Emancipation Laws For Pennsylvania

Description

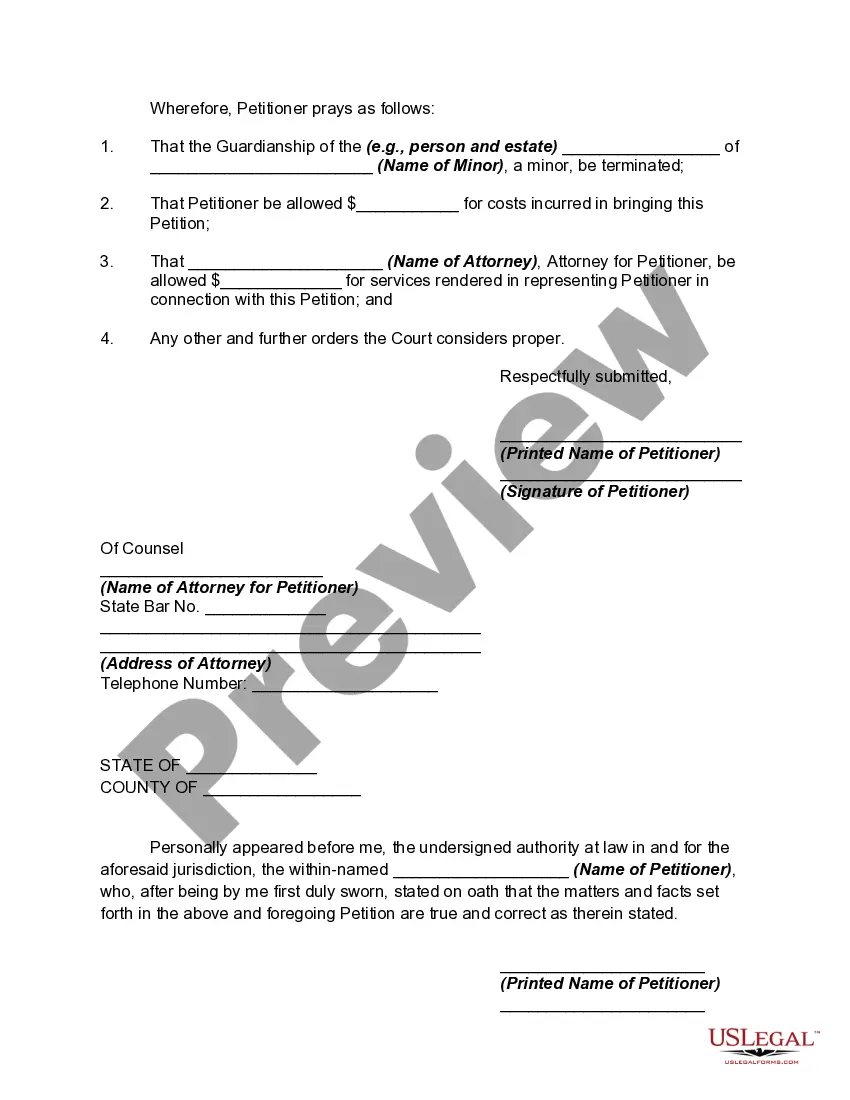

How to fill out Petition For Termination Of Guardianship By Emancipated Minor?

Legal documents handling can be daunting, even for the most skilled professionals.

When you are seeking Emancipation Laws For Pennsylvania and lack the time to commit to finding the suitable and current version, the tasks may be challenging.

Access a wealth of articles, guides, manuals, and resources pertinent to your situation and requirements.

Save time and effort in locating the documents you need, and use US Legal Forms’ sophisticated search and Preview capability to find Emancipation Laws For Pennsylvania and obtain it.

Confirm that the template is authorized in your state or county. Choose Buy Now when ready. Pick a monthly subscription option. Locate your preferred file format, then Download, fill out, eSign, print, and dispatch your documents. Enjoy the US Legal Forms web catalog, supported by 25 years of expertise and trustworthiness. Streamline your daily document management into a simple and user-friendly procedure now.

- If you hold a monthly subscription, Log In to your US Legal Forms account, search for the document, and download it.

- Check your My documents section to view documents you have saved and manage your folders as necessary.

- If this is your initial experience with US Legal Forms, register an account for unlimited access to all platform benefits.

- Follow these steps after accessing the desired form.

- Verify this is the correct form by previewing it and checking its description.

- Utilize state- or county-specific legal and organizational documents.

- US Legal Forms addresses all your needs, from personal to corporate paperwork, in one convenient location.

- Employ advanced tools to finalize and oversee your Emancipation Laws For Pennsylvania.

Form popularity

FAQ

Yes, a 16-year-old can seek emancipation in Pennsylvania, but the process can be challenging. Emancipation laws for Pennsylvania require the minor to show they can support themselves financially and responsibly manage their personal affairs. You will need to file a petition with the court and may have to present evidence of maturity and stability. Achieving emancipation can grant you the independence you seek.

In California, the cost for comprehensive estate plan drafting can range from $900 to $5,950 or more, depending on the complexity of your estate and the attorney's experience. The cost of creating a will in California can range from roughly $250 to $1,200.

?If the executor owns the home, there is no timeline for them to sell it,? Millane says. If you're tasked with selling the home per the terms of the will, you must obtain approval from the probate court to sell the home.

Do All Estates Have to Go Through Probate in North Carolina? Smaller estates with probate-qualified assets valued at less than $20,000 can avoid the formal probate proceeding. If the surviving spouse inherits the whole estate, however, the estate's value can't exceed $30,000 if probate is to be avoided.

Seeking Legal Recourse If you believe that the executor is not living up to their duties, you have two legal options: petition the court or file a civil lawsuit.

First 60 Days After Death Within the first 60 days after the decedent passes away, you will need to file all of the necessary paperwork to become the executor of the person's estate. If the decedent listed you as the executor in their will, this process will be relatively straightforward.

Assuming an attorney has reviewed the estate assets and has determined an estate will need to be opened for the assets to be distributed, there are fortunately statutes in place that allow the probate of a copy of the will. However extra steps will be necessary for the executor.

Some attorneys offer flat fee services for specific tasks, such as preparing a basic will or trust. In North Carolina, an estate planning attorney typically charges between $350 and $3,000 or more, depending on the complexity of the task.

Fabric. To make a will without having to sign up for anything or create an account, you can use Fabric's free online will tool. If you have a basic estate or simple family situation, this service could be a good fit. After answering a few questions, you can print the will and make it legally binding.

A simple will should include your beneficiaries, your executor/executrix and backup executor/executrix, and the guardian(s) for your children, if applicable. You will also include your assets and how you want those assets distributed, and to whom, once you are no longer here.