Bank Authorization Letter For Cheque Book

Description

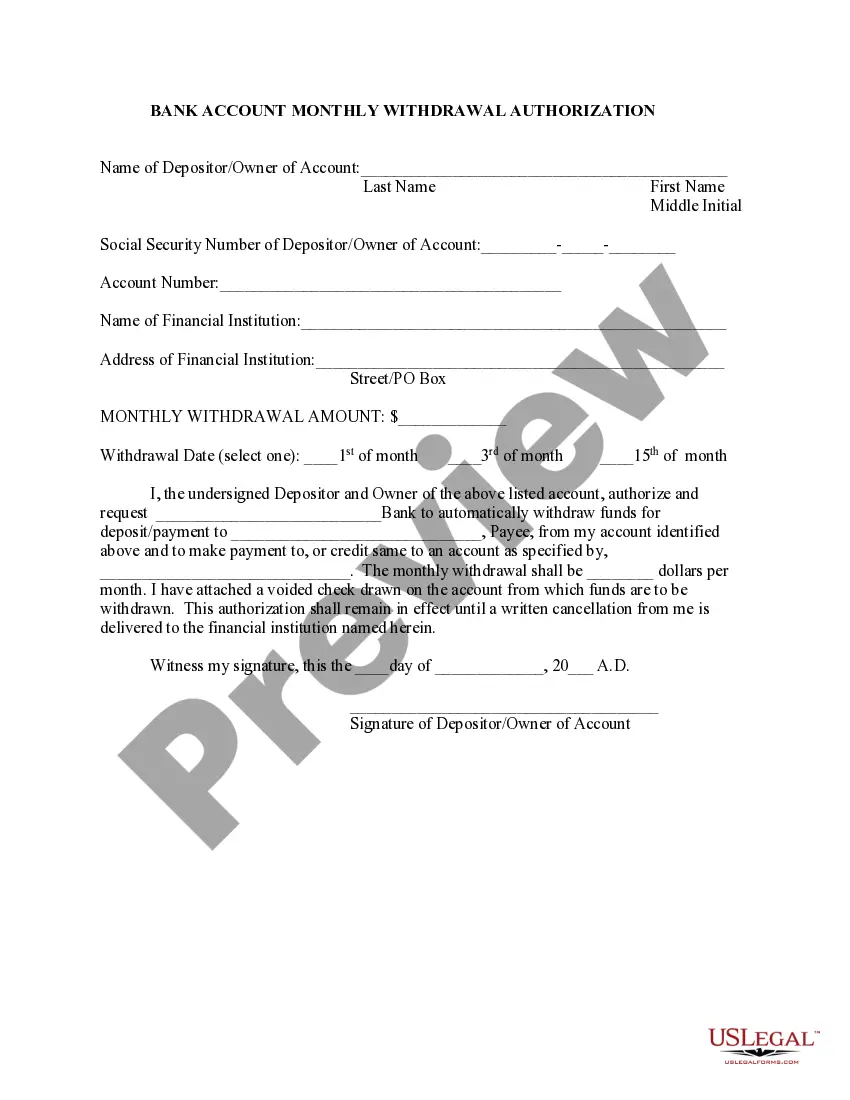

How to fill out Bank Account Monthly Withdrawal Authorization?

It’s clear that you cannot transform into a legal expert right away, nor can you determine how to swiftly create a Bank Authorization Letter For Cheque Book without possessing a specialized background.

Drafting legal documents is a lengthy process necessitating particular education and expertise. So why not entrust the drafting of the Bank Authorization Letter For Cheque Book to the professionals.

With US Legal Forms, one of the most extensive legal document repositories, you can discover everything from court documents to office communication templates.

If you require a different form, restart your search.

Establish a free account and choose a subscription plan to purchase the form. Click Buy now. After the payment is completed, you can obtain the Bank Authorization Letter For Cheque Book, complete it, print it, and send it to the appropriate individuals or organizations.

- We understand the significance of compliance and adherence to federal and regional laws and regulations.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how you can begin using our platform and acquire the form you need in just a few minutes.

- Locate the document you require using the search bar at the top of the page.

- Preview it (if this option is available) and review the accompanying description to determine if the Bank Authorization Letter For Cheque Book is what you seek.

Form popularity

FAQ

Start your letter by stating your full name and account details, followed by the reason for the authorization. Clearly identify the documents being handed over and mention the name and ID details of the person authorized to receive them. This makes it easy for the bank to accurately process your request and protects your interests.

Address your letter to the bank manager and provide your account details at the start. Clearly express your request for the cheque book to be handed over. Make sure to include identification details of the person collecting the cheque book if it is not you. A well-structured bank authorization letter for cheque book can simplify this process significantly.

A bank authorization letter should start with your name, address, and account number. Next, clearly state that you are authorizing someone to act on your behalf. Include the authorized person's details and specify the tasks they are permitted to perform. This structure ensures the bank understands your intentions and can facilitate the requests effectively.

To write a bank authorization letter for cheque book collection, start by addressing your bank and including your account details. Clearly state your intent to authorize someone to pick up the cheque book on your behalf. Provide the full name and identification details of the authorized person, and end with your signature. This simple structure ensures your request is clear and actionable.

drafted NonDisclosure Agreement should include the following specific information: The scope and definition of the confidential information. The permitted use of the confidential information. The obligations of the NonDisclosure Agreement. The parties' names and addresses. The duration of nondisclosure.

You do not need a lawyer to create and sign a non-disclosure agreement. However, if the information you are trying to protect is important enough to warrant an NDA, you may want to have the document reviewed by someone with legal expertise.

To create a Non-Disclosure Agreement, include the following information: The parties' names and contact information. The length of the non-disclosure period. The scope and definition of the confidential information. The obligations of the Non-Disclosure Agreement. The ownership and return information.

The short answer is yes?Canadian courts have, for the most part, held up NDAs as enforceable. However, there are a few important caveats: NDAs must meet requirements for being reasonable and of legitimate business interest (we'll explain those requirements in more detail below).

To be valid, a Non-Disclosure Agreement only needs two signatures ? the disclosing party and the receiving party. It doesn't need to be notarized or filed with any state or local administrative office.

Agreements that are overly broad, oppressive, or attempt to contain non-confidential information will also be challenged or invalidated by the courts. Before Signing an NDA, always have a lawyer review it. Keep an eye out for onerous clauses and proceed with caution before putting your name to anything.