Foreclosure For Dummies

Description

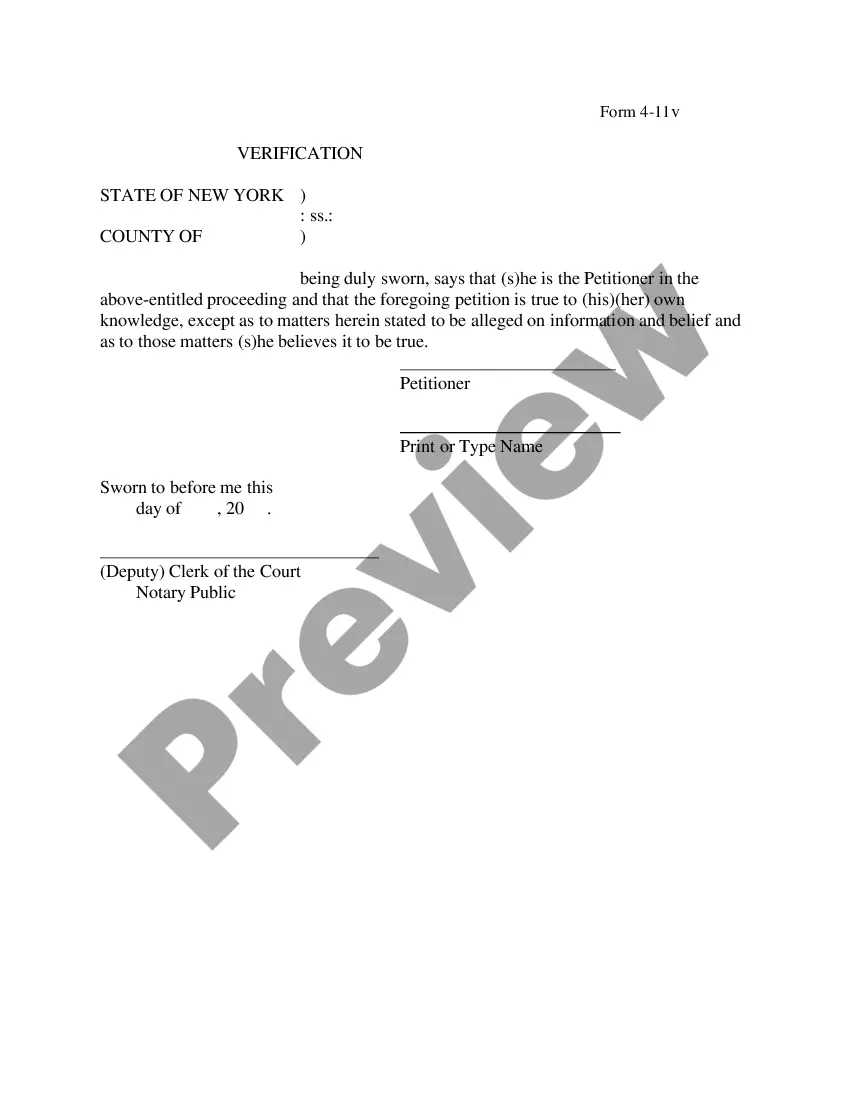

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

- Visit the US Legal Forms website and preview your form of interest to ensure it meets your requirements.

- If the current template doesn't match your needs, utilize the Search bar to find an alternative form that aligns with your local jurisdiction.

- Select the template that fits your circumstance and click on the 'Buy Now' button to choose your subscription plan.

- Create an account if you're new to the service, providing your payment details to finalize the purchase.

- Download the completed form directly to your device for easy access and future use via the 'My documents' section in your account.

In conclusion, US Legal Forms empowers you to efficiently handle legal matters, including foreclosure, with their extensive library and expert support. Take control of your legal needs today.

Don't hesitate—explore US Legal Forms now and find the perfect documents for your situation!

Form popularity

FAQ

The foreclosure process typically follows six distinct phases. It starts with the pre-foreclosure phase, where the homeowner receives a notice of default. Next is the foreclosure filing, followed by a court hearing. If the court rules in favor of the lender, the property moves into auction, then to the redemption period, and finally, the lender takes possession. Learning these phases can empower you with knowledge in foreclosure for dummies.

Foreclosure requirements vary depending on state laws, but generally, lenders must prove the borrower has defaulted on their mortgage. Additionally, lenders must follow specific legal processes, which often include providing proper notice to the homeowner. Familiarizing yourself with these requirements can help simplify the foreclosure journey for dummies.

The 120-day rule is a crucial aspect of foreclosure. It often requires lenders to wait at least 120 days after a homeowner misses a mortgage payment before initiating foreclosure. This waiting period allows homeowners a chance to address their financial situation. This rule serves as a safety net for those learning about foreclosure for dummies.

In New York, foreclosure rules can be quite specific. Generally, lenders must file a lawsuit, and borrowers are given a chance to respond. New York has a judicial foreclosure process, meaning a court oversees the case. Understanding these rules can simplify the overall process and provide clarity for foreclosure for dummies.

The new foreclosure law in California aims to provide greater protections for homeowners facing foreclosure. Under this law, various measures enhance communication between borrowers and lenders, and they also extend certain timelines tied to the foreclosure process. For those learning about foreclosure for dummies, understanding these changes can empower homeowners to take proactive steps. Visiting platforms like US Legal Forms can further illuminate these regulations and assist homeowners in navigating their options.

In the realm of foreclosure for dummies, the 120-day rule typically applies to specific mortgage contracts and deeds of trust. Understanding this aspect is crucial, as it helps ensure compliance with state regulations. If you hold a residential mortgage, it is vital to recognize if your contract falls under this rule. Consulting resources at US Legal Forms can clarify your specific situation and your rights.

Writing foreclosure documents requires specific details to ensure clarity and compliance with legal standards. Start by outlining the homeowner's name, property address, and the reason for foreclosure. Follow this with the timeline of events leading to the foreclosure process. Resources like US Legal Forms can provide templates and guides, making it simple to draft accurate foreclosure documents without legal jargon.

In the context of foreclosure for dummies, it's important to know that there are specific exceptions to the 120-day rule. For example, if the borrower is a tenant rather than a homeowner, different timelines can apply. Additionally, if the property is abandoned, the lender may proceed without waiting for the 120 days to elapse. Understanding these exceptions can help homeowners navigate the complex world of foreclosure more effectively.

Most lenders initiate foreclosure proceedings after a homeowner misses three to six consecutive payments, but this can vary based on the lender and local laws. It’s crucial to communicate with your lender if you're facing financial hardship, as they may offer solutions. Understanding the limits of missed payments can empower you in your financial choices. Resources like foreclosure for dummies can provide essential insights, and using tools from US Legal Forms can help you find relevant documents and information.

A bank can initiate foreclosure actions after a borrower misses several payments, but the overall timeline often depends on state laws and the specific lender's procedures. Generally, once a borrower is noticed for default, the process may take from a few months to over a year to finalize. Staying informed will help you understand your rights and options. Remember, guides on foreclosure for dummies can provide valuable knowledge, while US Legal Forms offers comprehensive resources to aid your understanding.