Employee Evaluation Goals With Case Managers

Description

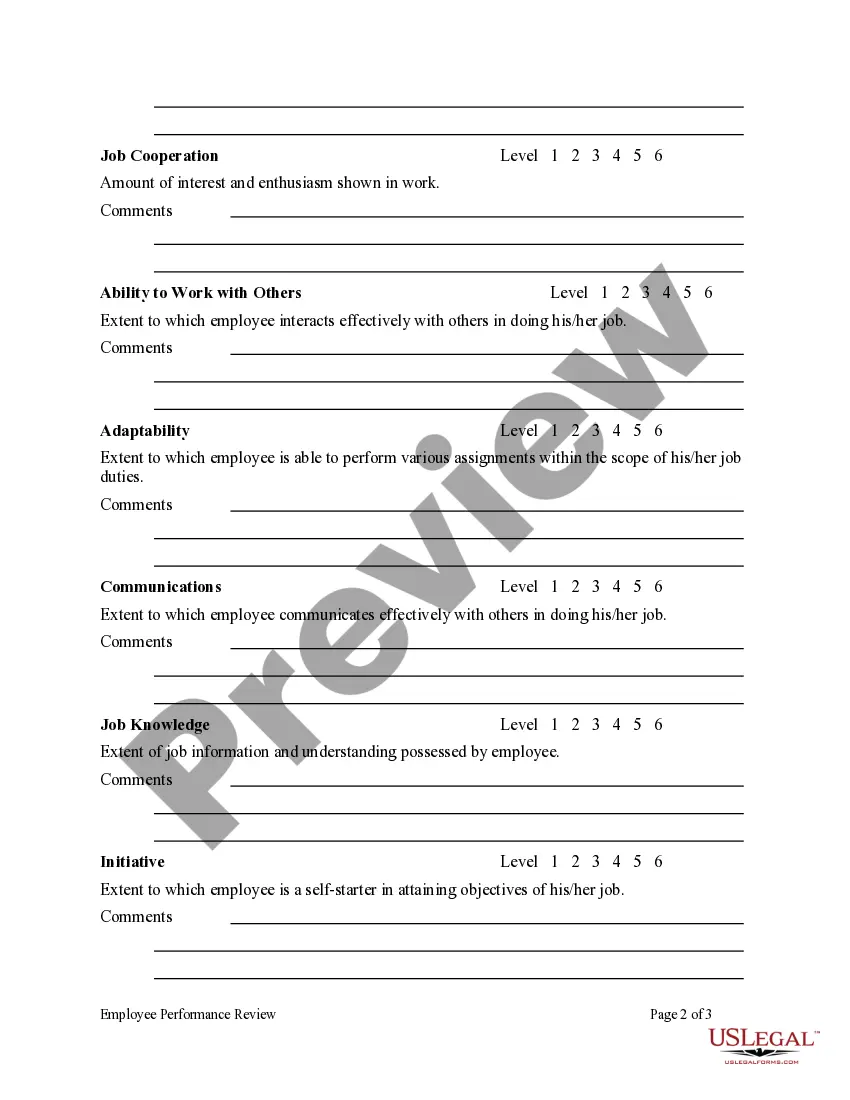

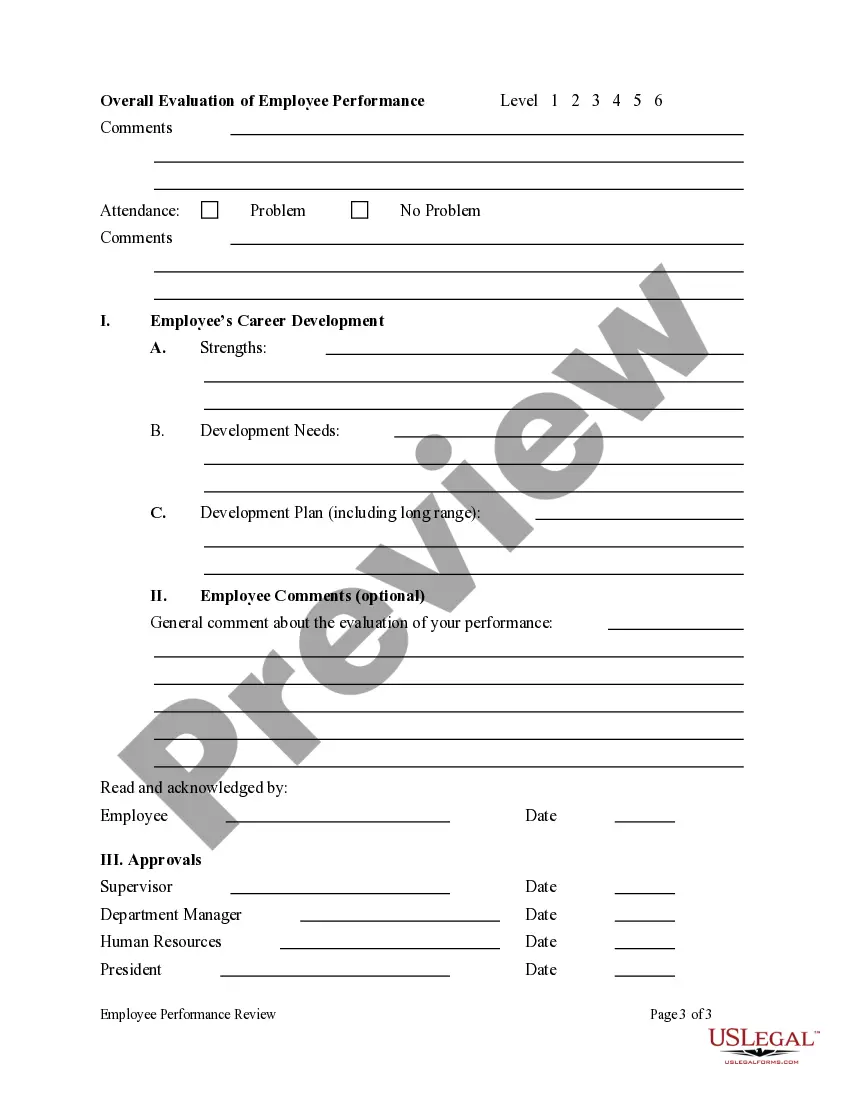

How to fill out Employee Performance Review?

It’s well known that you cannot become a legal authority overnight, nor can you master the rapid preparation of Employee Evaluation Objectives With Case Managers without possessing a specific background.

Assembling legal documents is an extensive endeavor necessitating specialized education and expertise. So why not entrust the preparation of the Employee Evaluation Objectives With Case Managers to the experts.

With US Legal Forms, which boasts one of the largest collections of legal documents, you can access everything from court filings to templates for internal communications. We understand how vital compliance and adherence to federal and state regulations are. That’s why, on our platform, all templates are region-specific and current.

You can recover access to your documents from the My documents section at any time. If you’re an existing user, simply Log In, and find and download the template from the same section.

Regardless of the intent of your forms—whether for financial, legal, or personal use—our website has you supported. Try US Legal Forms today!

- Locate the document you require using the search bar positioned at the top of the page.

- Preview it (if this option is available) and examine the accompanying description to determine whether Employee Evaluation Objectives With Case Managers is what you are looking for.

- If you need a different template, restart your search.

- Create a free account and choose a subscription plan to purchase the document.

- Select Buy now. After the payment is completed, you can download the Employee Evaluation Objectives With Case Managers, complete it, print it, and send or deliver it by mail to the appropriate individuals or organizations.

Form popularity

FAQ

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

Assignment in Blank means each assignment of mortgage in recordable form and otherwise in form and substance satisfactory to MBF, executed in blank by Seller and delivered to MBF as part of the Dry Funding Documents Package or the Wet Funding Documents Package.

The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note. Loan Transfers. Banks often sell and buy mortgages from each other. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another.

But note that an assignment is invalid if it would materially alter the other party's duties and responsibilities. Once an assignment is effective, the assignee stands in the shoes of the assignor and assumes all of assignor's rights.

Except in limited circumstances, the law requires that your lender send you this notice at least 15 days before the effective date of transfer, or at closing. Your new servicer must also send you this notice no later than 15 days after this effective date or at closing.

You'll receive a copy of the mortgage note when you close on your loan. If you misplace this copy, contact your mortgage lender or servicer and ask for a replacement. You can also find a copy of the mortgage note at your local Recorder of Deeds office.

"Mortgage" is a contract in writing and it falls within the six-year statute. Griffith v. Humble, 1942-NMSC-006, 46 N.M. 113, 122 P. 2d 134.

That a mortgage is not recorded does not prohibit the commencement of a mortgage foreclosure action. The mortgage contract between the borrower and the lender is no more binding when it is recorded and so legal action can be taken.

Before a bank can institute a foreclosure proceeding, the bank must record the assignment of the note. The bank must also be in actual possession of the note. If the bank fails to ?produce the note,? that is, cannot demonstrate that the note was assigned to it, the bank cannot demonstrate it owns the note.

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.