Deed In Lieu Of Foreclosure Form For Deceased

Description

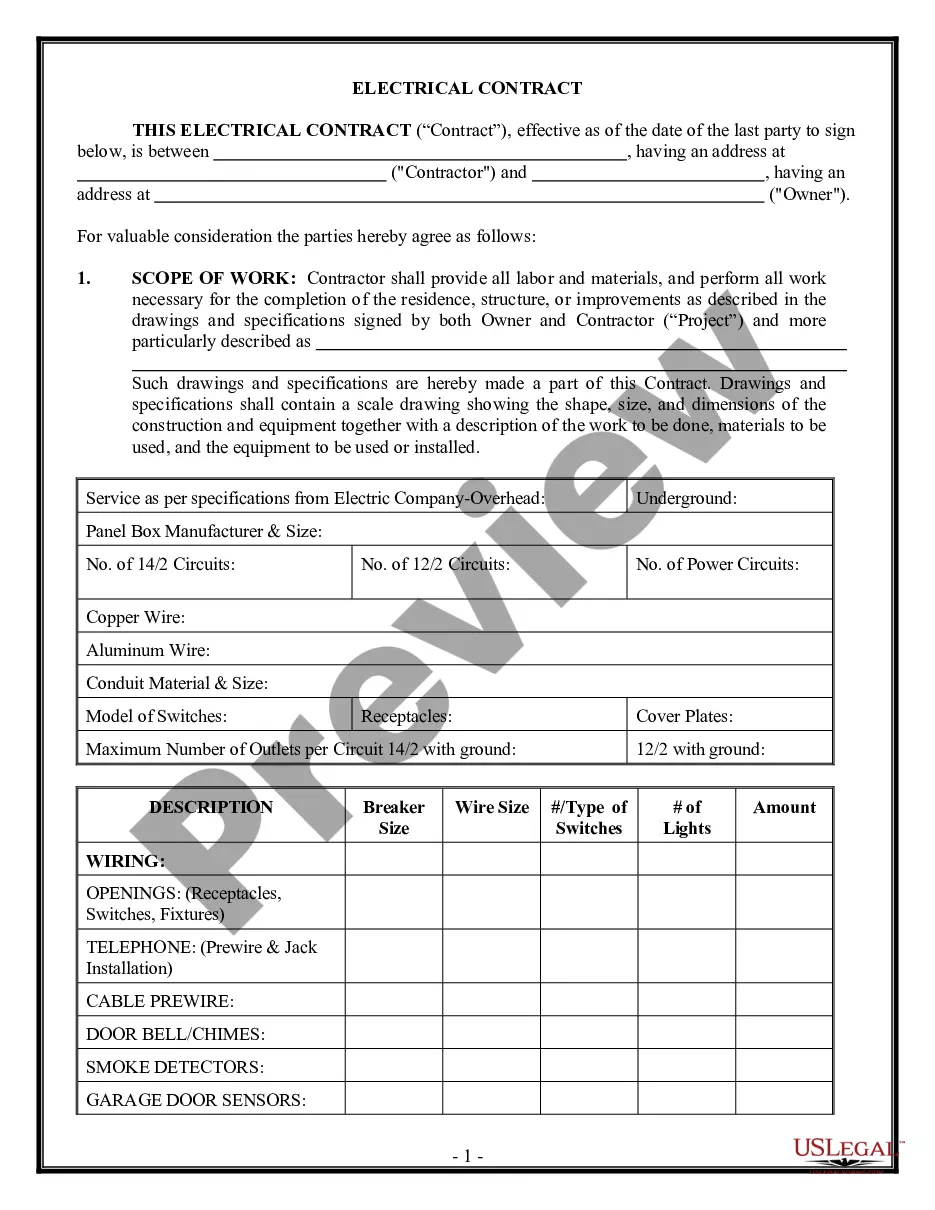

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

It's widely recognized that you can't transform into a legal expert in a day, nor can you swiftly learn how to prepare the Deed In Lieu Of Foreclosure Form For Deceased without possessing a specialized skill set.

Assembling legal documents is an extensive process that demands specific knowledge and skills.

So why not entrust the preparation of the Deed In Lieu Of Foreclosure Form For Deceased to the specialists.

You can access your documents again from the My documents section at any time. If you are an existing client, you can simply Log In and find and download the template from the same area.

Regardless of the purpose of your documents—whether they are financial or legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Explore the document you require by utilizing the search feature at the top of the page.

- Preview it (if this option is available) and review the accompanying description to ascertain if the Deed In Lieu Of Foreclosure Form For Deceased is what you seek.

- If you need another form, start your search anew.

- Sign up for a complimentary account and select a subscription plan to acquire the form.

- Click Buy now. After completing the payment, you can download the Deed In Lieu Of Foreclosure Form For Deceased, complete it, print it, and forward it by mail to the specified recipients or organizations.

Form popularity

FAQ

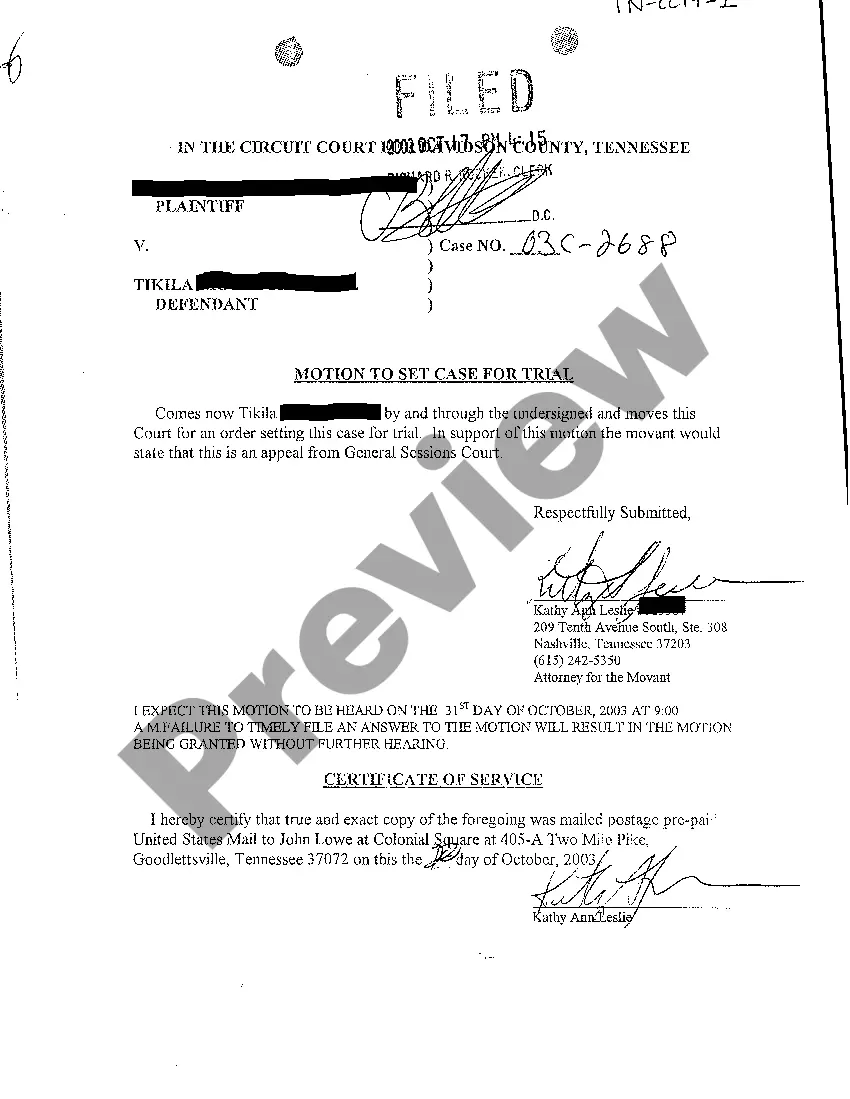

The deed in lieu of foreclosure process can take anywhere from several weeks to a few months to complete. Factors affecting this timeline include the lender's policies and the complexity of the case. To expedite the process, ensure that you submit a complete and accurate deed in lieu of foreclosure form for deceased property.

Lenders may accept a deed in lieu of foreclosure as it allows them to avoid the lengthy and costly foreclosure process. Accepting a deed is often quicker and provides a more straightforward resolution for both parties. Additionally, lenders may appreciate the opportunity to recover some of their losses through property ownership without taking drastic measures.

A deed in lieu of foreclosure can negatively impact your credit, but typically not as severely as a full foreclosure. Generally, you may see your score drop by 100 points or more, depending on your credit history. Maintaining good credit afterward is crucial, so stay informed about your credit report and consider rebuilding efforts post-process.

To file a deed in lieu of foreclosure, you need to prepare the deed in lieu of foreclosure form for deceased property owners. Firstly, gather necessary documents, including the mortgage information and proof of ownership. Next, submit the completed form to your lender for review, and if accepted, make sure to follow their specific instructions for recording the deed with your local government office.

Executing a deed in lieu of foreclosure form for deceased involves several straightforward steps. After gathering necessary documents, you should communicate with the lender about your intentions. Following their guidance, you'll proceed to prepare the deed, sign it in front of a notary, and then submit it to the lender for acceptance. Using a reliable service like US Legal Forms can simplify this process by providing the necessary forms and instructions tailored for your situation.

A key disadvantage to lenders when accepting a deed in lieu of foreclosure form for deceased is the potential loss of revenue. The property might not be worth the total amount owed, leading to financial loss for the lender. Additionally, lenders face the risk of property management and selling complications if the property needs repairs or cleaning before resale. This can result in increased costs and longer time frames to recover any funds.

To execute a deed in lieu of foreclosure form for deceased, start by contacting the lender to express your intention. You'll typically need to provide documentation such as the death certificate, proof of the property’s ownership, and any relevant financial records. After the lender reviews the information, they will give you specific instructions regarding the signing and filing process. It's wise to consult with an attorney to ensure all legal aspects are covered.

One disadvantage of a deed in lieu of foreclosure form for deceased is that it may not fully relieve the estate from any outstanding mortgage obligations. Depending on state laws, lenders may be able to pursue a deficiency judgment if the property's value is less than the owed mortgage amount. Additionally, this process can impact the estate’s creditworthiness. Therefore, it's important to fully understand the consequences before proceeding.

No, a lender does not have to accept a deed in lieu of foreclosure. Lenders have the discretion to approve or deny such requests based on their policies and your financial situation. However, if you present a well-prepared deed in lieu of foreclosure form for deceased, it may increase your chances of acceptance.

When considering a deed in lieu of foreclosure, it is essential to gather specific documents. You should obtain the deed in lieu of foreclosure form for deceased, any existing mortgage documents, proof of ability to make payments, and correspondence with your lender. These documents will help clarify your situation and facilitate a smoother process.