Cancel Services With Spectrum

Description

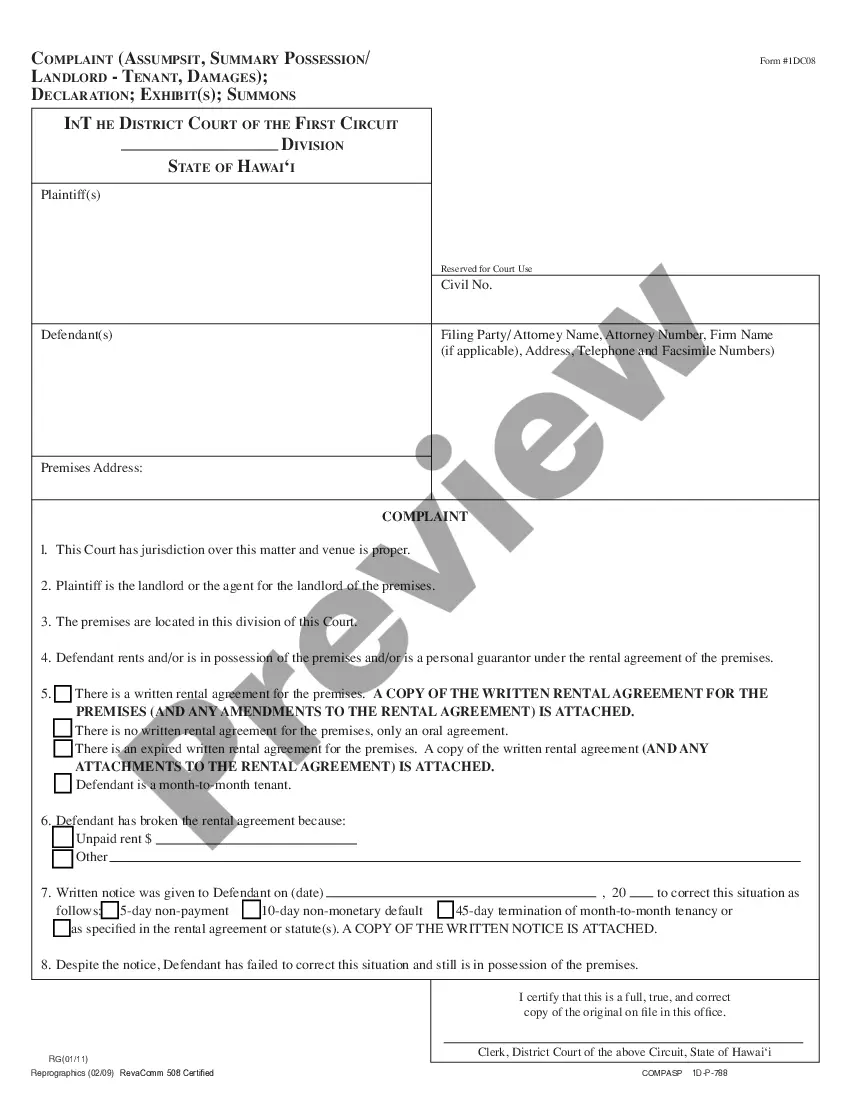

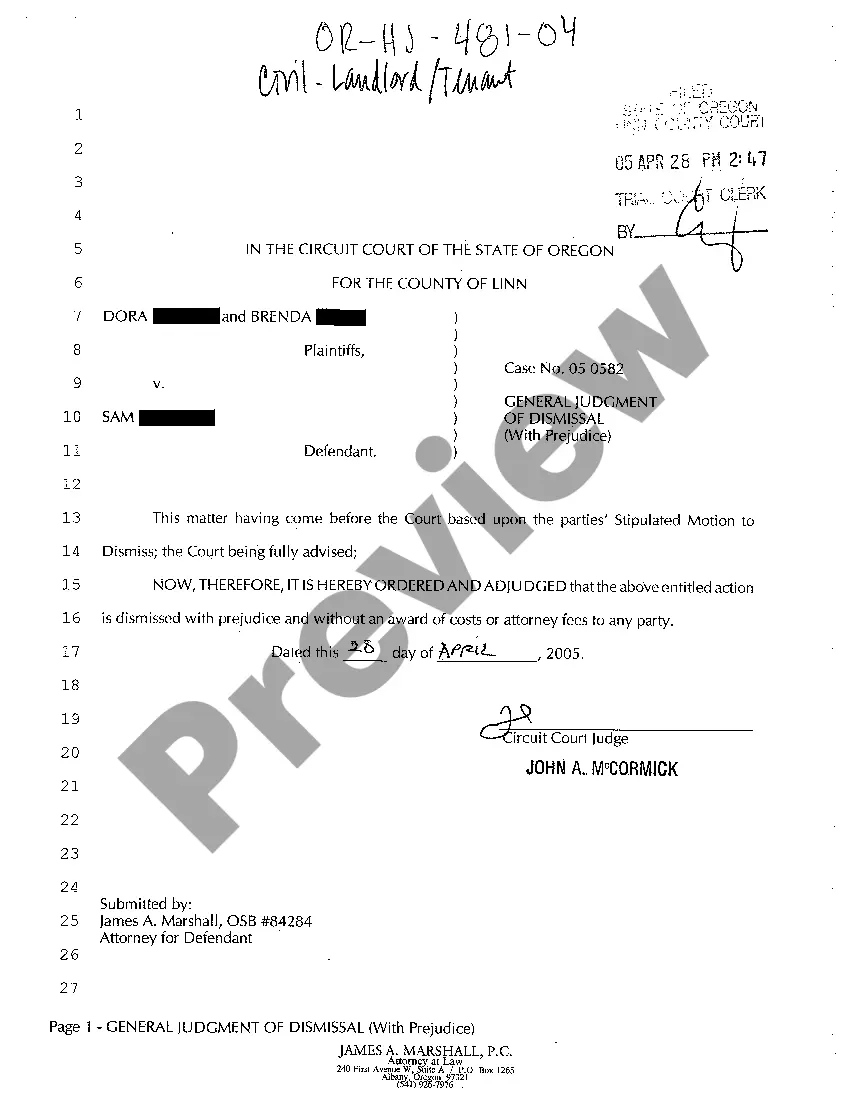

How to fill out Notice To Terminate Legal Services Agreement And Return File?

Locating a reliable source for the most updated and suitable legal templates is part of the challenge of managing bureaucracy.

Identifying the appropriate legal documents requires accuracy and carefulness, which is why it is essential to procure instances of Cancel Services With Spectrum exclusively from trustworthy providers, such as US Legal Forms.

Eliminate the stress that comes with your legal documentation. Explore the vast collection at US Legal Forms where you can find legal templates, assess their suitability to your needs, and download them instantly.

- Utilize the library navigation or search functionality to discover your template.

- Examine the form’s description to verify if it fulfills the criteria of your state and region.

- View the form preview, if available, to confirm that the form is the one you need.

- Return to the search and find the correct document if the Cancel Services With Spectrum does not meet your requirements.

- If you are certain of the form’s validity, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you haven’t created an account yet, click Buy now to obtain the form.

- Select the pricing option that aligns with your needs.

- Proceed to the signup to finalize your purchase.

- Complete your transaction by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Cancel Services With Spectrum.

- Once you have the form on your device, you may edit it using the editor or print it to fill out manually.

Form popularity

FAQ

Equipment Lease Types Operating Leases. An operating lease is a contract that permits one company to use another company's equipment in exchange for fixed monthly payments over a specific period of time. ... Finance Leases (or Capital Leases) ... $1 Buyout Lease. ... Purchase Option Lease. ... Sale-Leaseback (or Leaseback) ... TRAC Lease.

So, as you form your lease, make sure to include each of these items: Parties to the Lease. List the name of the landlord and tenant bound to the agreement. Description of the Property. List the address of the property. ... Terms of Rent. ... Lease Term. ... Occupants. ... Security Deposit Information. ... Damages and Repairs. ... Pets.

Yes, Microsoft Word has a free lease agreement template that you can customize to create your own contract and minimize any potential problems between tenant and landlord.

For example, a manufacturer might lease a production machine under a capital lease because they'll use the equipment daily over a number of years. A company with a warehouse might lease forklifts for the same reason. Many capital leases allow the lessee to purchase the equipment at the end of the term.

You are the lessee and the owner of the equipment, or the lender, is the lessor in a lease agreement. Once the lease period ends, the equipment is returned to the owner. In some cases, you may have the option to buy the equipment.

Every equipment lease should include the following fundamental contract elements: Lessor: The equipment owner who will be renting out the equipment. Lessee: The renter who will be paying for the privilege to use the gear. Term: The length of time the lessee will lease the equipment.

For leases generally exceeding one year the applicable accounting rules dictate that the lessee account for a leased asset as though it has been purchased. The lessee records the leased right as an item of property, plant, and equipment, which is then depreciated over its useful life to the lessee.

The lessee records the leased right as an item of property, plant, and equipment, which is then depreciated over its useful life to the lessee. The lessee must also record a liability reflecting the obligation to make continuing payments under the lease agreement, similar to the accounting for a note payable.