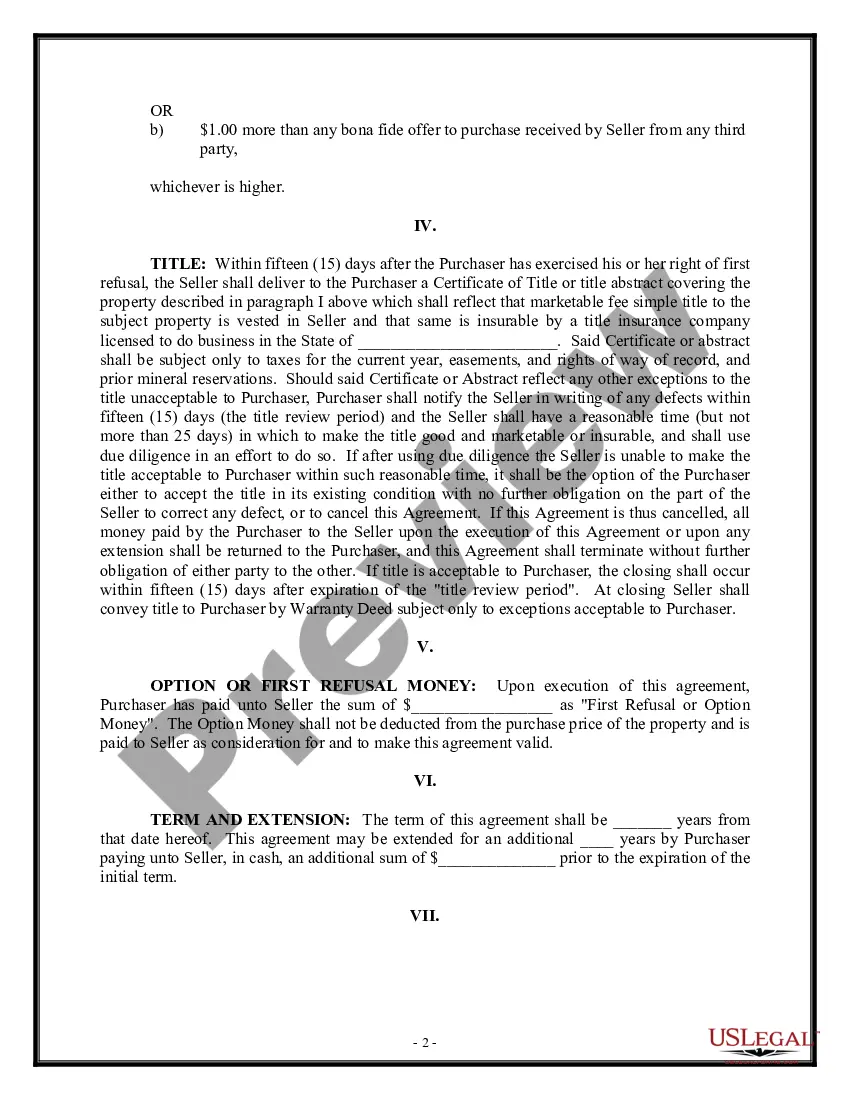

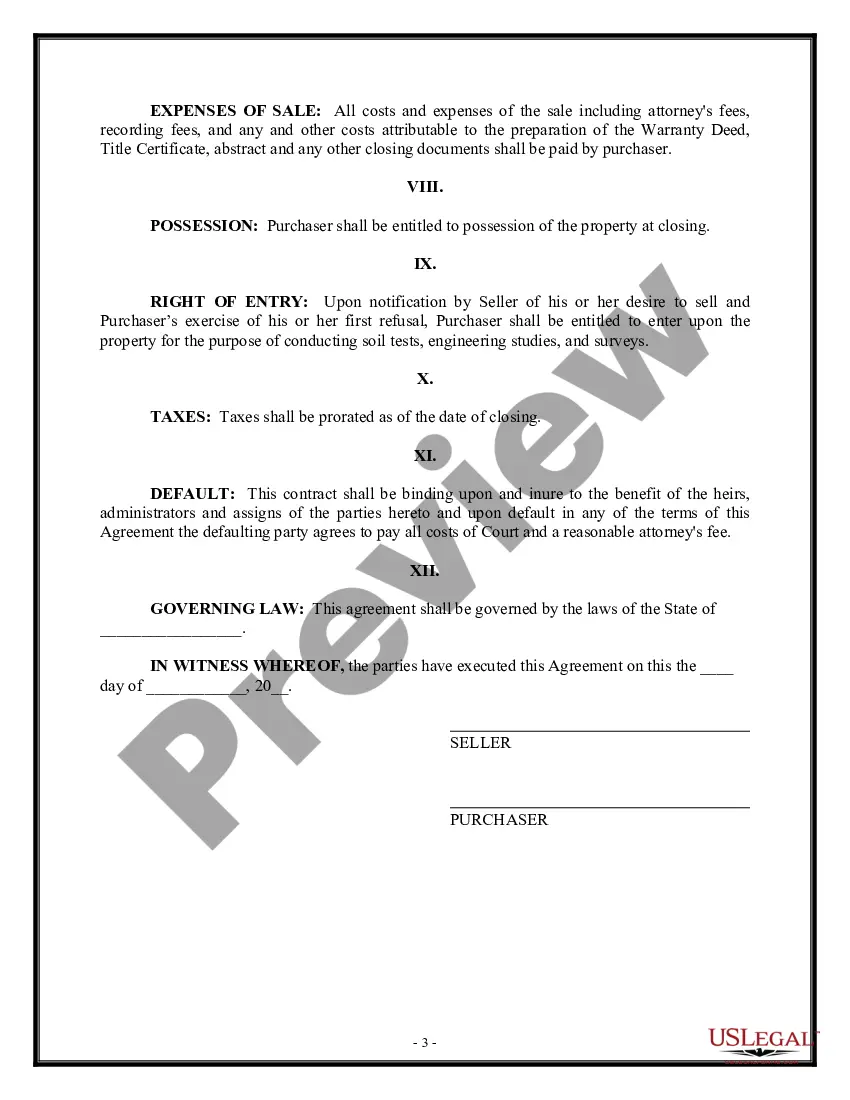

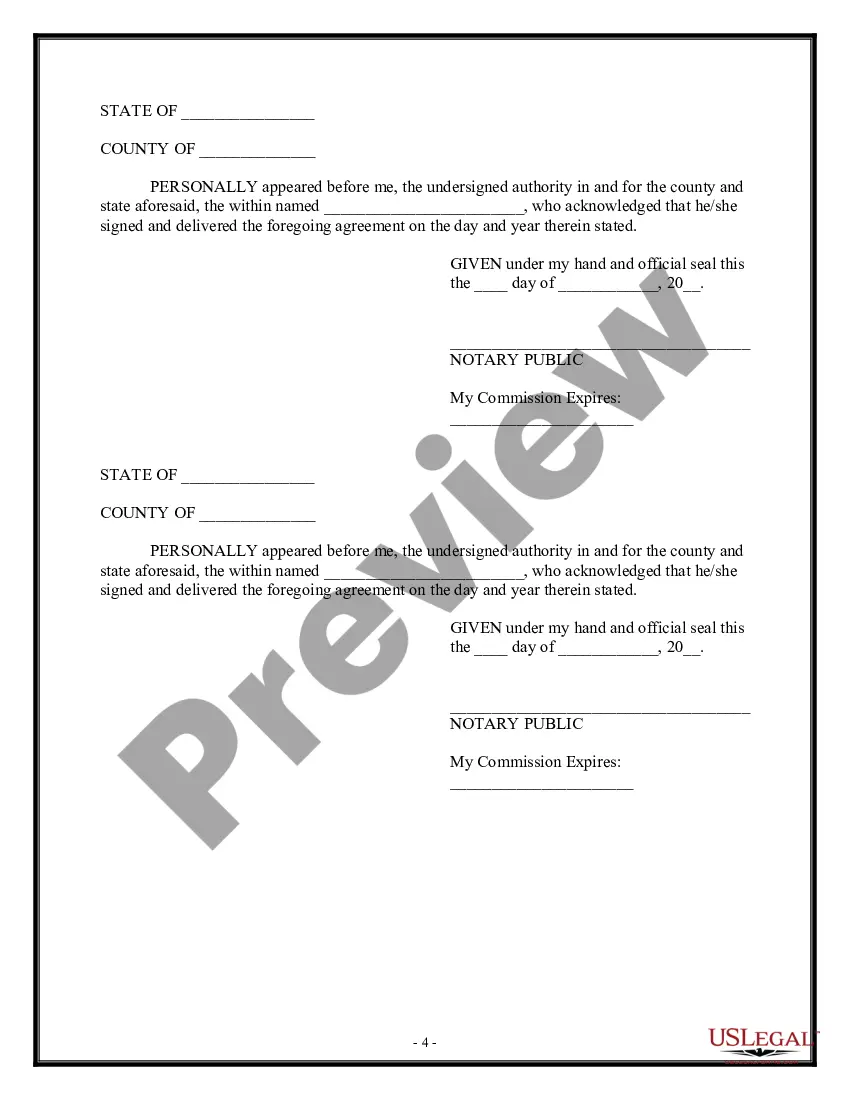

First Right Of Refusal Clause Sample With Real Estate

Description

How to fill out Right Of First Refusal To Purchase Real Estate?

The Initial Right Of Refusal Clause Example With Real Estate presented on this site is a versatile official template crafted by experienced attorneys in compliance with national and local laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, companies, and lawyers with more than 85,000 authenticated, state-specific documents for various business and personal needs. It’s the fastest, most straightforward, and most dependable method to acquire the documents you require, as the service assures the utmost level of data protection and anti-malware safeguards.

Subscribe to US Legal Forms to have authenticated legal templates for all of life’s events readily available.

- Search for the document you require and assess it.

- Browse through the example you searched and examine it or review the form description to confirm it meets your requirements. If it does not, utilize the search bar to locate the appropriate one. Click Buy Now once you have found the template you need.

- Subscribe and Log In.

- Select the pricing plan that best fits you and set up an account. Use PayPal or a credit card for an immediate payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template.

- Choose the format you desire for your Initial Right Of Refusal Clause Example With Real Estate (PDF, DOCX, RTF) and save the example to your device.

- Fill out and sign the documentation.

- Print the template to complete it by hand. Alternatively, use an online multifunctional PDF editor to quickly and accurately fill in and sign your form with a valid signature.

- Download your documents again.

- Reuse the same document whenever necessary. Access the My documents tab in your profile to redownload any previously saved forms.

Form popularity

FAQ

Mechanics liens apply only to private construction projects, since publicly owned property cannot be liened (public projects are subject to bond claims, however). On ?owner occupied? residential property, you will have mechanics lien rights only if you have the owner's signature on a contract.

As a lienholder, you gain legal rights to the company's property, as well as the authority to sell the property. Steps To Placing A Lien On A Business. ... Provide Proof Of Debt. ... File A Court Claim. ... Entering The Judgement. ... Sale Of Property. ... Dar Liens Offers Lien Processing and Filing in Arizona.

It might be possible to waive unconditional lien rights after work has started, but before payment has been made the waiver form will have to meet certain legal requirements. Arizona has no requirement that a lien waiver must be notarized; in fact, this could even invalidate the form.

In general, there are 3 steps to file a mechanics lien claim in Arizona: Complete a mechanics lien form that meets the legal requirements. Download an Arizona mechanics lien form. File the lien claim with the county prothonotary (clerk) by the deadline. Serve a copy of the lien on the property owner.

In Arizona, liens must be filed within 120 days from the completion of the project as a whole. However, if a notice of completion was filed, the deadline is shortened to 60 days from the date such notice was filed.

Send the preliminary notice as first-class mail and with a certificate of mailing. All contractors are required to send a prelim, including general contractors (GCs). If your project's dollar value (as indicated on your pre-lien) increases 30% or more during the process, you might have to send another pre-lien.

Construction Liens Basic Preliminary Notice for Arizona$29.00Bond Claim Letters (Preparation and Service)$200.00Mechanic's Liens (Preparation, Recording & Service for Maricopa County Only) Terms Net Five (5) Days from Date of Invoice$300.005 more rows