Inheritance Letter Format for Property: Explained in Detail An inheritance letter format for property is a formal document that is used to legally transfer ownership of a property from a deceased person to their rightful inheritors. This letter serves as proof of the transfer and ensures a smooth transition of assets and rights. The inheritance letter format for property typically includes several key components, ensuring clarity and legal compliance. Let's delve into each aspect with relevant keywords: 1. Heading: The letter begins with a concise heading mentioning "Inheritance Letter for Property" or a similar phrase. This highlights the purpose of the document immediately. 2. Date and Address: The date of writing the letter is mentioned, followed by the address of the deceased person's estate or property. A complete and accurate address is essential to identify the property in question. 3. Salutation: A formal salutation addressing the concerned parties, such as "Dear Executor" or "To Whom It May Concern," is used to greet the recipient of the letter. 4. Introductory Paragraph: This section briefly introduces the purpose of the letter, stating that it is an official document addressing the inheritance of a particular property. It may also mention the deceased person's name and connection to the recipient(s). 5. Body: The body of the letter contains crucial information including: a. Legal Framework: Explanation of the legal framework governing the inheritance process is included. Relevant laws, regulations, or acts, depending on the jurisdiction, are mentioned to reinforce the legitimacy and authenticity of the transfer. b. Property Description: Detailed information about the property being transferred is provided, ensuring precision. It includes the property's address, boundaries, land area, and any unique or notable features. c. Identification of Beneficiaries: The names and contact details of the inheritors are listed clearly. Additionally, their relationship with the deceased person may also be mentioned, reinforcing their right to inherit the property. d. Terms and Conditions: If there are any additional terms or conditions related to the inheritance, such as any outstanding mortgages, liens, or specific taxes, they should be clearly stated. This ensures all parties comprehend their responsibilities and obligations. e. Signatures: The letter concludes with the signatures of all inheritors, signaling their acceptance of the property transfer and acknowledging its legal implications. 6. Closing: A respectful closing is added, such as "Sincerely" or "Respectfully," followed by the full names and contact details of the inheritors. Different types of Inheritance letter formats for property may vary based on regional regulations and requirements. Some variations might include the introduction of witnesses or the need for notarization to strengthen the legal validity of the document. To ensure compliance, it is advisable to consult a legal professional or seek guidance from local authorities when drafting an inheritance letter for property. Remember, accuracy, transparency, and adherence to legal guidelines are vital when creating an inheritance letter format for property. This document serves as a key legal evidence for property transfer, ensuring a smooth transition of ownership while safeguarding the rights and interests of all parties involved.

Inheritance Letter Format For Property

Description

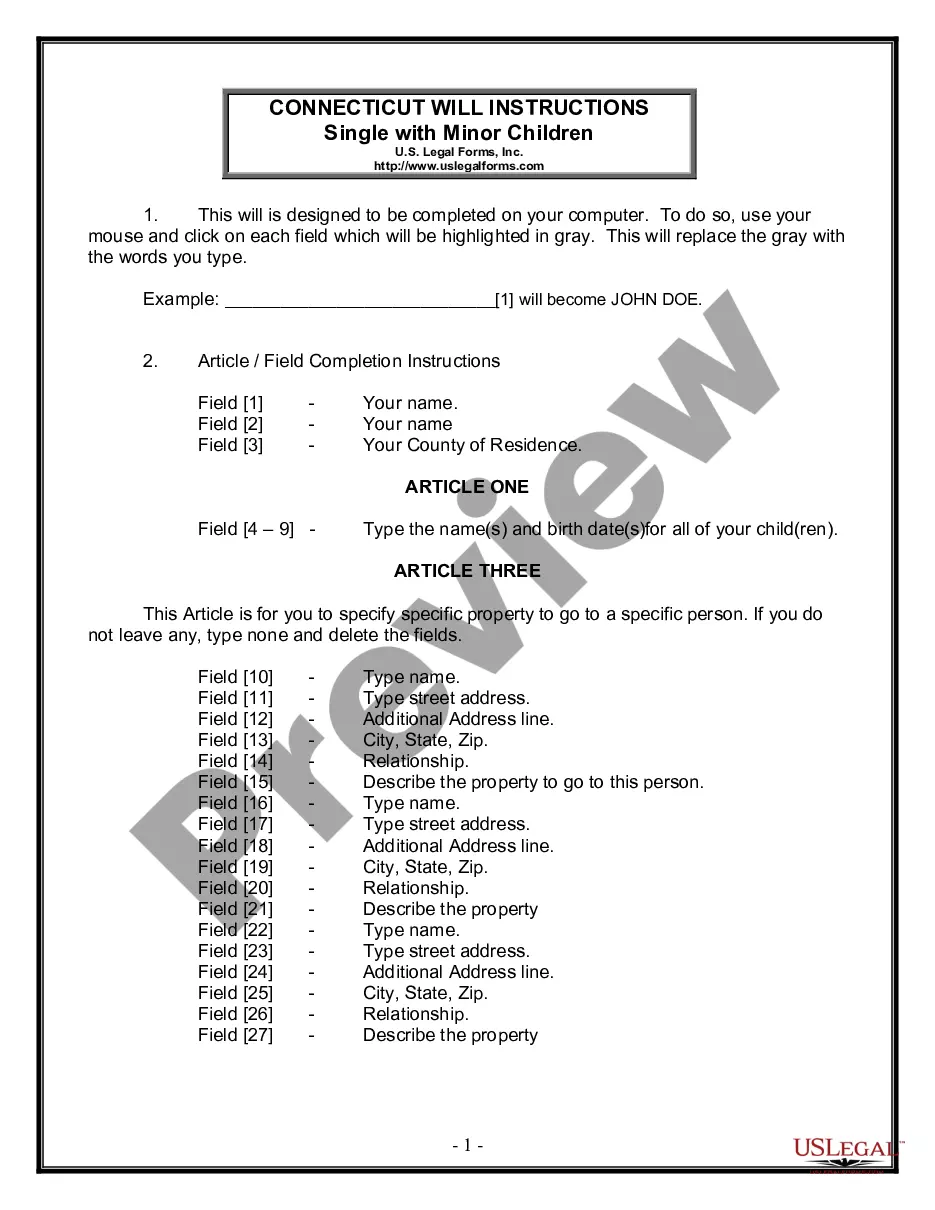

How to fill out Inheritance Letter Format For Property?

Managing legal documents and processes can be a lengthy addition to your schedule.

Inheritance Letter Template For Property and similar forms often necessitate your search for them and figuring out how to accurately complete them.

Thus, if you are addressing financial, legal, or personal issues, having access to a comprehensive and seamless online repository of forms will be extremely beneficial.

US Legal Forms is the premier online source for legal templates, providing over 85,000 state-specific forms along with a variety of tools to help you fill out your documents effortlessly.

Is it your first experience with US Legal Forms? Create and establish an account in just a few minutes, and you will gain access to the form repository and Inheritance Letter Template For Property. Then, follow the steps below to complete your form.

- Explore the collection of pertinent documents accessible to you with just one click.

- US Legal Forms offers state- and county-specific forms that are available anytime for download.

- Safeguard your document management tasks by utilizing a dependable service that allows you to generate any form in minutes without additional or hidden fees.

- Simply Log In to your account, search for Inheritance Letter Template For Property, and download it immediately from the My documents section.

- You can also retrieve previously downloaded forms.

Form popularity

FAQ

Documenting inheritance involves gathering necessary legal documents, such as the will, death certificate, and any property titles. When you write an inheritance letter format for property, include detailed descriptions of all inherited assets. It’s essential to keep records organized and accessible for future reference. Proper documentation supports your claims and eases the transfer process.

To claim an inheritance from a will, first obtain a copy of the will from the executor or probate court. Next, prepare the necessary documentation, including an inheritance letter formatted specifically for property claims. This letter should confirm your beneficiary status and describe the property in detail. Following this process streamlines your claim and facilitates communication with the executor.

Writing a beneficiary letter involves stating your full name, relationship to the deceased, and details of the property you stand to inherit. Ensure you use an inheritance letter format for property to articulate your claims effectively. Include any relevant documents that support your position. This method promotes transparency and helps prevent disputes.

To write an inheritance letter, start by including your contact information and the date at the top. Clearly state your relation to the deceased, followed by details about the property being inherited. Use the inheritance letter format for property to ensure clarity, then close with your signature. This structured approach helps avoid confusion and facilitates smooth communication.

Writing a sample disclaimer of inheritance involves creating a clear structure that outlines your decision. Start with your contact information, the date, and the relevant estate details. Clearly state your desire to disclaim the inheritance and include your signature. To assist you, uslegalforms provides templates to help create an inheritance letter format for property, ensuring all essential components are covered for valid disclaimers.

An inheritance disclaimer letter typically includes the beneficiary’s name, a clear statement of the intention to disclaim, and relevant details about the estate. For example, it might start with acknowledging the inheritance offer, followed by a formal statement of refusal. This template can help maintain transparency in legal matters. Utilizing an inheritance letter format for property will ensure that your disclaimer meets the necessary criteria and standards.

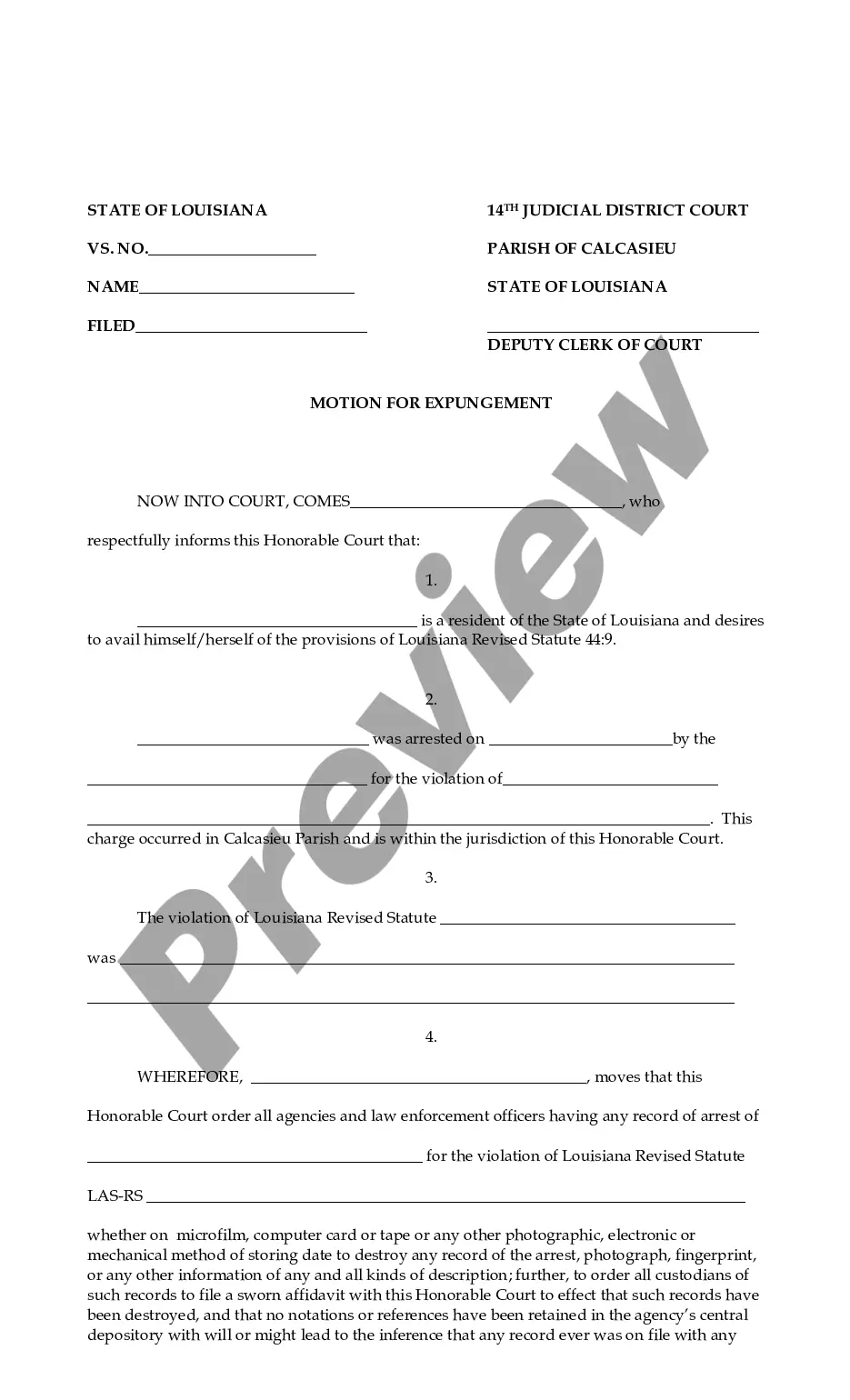

To disclaim an inheritance, a beneficiary must prepare a formal disclaimer document. This document should state the intention to refuse the inheritance and must be signed and submitted within a specific timeframe. It's crucial to follow your state's rules closely to ensure the disclaimer is valid. For guidance, an inheritance letter format for property can be beneficial in composing a clear and effective disclaimer.

A disclaimer of inheritance does not always need to be notarized, but having it notarized adds a layer of authenticity. Some states may require a signature on the disclaimer to be witnessed or notarized. Therefore, it’s essential to check your local laws to determine the specific requirements. For clarity, using a well-structured inheritance letter format for property ensures your intentions are clear and legally sound.

The time it takes to obtain a letter of inheritance can vary, depending on the complexity of the estate and court processes. Typically, it may take anywhere from a few weeks to several months to receive this document. To expedite the process, having your inheritance letter format for property ready beforehand can help streamline communication with the necessary authorities.

An example of an inheritance letter outlines the transfer of property and assets from a deceased individual to their heirs. It should include pertinent information such as the decedent's details, asset descriptions, and beneficiary names. Following a recognized inheritance letter format for property helps ensure that the example adheres to legal standards and effectively communicates intentions.