Emancipation Laws For Georgia

Description

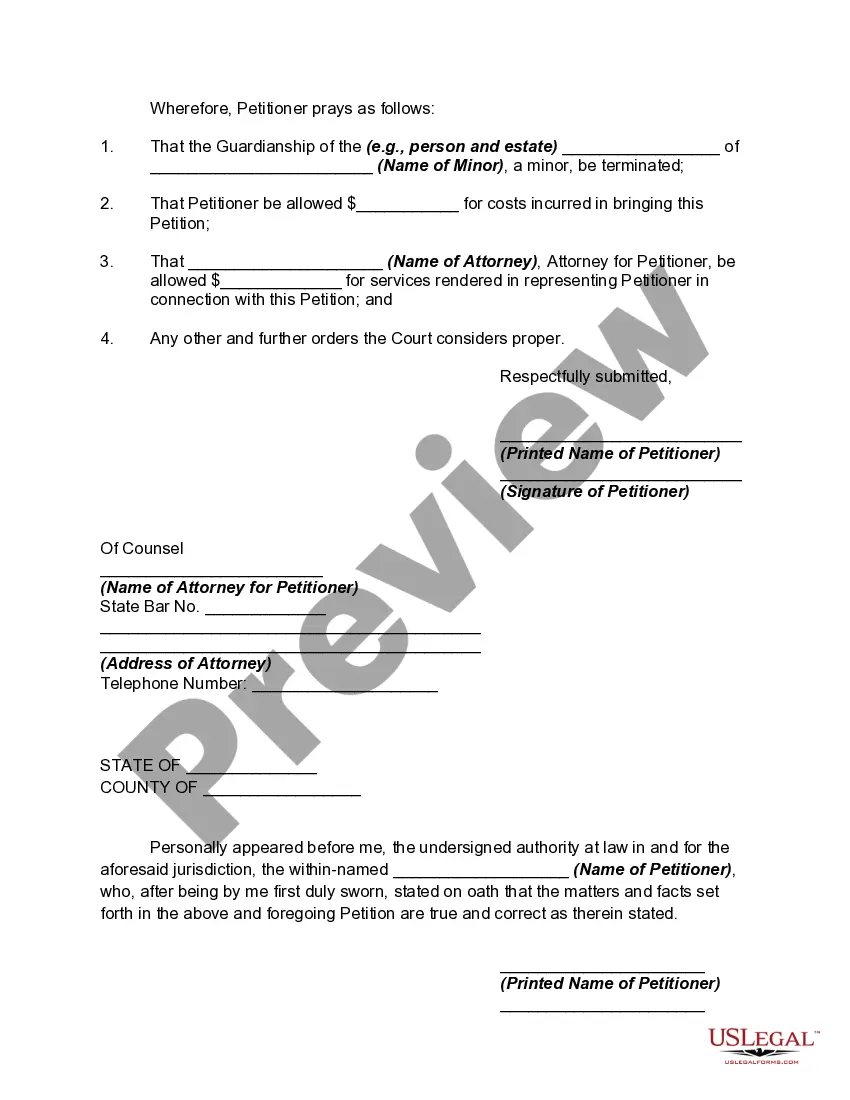

How to fill out Petition For Termination Of Guardianship By Emancipated Minor?

Whether for corporate reasons or personal matters, everyone has to confront legal circumstances at some stage in their life.

Filling out legal documentation requires meticulous care, beginning with choosing the correct form template.

With an extensive US Legal Forms catalog available, you don’t have to waste time looking for the correct template online. Utilize the library’s straightforward navigation to find the suitable template for any occasion.

- Obtain the template you require by using the search bar or catalog navigation.

- Review the form’s description to confirm it aligns with your circumstances, state, and area.

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search feature to locate the Emancipation Laws For Georgia template you need.

- Acquire the document when it suits your criteria.

- If you possess a US Legal Forms account, simply click Log in to retrieve previously saved documents in My documents.

- If you don't yet have an account, you can acquire the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the account registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the file format you desire and download the Emancipation Laws For Georgia.

- Once it is saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone ? 800-TAX-FORM (800-829-3676).

Your North Carolina income tax return (Form D-400). Federal forms W-2 and 1099 showing the amount of North Carolina tax withheld as reported on Form D-400, Line 20.

Legal Aid of North Carolina is a statewide, nonprofit law firm that provides free legal services in civil matters to low-income people in order to ensure equal access to justice...

North Carolina name change forms can be used by residents ages 18 and over to legally change their name by following the court process. Individuals only need a copy of their marriage certificate or divorce decree to change their surname when getting married or divorced.

How to Get Forms To download forms from this website, go to NC Individual Income Tax Forms. To order forms, call 1-877-252-3052. Touch tone callers may order forms 24 hours a day, seven days a week. You may also obtain forms from a service center or from our Order Forms page.

Convenient Locations in Your Community: During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD.

An emergency custody order, sometimes referred to as an ?ex parte order,? is an immediate, short-term custody order that a judge can grant under limited emergency circumstances, without hearing from the other party.

All individuals (including part-year residents and nonresidents) required to file a North Carolina individual income tax return must file Form D-400.