Open Estate Account Without Probate

Description

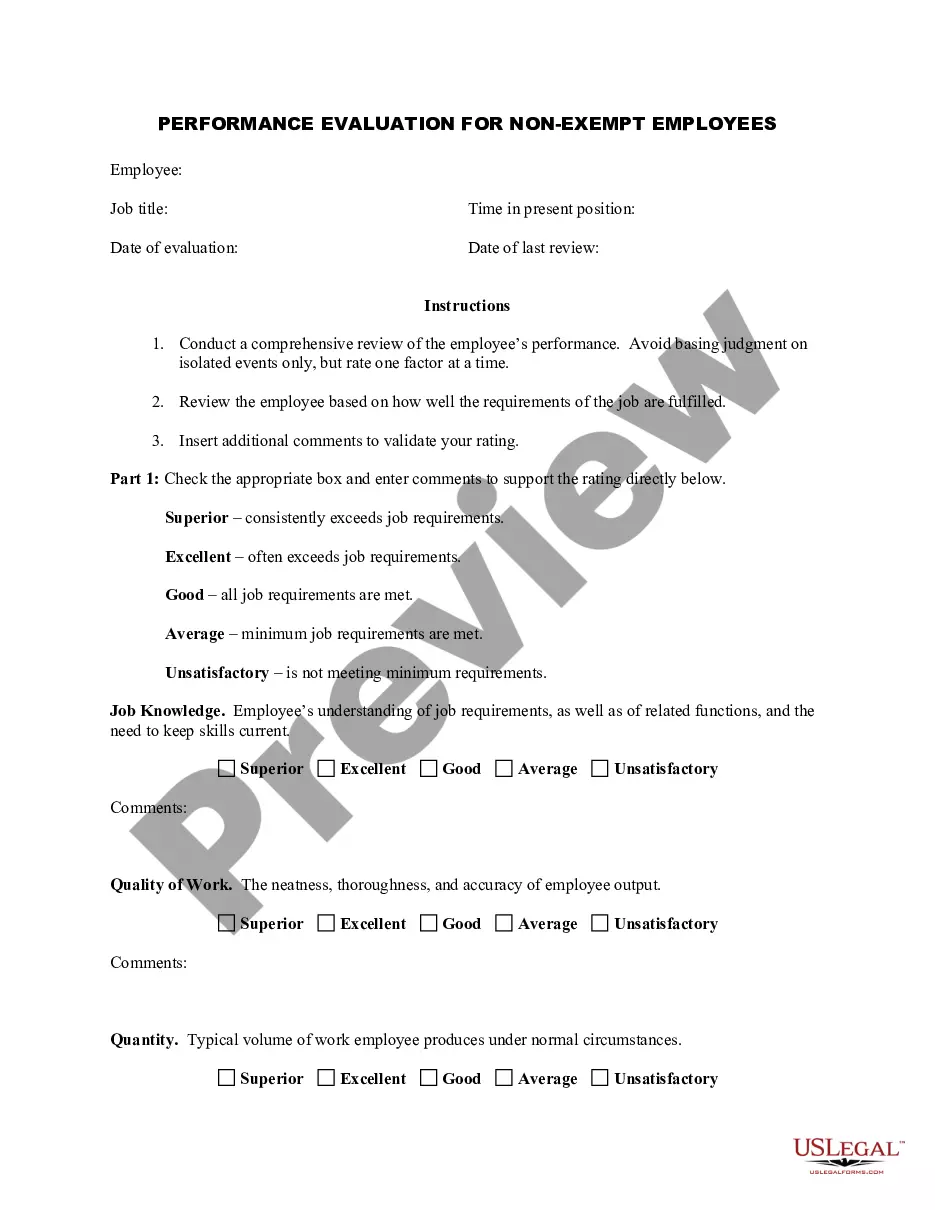

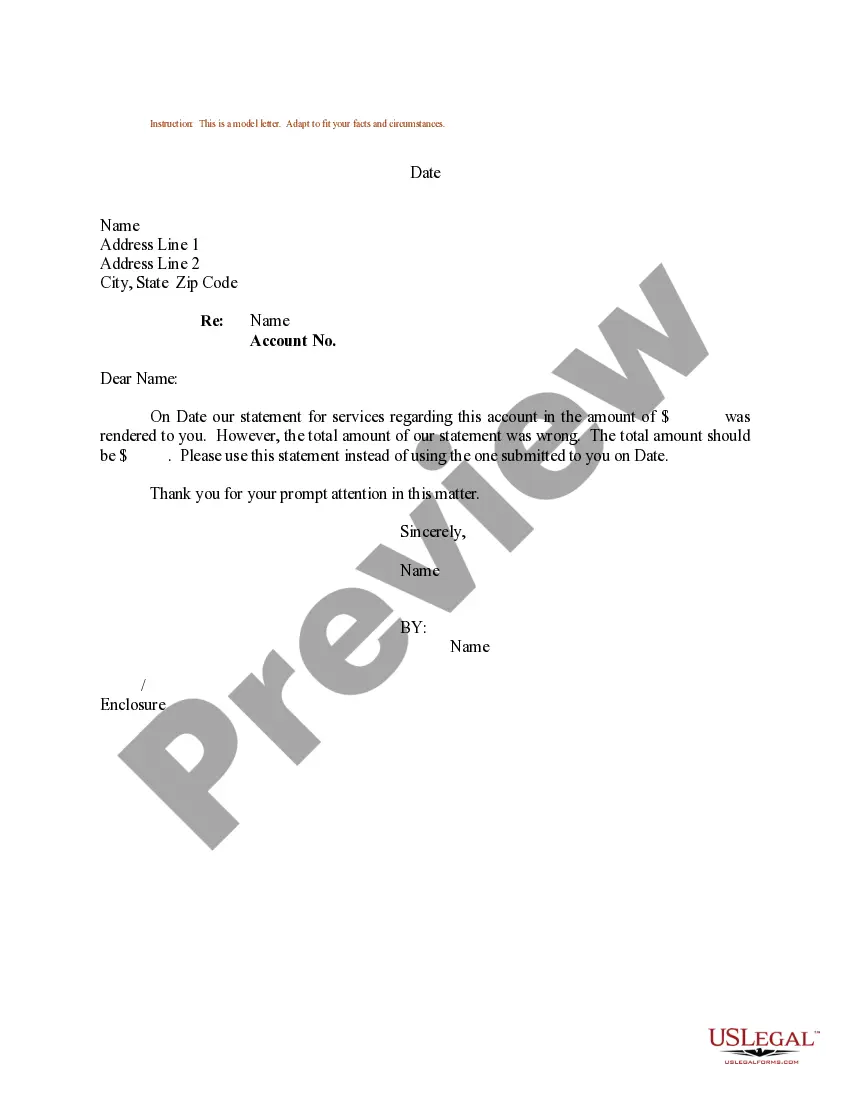

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

Whether for corporate objectives or personal issues, everyone must confront legal circumstances at some stage in their life.

Filling out legal paperwork requires meticulous care, starting from choosing the appropriate form template.

With an extensive US Legal Forms catalog available, you do not have to waste time searching for the right template online. Utilize the library’s simple navigation to find the correct template for any occasion.

- Locate the template you require using the search box or catalog navigation.

- Review the form’s details to confirm it corresponds with your situation, state, and county.

- Click on the form’s preview to review it.

- If it is the wrong form, revert to the search function to find the Open Estate Account Without Probate template you need.

- Download the template if it fulfills your needs.

- If you already possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- In case you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you desire and download the Open Estate Account Without Probate.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

The best bank to open an estate account often depends on your specific needs, such as fees, ease of access, and customer service. Look for banks that allow you to open an estate account without probate, as this can save you time. Many banks offer dedicated services for estates, so it’s wise to compare options before making a decision.

If no beneficiary is named on a bank account, the funds typically become part of the deceased’s estate. This means that the account will likely go through probate unless you can open an estate account without probate. The distribution will then follow the state’s intestacy laws, which dictate how assets are allocated.

To close a deceased person's bank account without probate, you should collect the necessary documents, which usually include the death certificate and proof of your relationship. Contact the bank to learn their specific requirements for closing the account. In many cases, you may need to open an estate account without probate to facilitate this process.

To claim a deceased bank account without probate, you typically need to provide the bank with the death certificate and proof of your relationship to the deceased. Many banks also require you to complete specific forms to open an estate account without probate. Resources like USLegalForms can guide you through these requirements.

Yes, you can access your bank account without probate in some situations. If you are a joint account holder, you often maintain access without needing to go through the probate process. Additionally, certain banks allow you to open an estate account without probate, simplifying the management of funds.

When you open an estate account without probate, you should title the account in the name of the estate. This typically includes the name of the deceased followed by the term 'Estate of Deceased's Name'. By using this format, you ensure clarity when managing the estate's financial matters. It’s crucial to have all necessary documentation, such as the death certificate and any court orders, to facilitate a smooth process.

Absolutely, beneficiaries can request an accounting from the executor. This request helps ensure transparency regarding the estate's finances. Executors should be prepared to provide this information to maintain trust. If you are involved in an estate process, consider tools that assist you to open an estate account without probate to streamline your experience.

Generally, an executor can sell estate property without getting approval from all beneficiaries. However, laws may vary by state, so it’s wise to check local regulations. Open communication with beneficiaries can help reduce conflicts. Utilizing services that help you open an estate account without probate can facilitate smoother transactions.

Yes, executors typically need to provide an accounting to beneficiaries. This accounting details the estate's assets and expenditures. The beneficiaries have the right to see how funds are managed. Proper accounting streamlines the process and helps you open an estate account without probate.

Beneficiaries do not need to approve estate accounts, but their input can be beneficial. It is helpful to keep beneficiaries informed about the estate's finances. This communication fosters transparency and trust. If you want to open an estate account without probate, ensure all beneficiaries understand the process.