Accounting Form Document For Company

Description

How to fill out Demand For Accounting From A Fiduciary?

Legal document managing might be overwhelming, even for the most skilled specialists. When you are searching for a Accounting Form Document For Company and don’t have the a chance to commit looking for the right and updated version, the operations might be stressful. A robust web form catalogue could be a gamechanger for anybody who wants to take care of these situations effectively. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms available to you at any moment.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any requirements you could have, from individual to enterprise papers, all in one place.

- Employ advanced resources to finish and deal with your Accounting Form Document For Company

- Access a resource base of articles, guides and handbooks and materials connected to your situation and requirements

Save effort and time looking for the papers you need, and make use of US Legal Forms’ advanced search and Preview tool to locate Accounting Form Document For Company and get it. In case you have a monthly subscription, log in in your US Legal Forms profile, look for the form, and get it. Review your My Forms tab to find out the papers you previously downloaded and also to deal with your folders as you can see fit.

If it is the first time with US Legal Forms, create an account and get unlimited access to all advantages of the platform. Here are the steps to take after downloading the form you want:

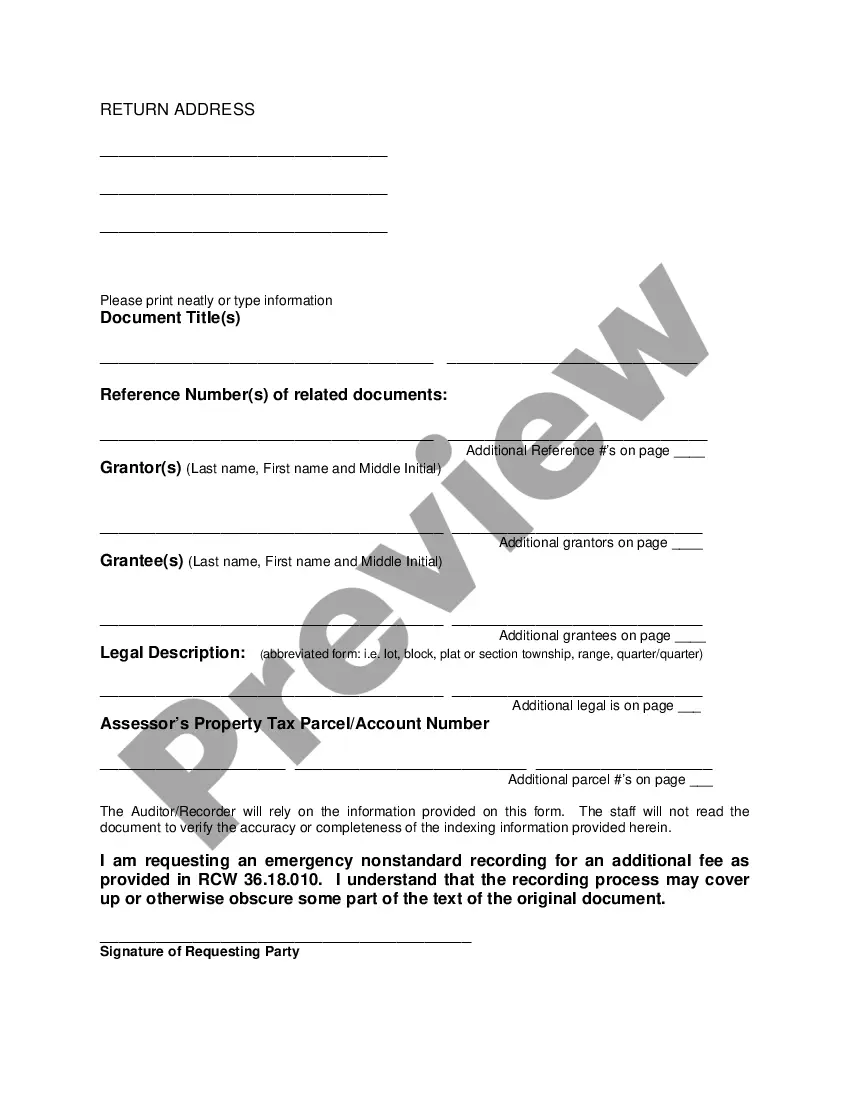

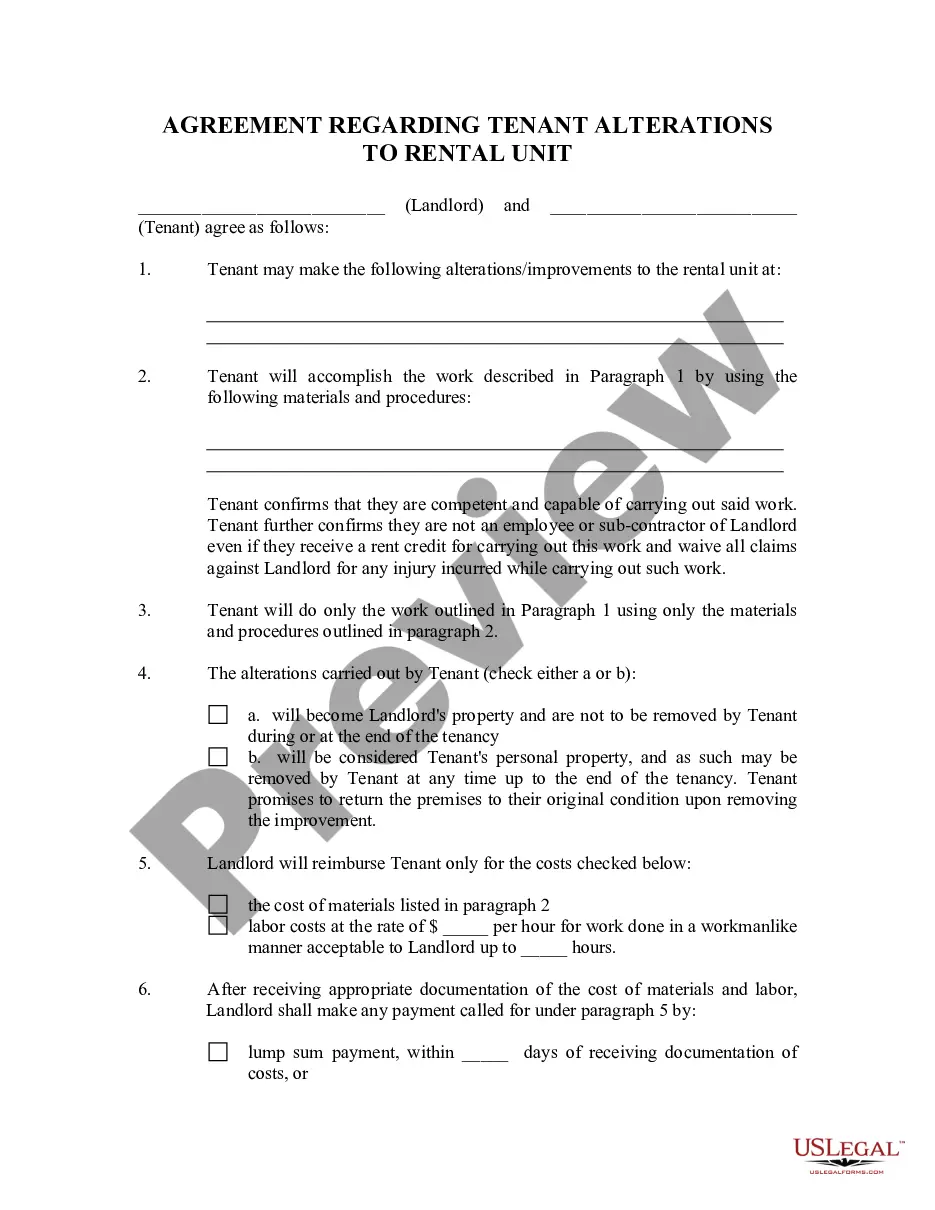

- Validate this is the right form by previewing it and reading through its information.

- Be sure that the sample is approved in your state or county.

- Choose Buy Now when you are all set.

- Choose a subscription plan.

- Find the formatting you want, and Download, complete, eSign, print out and send your papers.

Benefit from the US Legal Forms web catalogue, backed with 25 years of experience and stability. Transform your everyday papers managing into a smooth and intuitive process today.

Form popularity

FAQ

LLC Corporations It is mandatory for all corporations to file annual tax returns, even if the business was inactive or did not receive income. An LLC that chooses to be treated as a C corporation for tax purposes is required to file Form 1120 (U.S. Corporation Income Tax Return).

In accounting, the term ?account form? typically refers to the way financial information is presented in the balance sheet. The account form balance sheet displays assets on the left side and liabilities and equity on the right side, resembling the format of a T-account.

How to fill out Form 1120 Employer Identification Number (EIN) Date you incorporated. Total assets. Gross receipts and sales. Cost of goods sold (COGS) Tax deductions. Tax credits. Capital gains.

Accounting is a process of identifying financial transactions, measuring them in monetary terms, and recording, classifying, summarizing, analyzing, interpreting them and communicating the results to the users.

Accounting is the process of recording financial transactions pertaining to a business. The accounting process includes summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities.