Independent Contractor With Llc

Description

How to fill out Independent Contractor Agreement Between Licensed Counselor And Therapist And Licensed Counselor And Therapist Practicing As A Solo Practitioner?

Correctly composed official documents serve as one of the essential assurances for preventing complications and legal disputes, but acquiring them without the assistance of a legal professional may require time.

Whether you're looking to swiftly locate a current Independent Contractor With Llc or any other forms related to employment, family, or business circumstances, US Legal Forms is always ready to assist.

For current users of the US Legal Forms library, the process is even more straightforward. If your subscription is active, simply Log In to your account and click the Download button next to the selected form. Furthermore, you can access the Independent Contractor With Llc at any time, as all documents obtained on the platform are retrievable within the My documents section of your account. Save time and costs when preparing formal documents. Explore US Legal Forms today!

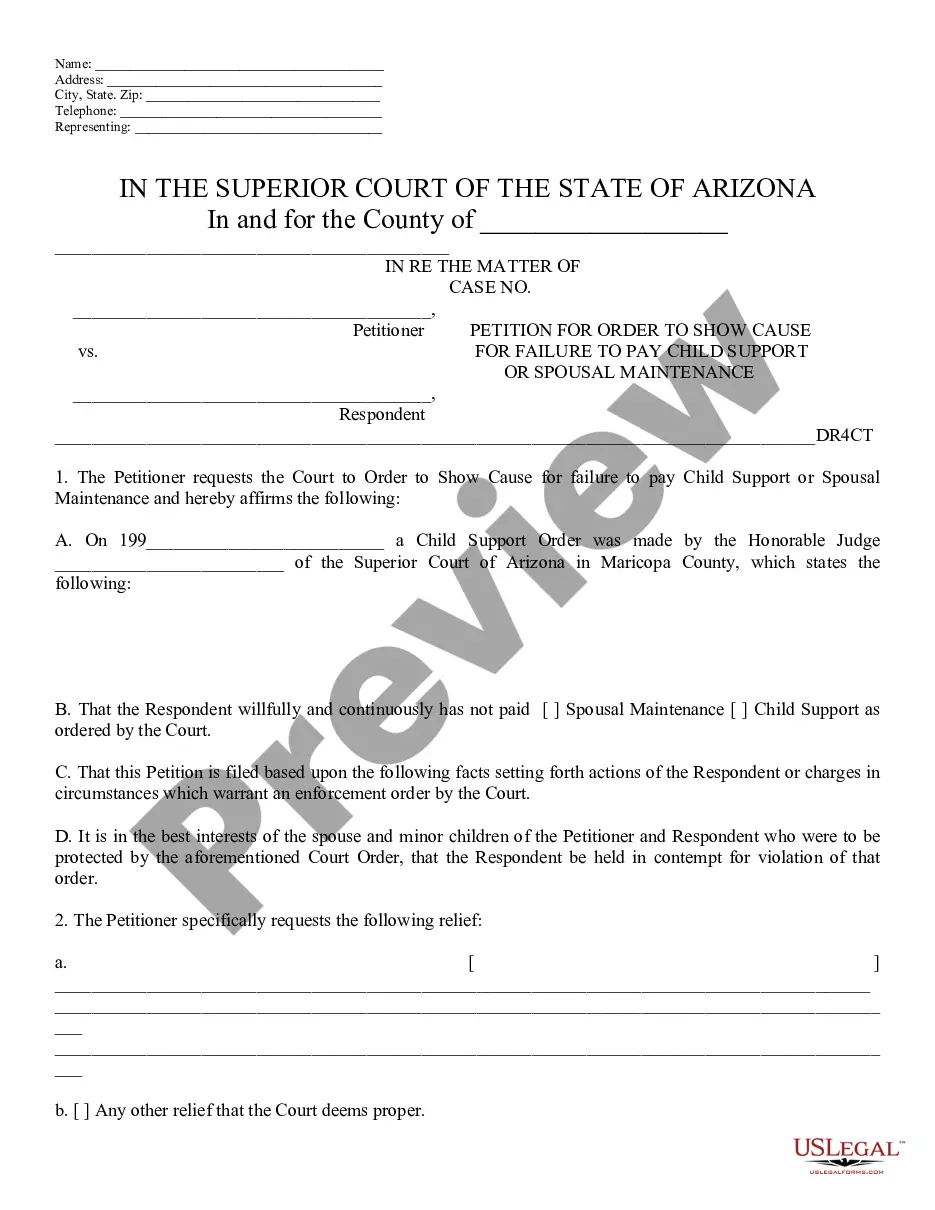

- Verify that the template is applicable to your circumstances and area by reviewing the description and preview.

- If necessary, search for another example using the Search bar located in the header of the page.

- Select Buy Now once you identify the correct document.

- Choose your pricing option, Log In to your account or set up a new one.

- Select your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Pick between PDF or DOCX file formats for your Independent Contractor With Llc.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Unless a corporate tax structure is elected, business income from an LLC is subject to self-employment tax. So for the majority of LLCs, the owners are self-employed. Owners of LLCs who elect to be taxed as corporations, on the other hand, are not self-employed.

LLC members are considered self-employed business owners rather than employees of the LLC so they are not subject to tax withholding. Instead, each LLC member is responsible for setting aside enough money to pay taxes on that member's share of the profits.

Can I 1099 myself from my LLC? Yes, you can hire yourself as an independent contractor to perform work for your LLC. If you do that, the LLC would then issue you a Form 1099-MISC.

Paying yourself as an independent contractor As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC. The LLC will be responsible for IRS Form 1099-MISC during tax season.

Therefore, independent contractors should consider forming their company as a separate business entity. Whether or not a 1099 contractor should form his company as an LLC will depend largely on his personal situation, but there are many benefits that come with forming a limited liability company.