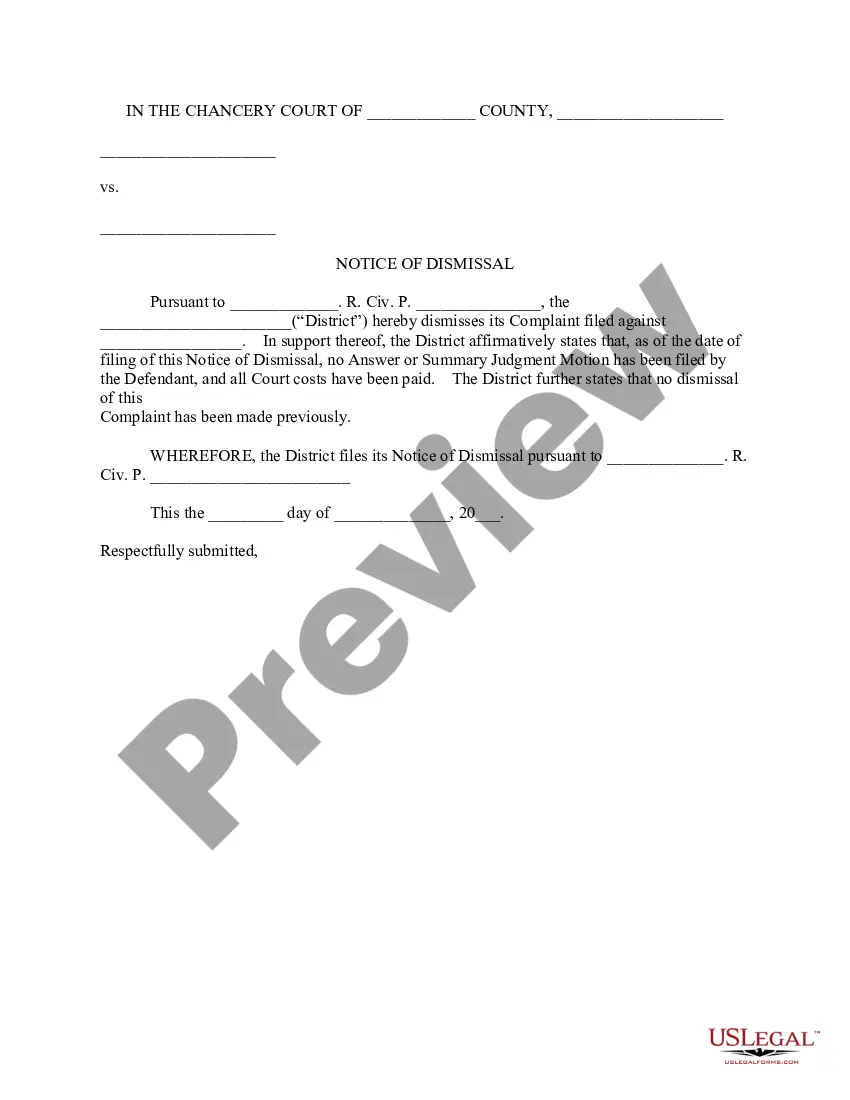

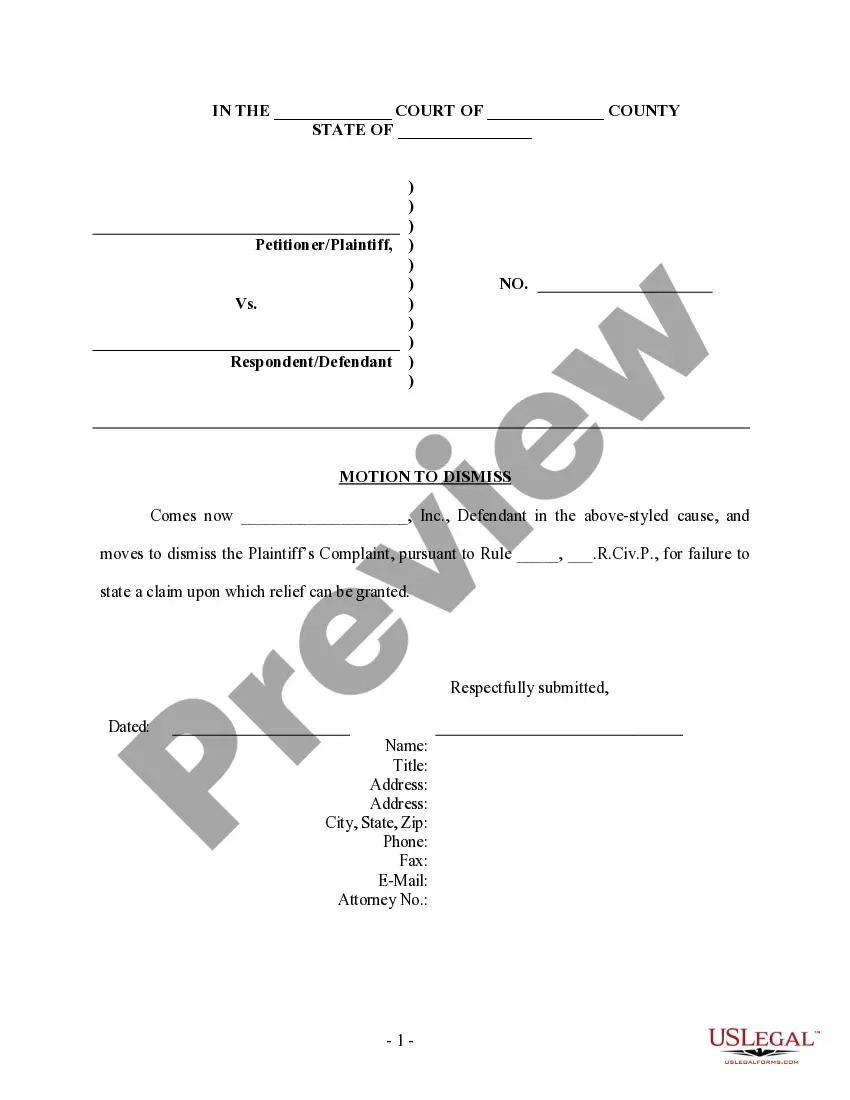

How to fill out Motion To Dismiss Foreclosure Action And Notice Of Motion?

- If you are a returning user, log in to your account and download your required form by selecting the Download button. Ensure your subscription is current or renew it as needed.

- For new users, start by reviewing the Preview mode and descriptions for your chosen form. Confirm it meets your requirements and complies with your local legal standards.

- If necessary, refine your search. Should you encounter any issues, utilize the Search tab to find the most suitable document. Once located, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting the subscription plan that fits your needs. Registration is necessary to access the extensive library.

- Complete your purchase by entering your payment information, whether via credit card or PayPal, to finalize your subscription.

- After payment, download the form to your device, allowing you easy access for completion at any time through the My Forms section in your profile.

By leveraging US Legal Forms, users and attorneys alike can efficiently execute crucial legal documents with an easy-to-navigate library.

Explore the advantages today and take control of your legal needs—start your journey with US Legal Forms now!

Form popularity

FAQ

Yes, you can stop foreclosure by paying the overdue amounts along with any applicable fees. Lenders may allow you to reinstate your mortgage, bringing your account back to good standing. It's essential to communicate directly with your lender to understand your options within the framework of foreclosure como funciona. Platforms like US Legal Forms can provide vital resources and forms needed in this situation.

The fastest way to stop foreclosure is often through reinstatement, which means paying the overdue amount including fees. Alternatively, filing for bankruptcy can temporarily halt the proceedings. Being proactive and understanding your options can make a significant impact on how foreclosure como funciona affects you. For more structured legal advice and documentation, consider using US Legal Forms.

Foreclosure como funciona in Texas typically takes about 60 to 90 days. The process can vary based on the specific circumstances of the case and the lender's actions. However, the timeline remains generally consistent, allowing homeowners a clear understanding of their situation. You may want to consult US Legal Forms for resources that help clarify this process further.

To initiate foreclosure, a lender files a legal notice, begins the court process, and ultimately may take possession of the property. Understanding the steps involved can help you either respond effectively or seek alternatives. Knowing how foreclosure como funciona can drastically impact your strategy and next steps during this period.

Foreclosing on a home in California usually takes around 4 to 6 months, although delays can happen due to legal complexities or appeals. It's essential for homeowners to understand their rights throughout this process. Learning how foreclosure como funciona can empower you to explore all available options.

The pre-foreclosure timeline in California can start as soon as you fall behind on payments. Generally, lenders will issue a notice of default after a few months of missed payments, leading to a period where you can resolve your debt. To effectively navigate this phase, knowing how foreclosure como funciona can guide you toward viable solutions.

In California, the foreclosure process generally takes between 4 to 6 months, but this can vary based on the lender and specific circumstances. Homeowners should stay informed about their rights and the steps involved. Understanding how foreclosure como funciona is crucial for making informed decisions during this challenging time.

In Illinois, the foreclosure process typically takes about 6 to 12 months to complete, depending on various factors such as court schedules and property conditions. During this time, homeowners should explore alternatives to foreclosure. Knowing how foreclosure como funciona in your situation can provide you with valuable insights and options.

The new foreclosure law in California aims to protect homeowners facing financial hardship. It includes measures such as extended repayment plans and mandatory notices to borrowers. Understanding how foreclosure como funciona in this context helps homeowners navigate their options more effectively.

Getting around foreclosure may involve strategies like negotiating with your lender or considering a short sale if you're unable to keep your home. Understanding your legal rights and exploring alternatives can be your path to avoid losing your property. Platforms like US Legal Forms can provide valuable resources and documents to help you navigate this challenging situation effectively.