Deed Foreclosure Form For Sale Of Property

Description

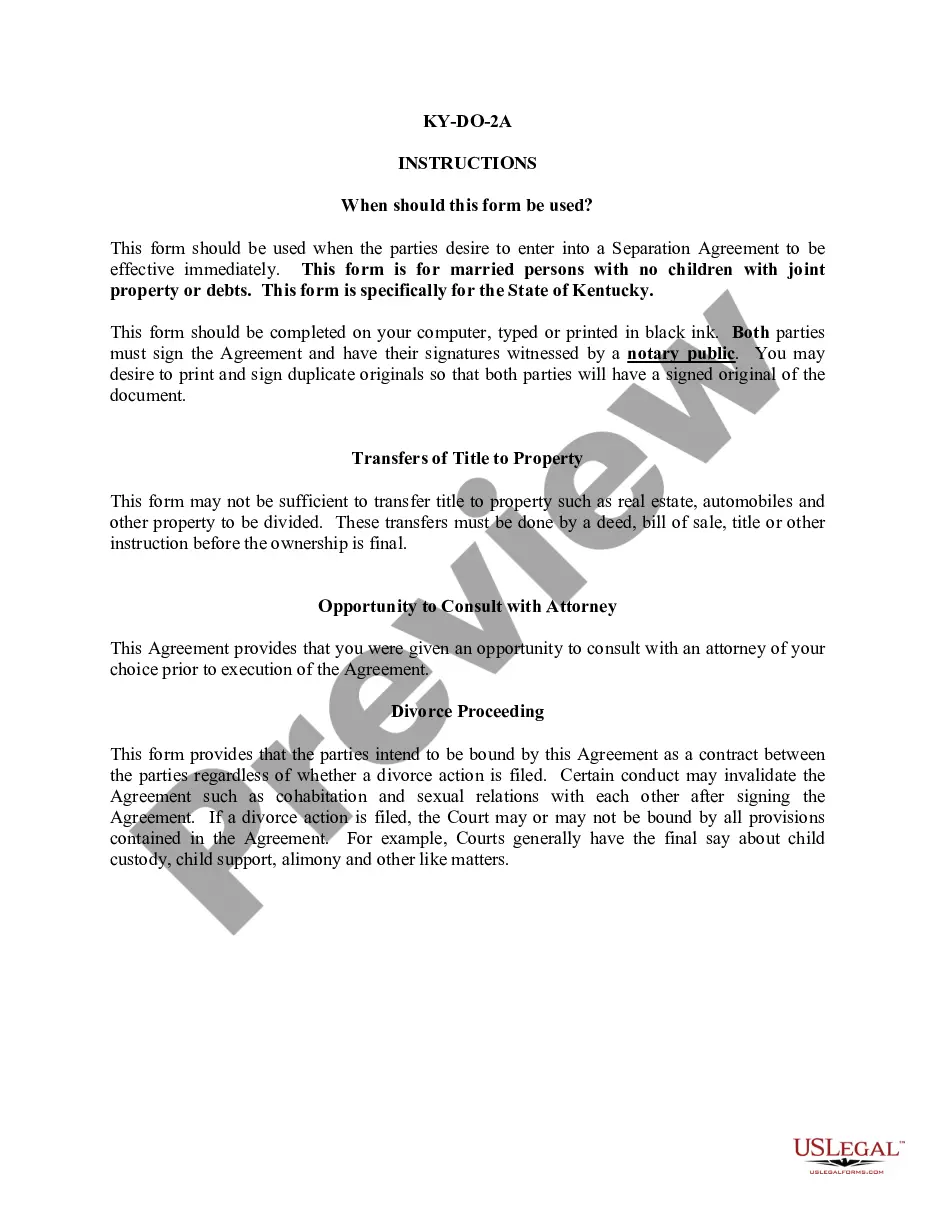

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Whether for commercial reasons or for individual issues, everyone must handle legal matters at some stage in their life.

Completing legal documents demands meticulous focus, starting from selecting the appropriate form sample.

With a vast US Legal Forms collection available, you do not need to waste time looking for the suitable template online. Utilize the library’s straightforward navigation to find the correct form for any occasion.

- Locate the template you require by using the search bar or catalog browsing.

- Review the form’s details to ensure it aligns with your situation, state, and locality.

- Click on the form’s preview to review it.

- If it is the incorrect document, return to the search tool to find the Deed Foreclosure Form For Sale Of Property sample you require.

- Obtain the template if it fulfills your criteria.

- If you have a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the correct pricing option.

- Fill out the account registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the document format you prefer and download the Deed Foreclosure Form For Sale Of Property.

- Once it is downloaded, you can complete the form using editing software or print it and fill it out manually.

Form popularity

FAQ

In a deed in lieu of foreclosure, also known as a friendly foreclosure, the borrower transfers ownership of the commercial property to the lender voluntarily. Instead of going through a lengthy and costly foreclosure process, the borrower willingly gives up the property to satisfy the debt.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

Prior to the mortgage crisis, voluntary foreclosures?also called friendly foreclosure, mortgage release, strategic release or simply walking away?were rarely used. But with a shifting real estate market and challenging economic times, some homeowners still may choose this option today.

A deed in lieu of foreclosure is a deed instrument in which a mortgagor (i.e. the borrower) conveys all interest in a real property to the mortgagee (i.e. the lender) to satisfy a loan that is in default and avoid foreclosure proceedings.

Once the bank takes over on the property, it sells the property at a discounted price to recover money lost on the mortgage loan. Foreclosure remains on a borrower's credit report for seven years and it is one of the worst types of credit report entered and can have negative impact on future ability to get credit.