Allowance Decedent With Ira

Description

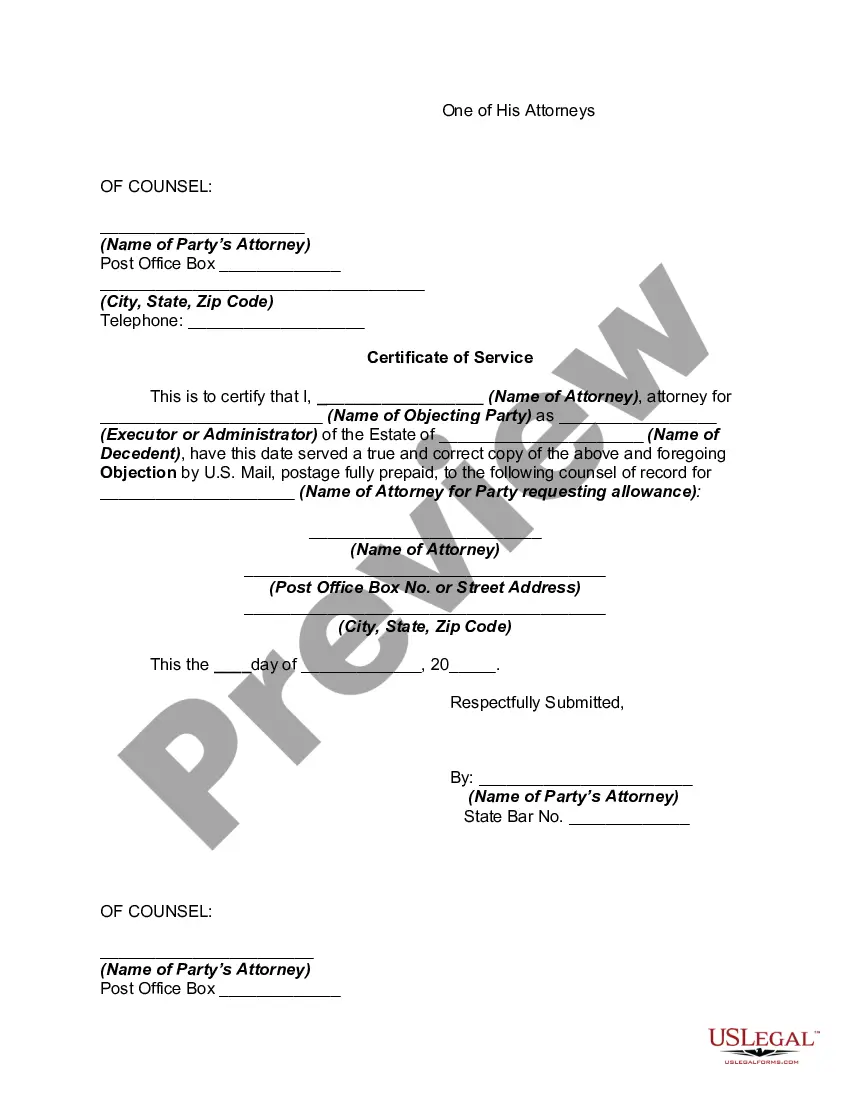

How to fill out Objection To Family Allowance In A Decedent's Estate?

Finding a go-to place to take the most current and relevant legal samples is half the struggle of working with bureaucracy. Finding the right legal papers requirements precision and attention to detail, which explains why it is vital to take samples of Allowance Decedent With Ira only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and view all the details regarding the document’s use and relevance for your circumstances and in your state or region.

Consider the listed steps to complete your Allowance Decedent With Ira:

- Utilize the catalog navigation or search field to find your template.

- Open the form’s information to see if it fits the requirements of your state and region.

- Open the form preview, if there is one, to make sure the template is definitely the one you are searching for.

- Go back to the search and find the appropriate template if the Allowance Decedent With Ira does not suit your needs.

- When you are positive regarding the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Choose the pricing plan that fits your needs.

- Go on to the registration to complete your purchase.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Allowance Decedent With Ira.

- Once you have the form on your gadget, you may modify it with the editor or print it and finish it manually.

Eliminate the headache that accompanies your legal paperwork. Discover the comprehensive US Legal Forms library to find legal samples, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

Distributions from an inherited IRA is reported on Form 1040, Line 5b, instead of Form 8606 in the following situations: the inherited IRA did not contain a basis or the taxpayer did not receive a distribution from both an inherited IRA and personal IRA with both containing a basis.

When the taxpayer has an inherited IRA from someone other than their spouse, enter the distribution information on Screen 1099R, in the Retirement folder. Next, enter an X in the Inherited IRA field on Screen 1099R-3. The taxable amount is reported on Form 1040, Page 1 and is not reported on Form 8606.

If you inherit a Roth IRA, you're free of taxes. But with a traditional IRA, any amount you withdraw is subject to ordinary income taxes. For estates subject to the estate tax, inheritors of an IRA will get an income-tax deduction for the estate taxes paid on the account.

However, distributions from an inherited traditional IRA are taxable. This is referred to as ?income in respect of a decedent.? That means if the owner would have paid tax, the income is taxable to the beneficiary. If you inherit the IRA from your spouse, you have the option to treat the IRA as your own.

Transfer the funds into your own IRA If your spouse lists you as beneficiary, you have the option to roll over the funds to your own IRA where the money can potentially continue to grow tax-free.