Agreement Partners Partnership With Profit Sharing

Description

How to fill out Agreement To Partners To Incorporate Partnership?

Individuals often connect legal documentation with something complex that only a specialist can manage.

In a certain sense, this is correct, as crafting a Partnership Agreement with Profit Sharing requires considerable expertise in subject matter, including state and local statutes.

However, with US Legal Forms, everything has become more straightforward: pre-prepared legal documents for any personal and business situation specific to state laws are gathered in one online catalog and are now accessible to everyone.

Select the format for your document and click Download. Print your paperwork or upload it to an online editor for quicker completion. All templates in our inventory are reusable: once purchased, they remain saved in your profile. You can access them whenever necessary through the My documents section. Explore all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents categorized by state and purpose, making the search for a Partnership Agreement with Profit Sharing or any specific document a matter of minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to obtain the form.

- New users to the service must create an account and subscribe before they can save any documents.

- Here is a step-by-step guide on how to obtain the Partnership Agreement with Profit Sharing.

- Carefully review the page content to ensure it meets your requirements.

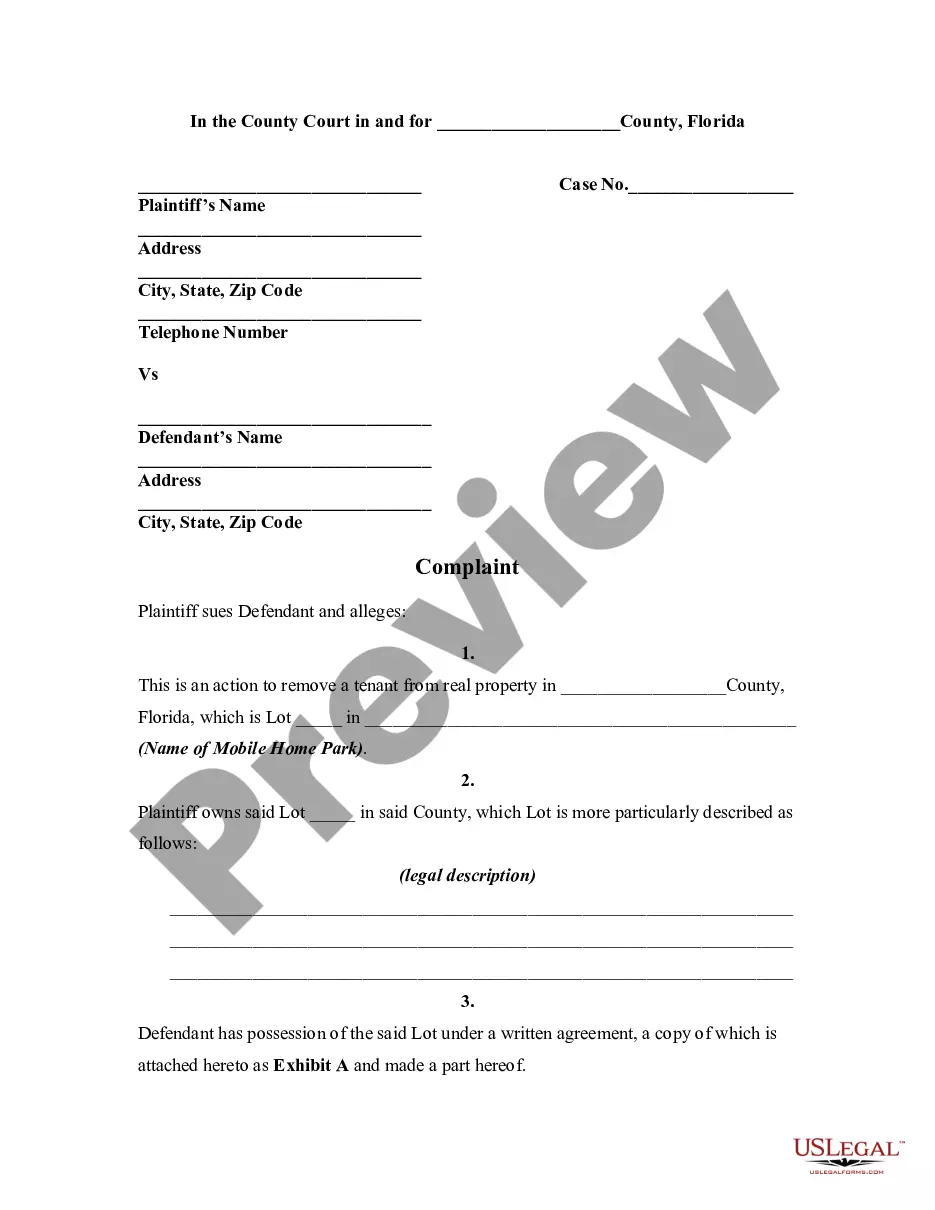

- Check the form description or view it through the Preview feature.

- If the previous option is unsuitable, find another sample using the Search bar in the header.

- Once you locate the appropriate Partnership Agreement with Profit Sharing, click Buy Now.

- Select a subscription plan that aligns with your needs and budget.

- Sign up or Log In to proceed to the payment stage.

- Complete your subscription payment using PayPal or a credit card.

Form popularity

FAQ

If you want your profit-sharing agreement to be rock solid, here are a few clauses that you must include in it.Profit Sharing. Clearly mention the ratio/percentage in which you will be dividing the profits.Termination.Dispute Resolution.Confidentiality.Obligations.Intellectual Property.Indemnities and Liabilities.

These are the steps you can follow to write a partnership agreement:Step 1 : Give your partnership agreement a title.Step 2 : Outline the goals of the partnership agreement.Step 3 : Mention the duration of the partnership.Step 4 : Define the contribution amounts of each partner (cash, property, services, etc.).More items...?

Suppose A and B invest Rs. x and Rs. y respectively for a year in a business, then at the end of the year: (A's share of profit) : (B's share of profit) = x : y.

In a business partnership, you can split the profits any way you want, under one conditionall business partners must be in agreement about profit-sharing. You can choose to split the profits equally, or each partner can receive a different base salary and then the partners will split any remaining profits.

Profits should be divided among the partners according to their share of the ownership, as specified in their partnership agreement. If there is no written or oral agreement among the partners, then under common law, each partner is to receive equal profits and losses.