Deed In Lieu Of Foreclosure For

Description

How to fill out Deed In Lieu Of Foreclosure For?

There is no further necessity to squander time searching for legal paperwork to satisfy your local state obligations.

US Legal Forms has compiled all of them in one location and enhanced their availability.

Our platform offers over 85k templates for various business and personal legal situations categorized by state and usage area.

Using the Search field above to look for another template if the prior one didn't meet your requirements. Click Buy Now next to the template name when you locate the correct one. Choose the preferred subscription plan and register for an account or sign in. Process payment for your subscription using a card or via PayPal to continue. Select the file format for your Deed In Lieu Of Foreclosure For and download it to your device. Print your form to complete it manually or upload the template if you prefer to utilize an online editor. Completing official documentation under federal and state laws and regulations is quick and straightforward with our platform. Give US Legal Forms a try now to maintain your documentation in order!

- All forms are correctly drafted and validated for authenticity, ensuring your access to a current Deed In Lieu Of Foreclosure For.

- If you are acquainted with our platform and possess an account, ensure your subscription is active before acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained paperwork anytime needed by accessing the My documents tab in your profile.

- If you've not previously utilized our platform, the process will require a few additional steps.

- Here's how new users can acquire the Deed In Lieu Of Foreclosure For from our catalog.

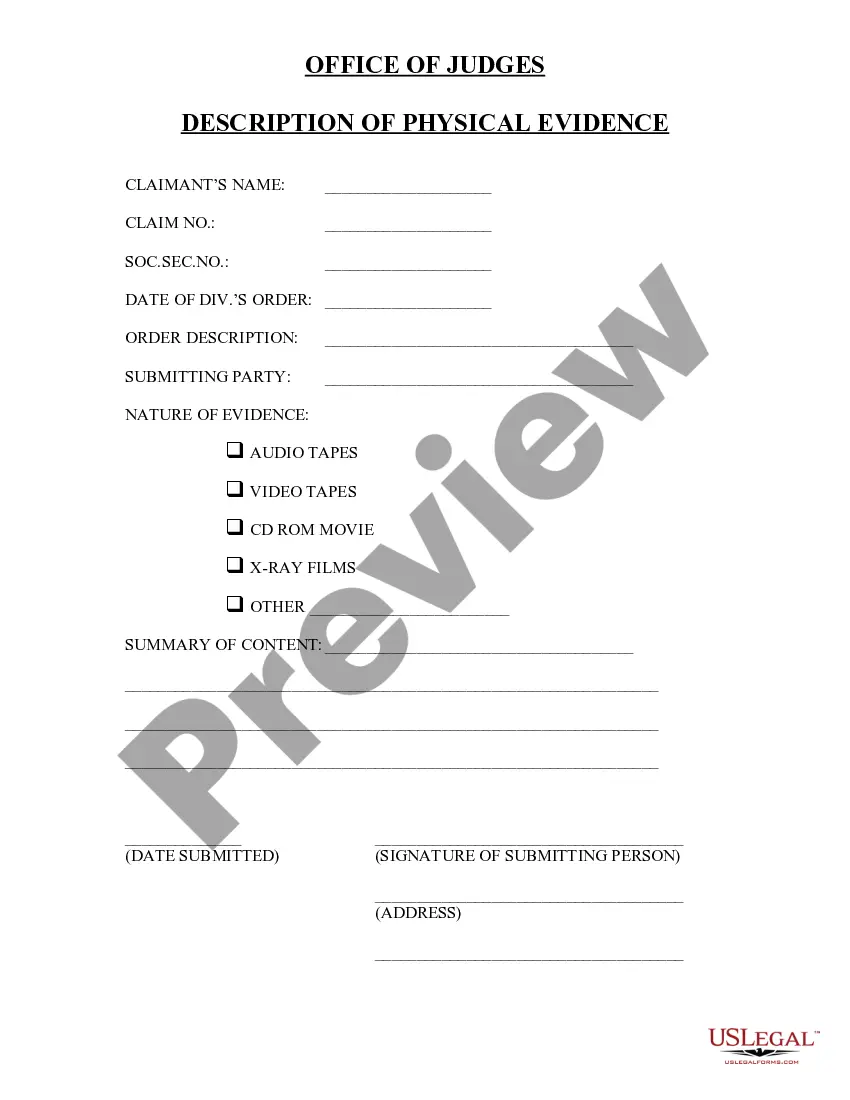

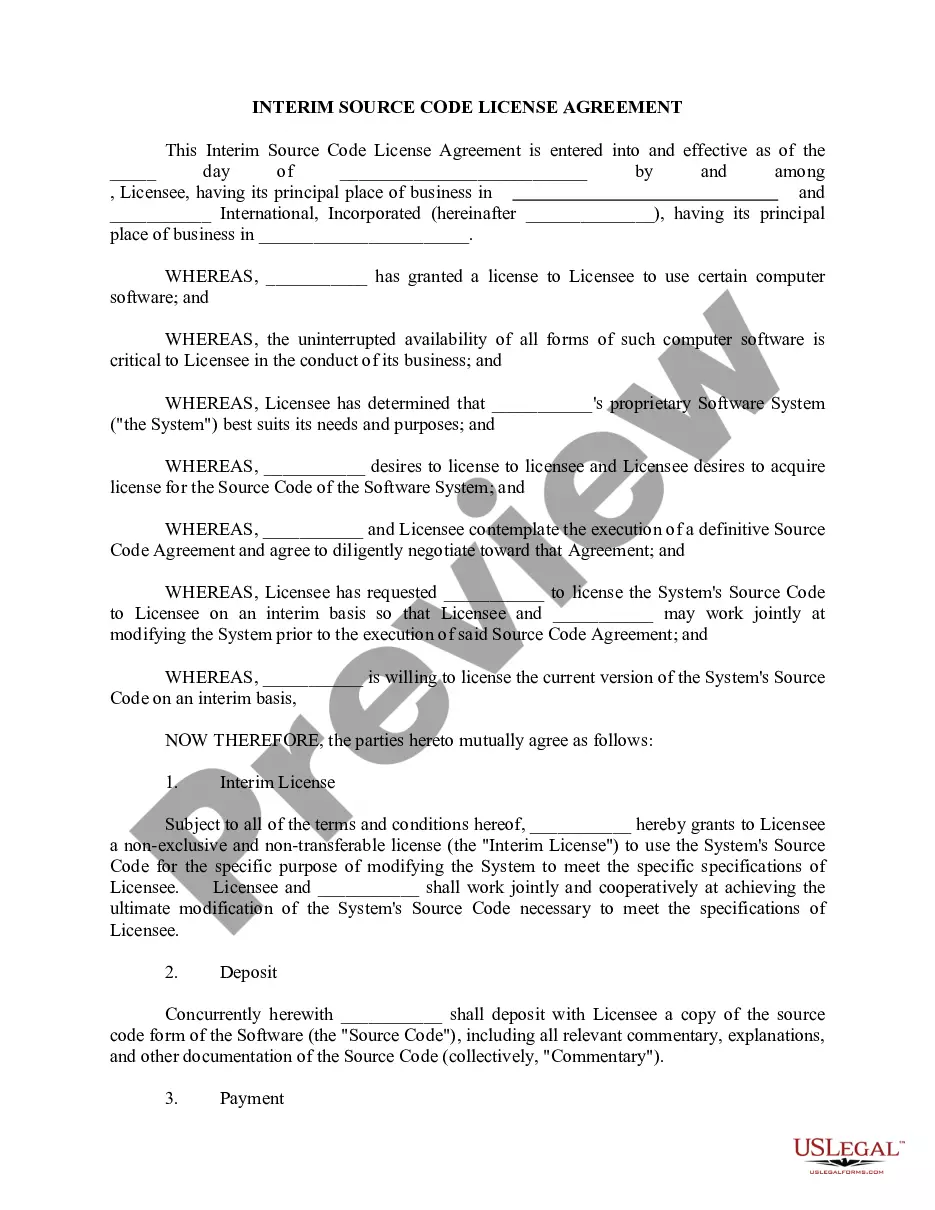

- Carefully read the page content to confirm it includes the sample you need.

- Utilize the form description and preview options, if available.

Form popularity

FAQ

The most likely disadvantage for lenders in accepting a deed in lieu of foreclosure is the risk of inherited liabilities associated with the property. When lenders take ownership, they may also assume issues like unpaid property taxes or violations of local codes. This can lead to unexpected costs and complications that affect their bottom line. Lenders can stay informed about these risks by utilizing uslegalforms for proper documentation and insight.

The disadvantages of a deed in lieu of foreclosure include the potential for tax implications on any forgiven debt. Homeowners may also face emotional distress from losing their property, impacting their overall well-being. Moreover, the process requires the lender's approval, meaning you may not have complete control over the outcome. To navigate these complexities, uslegalforms offers resources to help you understand your rights and responsibilities.

One major disadvantage of a deed is that it may affect the homeowner’s ability to secure future loans. When you opt for a deed in lieu of foreclosure, it could appear as a negative mark on your credit report, limiting your financial opportunities. Furthermore, it's essential to understand that not all lenders accept this option, potentially reducing your choices. If you're considering this path, uslegalforms can help clarify your options and create necessary documents.

The biggest disadvantage for lenders accepting a deed in lieu of foreclosure is the uncertainty surrounding the property's condition. When lenders acquire a property through this process, they may discover unforeseen issues which could lead to significant repair costs. Additionally, lenders might face challenges in reselling the property later, which can affect their financial recovery. Engaging with uslegalforms can guide lenders in managing potential risks effectively.

A deed in lieu of foreclosure is often considered one of the best alternatives to foreclosure. This process allows homeowners to voluntarily transfer ownership of their property to the lender, helping them avoid the lengthy and damaging effects of foreclosure. By choosing this option, you can rehabilitate your financial standing more quickly and potentially mitigate the impact on your credit score. For further assistance, uslegalforms can provide the necessary documentation to streamline this process.

Considering a deed in lieu of foreclosure for offers homeowners a proactive way to avoid the repercussions of foreclosure. By negotiating with your lender, you can transfer your property voluntarily and potentially alleviate future debts. This option not only offers an opportunity to escape financial distress, but it also could facilitate a fresh start for those seeking to regain control of their financial situation. If you're uncertain about the process, platforms like US Legal Forms can guide you through the necessary steps, simplifying your experience.

A deed in lieu of foreclosure for closely resembles foreclosure but offers a more straightforward and less stressful outcome for homeowners. While foreclosure involves legal proceedings and potential loss of property, a deed in lieu allows homeowners to relinquish ownership without going through court. It provides a smoother exit strategy, ultimately reducing the emotional and financial strain typical of a full foreclosure.

A deed in lieu of foreclosure for is a viable alternative to the more traditional foreclosure process. This arrangement allows homeowners to voluntarily transfer their property to the lender, thereby avoiding a lengthy foreclosure. It simplifies the transition and may help preserve the homeowner's credit ratings much better than a foreclosure would. Exploring this option can often lead to a more considerate resolution for all parties involved.

While a deed in lieu of foreclosure does impact your credit score, it is generally less severe than a traditional foreclosure. Typically, you can expect a drop of up to 100 points, depending on your overall credit situation. This mark can remain on your credit report for several years, but working with resources like US Legal Forms can help you understand and manage your financial recovery thereafter.

A deed in lieu of foreclosure is a legal document that allows homeowners to voluntarily transfer ownership of their property to the lender in exchange for relief from mortgage obligations. In contrast, a quit claim deed transfers any interest you might have in a property to another party without guaranteeing that interest is valid. Understanding these distinctions can be key in deciding the best option when facing financial challenges.