Deed In Lieu Of Foreclosure For Reverse Mortgage

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

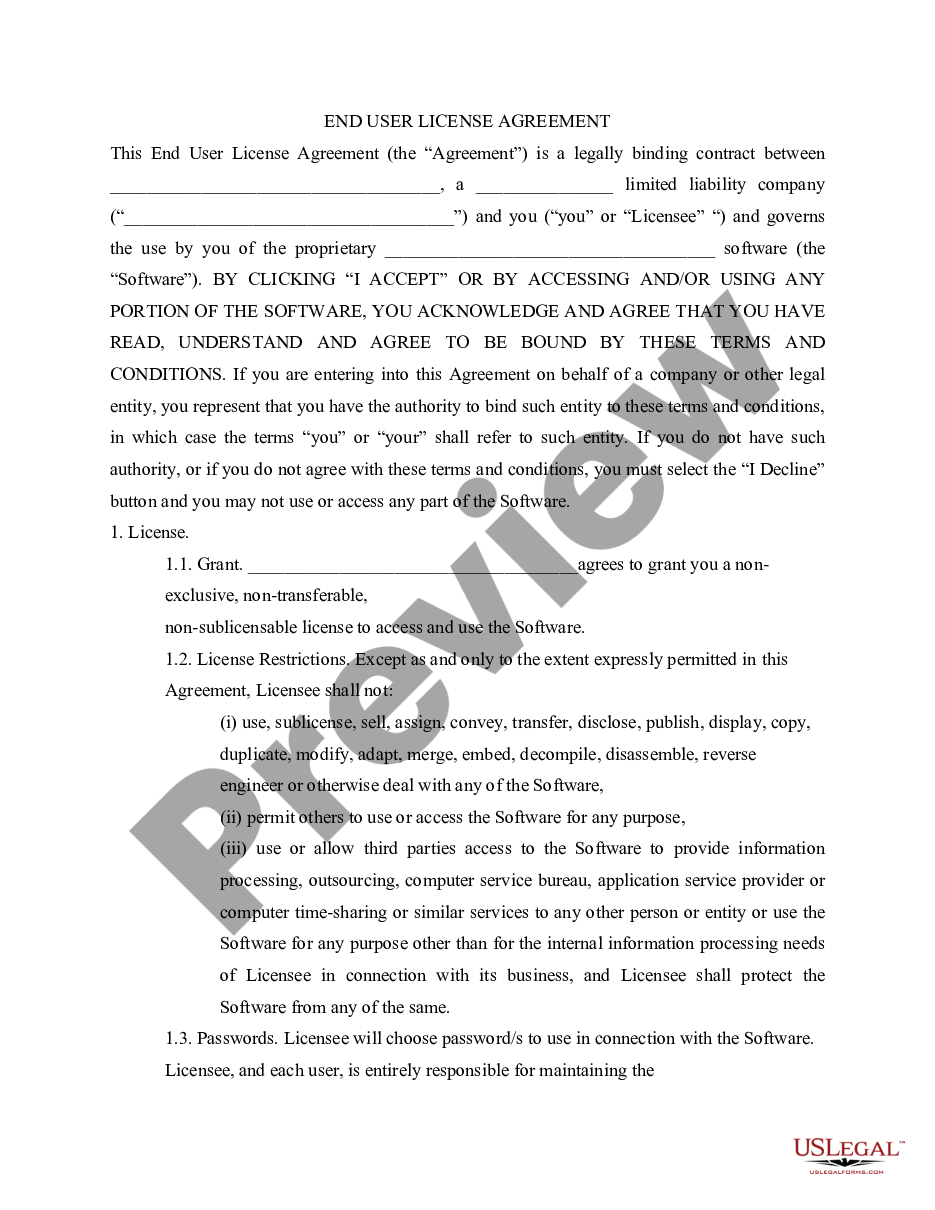

Individuals generally link legal documentation with something intricate that only an expert can handle.

In a certain aspect, this is accurate, as preparing Deed In Lieu Of Foreclosure For Reverse Mortgage requires significant knowledge of subject matters, such as state and county laws.

Nevertheless, with the US Legal Forms, processes have become simpler: pre-made legal documents for any personal and business circumstance tailored to state regulations are compiled in a single online directory and are now accessible to everyone.

Register for an account or Log In to proceed to the payment section. Pay for your subscription via PayPal or use your credit card. Choose the format for your document and click Download. Print your document or upload it to an online editor for a quicker completion. All templates in our collection are reusable: once acquired, they remain saved in your profile. You can access them anytime through the My documents tab. Discover the full advantages of utilizing the US Legal Forms platform. Subscribe now!

- US Legal Forms offers over 85,000 current forms categorized by state and usage area, making the search for Deed In Lieu Of Foreclosure For Reverse Mortgage or any specific template quick and effortless.

- Previously registered users with an active subscription must Log In to their account and press Download to obtain the form.

- New users to the service will need to create an account and subscribe before they can access any documents.

- Here’s a detailed guideline on how to obtain the Deed In Lieu Of Foreclosure For Reverse Mortgage.

- Carefully review the page content to confirm it meets your requirements.

- Read the form description or inspect it using the Preview feature.

- Search for another sample using the Search field above if the previous option doesn't fit your needs.

- Press Buy Now once you find the suitable Deed In Lieu Of Foreclosure For Reverse Mortgage.

- Select a pricing plan that aligns with your requirements and financial capabilities.

Form popularity

FAQ

Senior homeowners who need additional income during retirement often benefit the most from reverse mortgages. These loans allow them to tap into their home equity without selling their property. It's a suitable option for those who plan to age in place while managing financial needs. However, understanding all implications, including the potential for a deed in lieu of foreclosure for reverse mortgage, is essential for making informed decisions.

One significant catch with reverse mortgages is that they can become costly over time. Homeowners often incur higher fees and interest charges, which can reduce their home's equity. Additionally, if homeowners decide to leave their home or pass away, repayment is required. In such situations, exploring a deed in lieu of foreclosure for reverse mortgage may provide a viable option for people facing financial challenges.

Yes, people can lose their homes with a reverse mortgage. If the homeowner fails to meet the obligations, such as paying property taxes or maintaining the home, the lender may initiate a foreclosure process. In some cases, homeowners may consider a deed in lieu of foreclosure for reverse mortgage as an alternative to foreclosure. This option can allow homeowners to voluntarily transfer the home back to the lender, which may benefit both parties.

The best alternative to foreclosure often depends on individual circumstances, but a deed in lieu of foreclosure for reverse mortgage is frequently recommended. This option allows you to turn over your property to the lender and relieve yourself of the financial burden. It is a simpler solution compared to proceeding through a foreclosure, with a potentially less damaging effect on your credit history. Explore how this method can provide you with a fresh start and a smoother transition.

One effective option to avoid foreclosure is a deed in lieu of foreclosure for reverse mortgage. This arrangement allows you to voluntarily transfer the ownership of your property back to the lender, thereby eliminating your mortgage debt. It is a straightforward process that can help you escape the lengthy foreclosure procedure and protect your credit score. By choosing this solution, you can move forward with less financial stress and regain peace of mind.

The best strategy to exit a reverse mortgage depends on individual circumstances. Homeowners can sell their property, use personal savings, or consider a deed in lieu of foreclosure for reverse mortgage as solutions. Each of these options has its own implications, and working with a platform like uslegalforms can guide you through this process, helping you make informed decisions about your financial future.

For lenders, the biggest drawback of a deed in lieu of foreclosure is the potential loss incurred from accepting the property. They may find themselves owning a home with reduced market value, especially in areas with fluctuating real estate prices. That said, offering options like a deed in lieu of foreclosure for reverse mortgage can mitigate long-term losses and streamline the property disposition process.

Walking away from a reverse mortgage is not as straightforward as it may seem. The homeowner needs to adhere to specific obligations, or they might face foreclosure. However, exploring a deed in lieu of foreclosure for reverse mortgage can offer a structured way to relinquish the home without the burden of further debt or legal consequences.

If you are considering a deed in lieu of foreclosure for your house, it’s advisable to gather all the necessary documents and consult your lender. Platforms, like US Legal Forms, can provide you with the essential documentation needed for the process. Ensure you understand how this decision affects your future, especially in the context of a reverse mortgage.

One significant disadvantage of a deed in lieu of foreclosure is the potential negative impact on your credit score. In addition, your lender may not cover all homeowner expenses, such as taxes and insurance. It's essential to evaluate the long-term financial implications, particularly if you have a reverse mortgage.