Deed In Lieu Template With Formulas

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Utilizing legal templates that comply with federal and local laws is crucial, and the web presents numerous choices to choose from.

However, what’s the point of spending time searching for the appropriate Deed In Lieu Template With Formulas example online when the US Legal Forms digital library already has such templates compiled in one location.

US Legal Forms is the largest online legal repository with more than 85,000 editable templates created by attorneys for any business and personal circumstance. They are straightforward to navigate with all documents categorized by state and intended use. Our experts keep abreast of legislative updates, ensuring your form is always current and compliant when obtaining a Deed In Lieu Template With Formulas from our site.

Click Buy Now once you’ve identified the appropriate form and choose a subscription plan. Create an account or Log In and make a payment with PayPal or a credit card. Choose the ideal format for your Deed In Lieu Template With Formulas and download it. All templates you find through US Legal Forms are reusable. To re-download and complete previously obtained forms, access the My documents tab in your account. Enjoy the most comprehensive and user-friendly legal document service!

- Acquiring a Deed In Lieu Template With Formulas is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you need in the desired format.

- If you are new to our platform, follow the steps below.

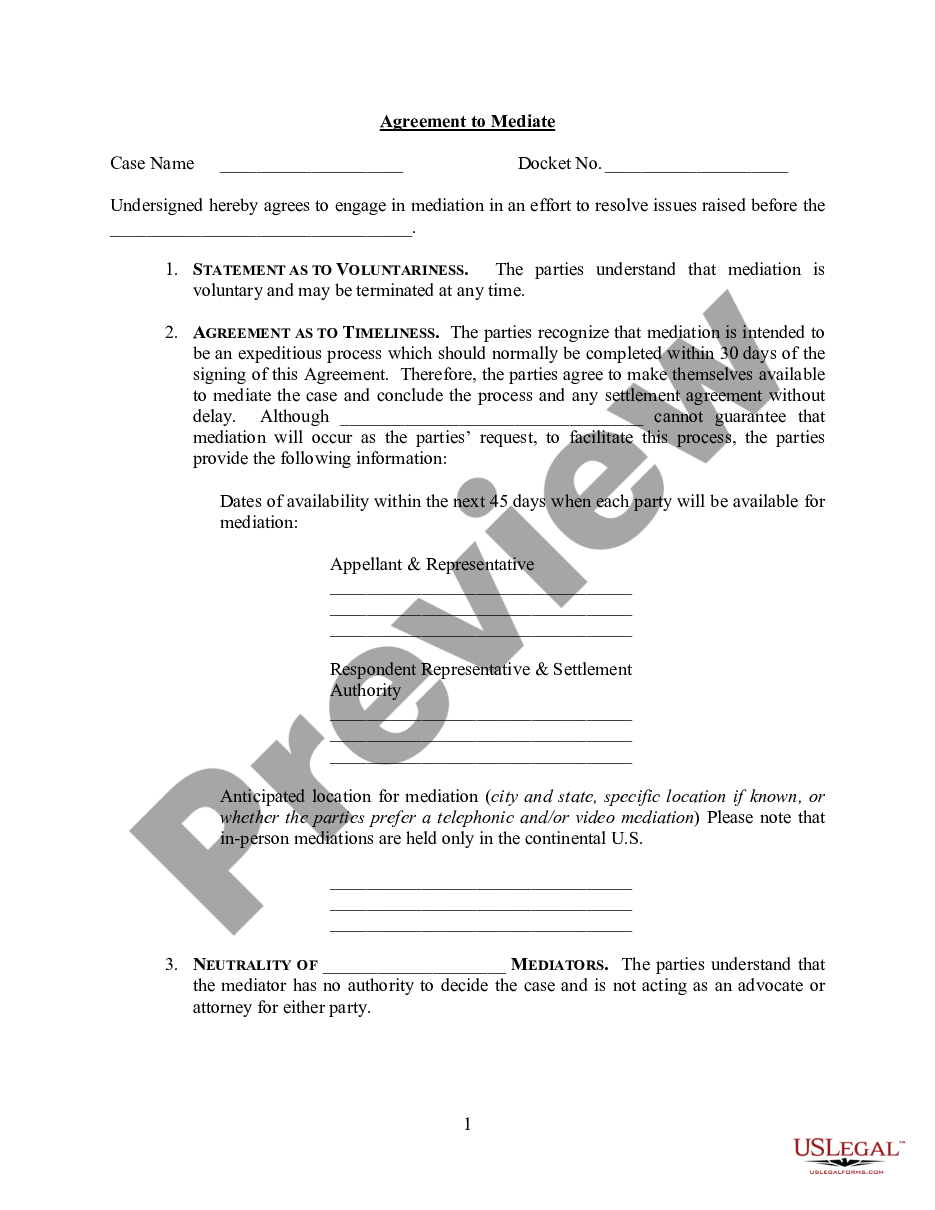

- Review the template using the Preview feature or via the text outline to ensure it fits your requirements.

- Search for another example using the search function at the top of the page if needed.

Form popularity

FAQ

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven deficiency. The IRS learns of the deficiency when the lender sends it a Form 1099-C, which reports the forgiven debt as income to you.

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven deficiency. The IRS learns of the deficiency when the lender sends it a Form 1099-C, which reports the forgiven debt as income to you.

This transfer essentially releases the borrower from their mortgage debt and helps the lender avoid the lengthy and costly foreclosure process. The Deed in Lieu is an alternative for homeowners struggling with mortgage payments and helps the lender recoup some of their investment faster.

When does the waiting period begin once a DIL has been started? A three-year mandatory waiting period starts, ?on the date of the DIL or the date that the Borrower transferred ownership of the Property to the foreclosing Entity/designee.?