Default Security Agreement For Car Loan

Description

How to fill out Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

How to locate expert legal documents that adhere to your state's regulations and draft the Default Security Agreement For Car Loan without hiring an attorney.

Numerous online services offer templates for various legal circumstances and formalities.

However, it might require some time to determine which of the available examples meet both your requirements and legal standards.

Download the Default Security Agreement For Car Loan using the corresponding button next to the document name. If you do not have an account with US Legal Forms, follow the instructions below: Examine the webpage you have opened and check if the form meets your requirements. To accomplish this, utilize the form description and preview options if they are available. If necessary, search for another template in the header by entering your state. When you locate the appropriate document, click the Buy Now button. Select the most appropriate pricing plan, then Log In or preregister for an account. Choose your payment method (by credit card or via PayPal). Convert the file format for your Default Security Agreement For Car Loan and click Download. The documents you acquire belong to you: you can always access them later in the My documents tab of your profile. Join our library and create legal documents independently, similar to a seasoned legal expert!

- US Legal Forms is a trusted resource that assists you in finding official documents aligned with the latest state law revisions and reduces legal costs.

- US Legal Forms is not just a typical online library.

- It's a repository of over 85,000 verified templates tailored for different business and personal needs.

- All documents are categorized by area and state to expedite and simplify your searching process.

- Moreover, it offers robust integrations for PDF editing and eSignature, allowing users with a Premium subscription to effortlessly finalize their documents online.

- Obtaining the necessary paperwork requires minimal time and effort.

- If you already possess an account, Log In and verify that your subscription is active.

Form popularity

FAQ

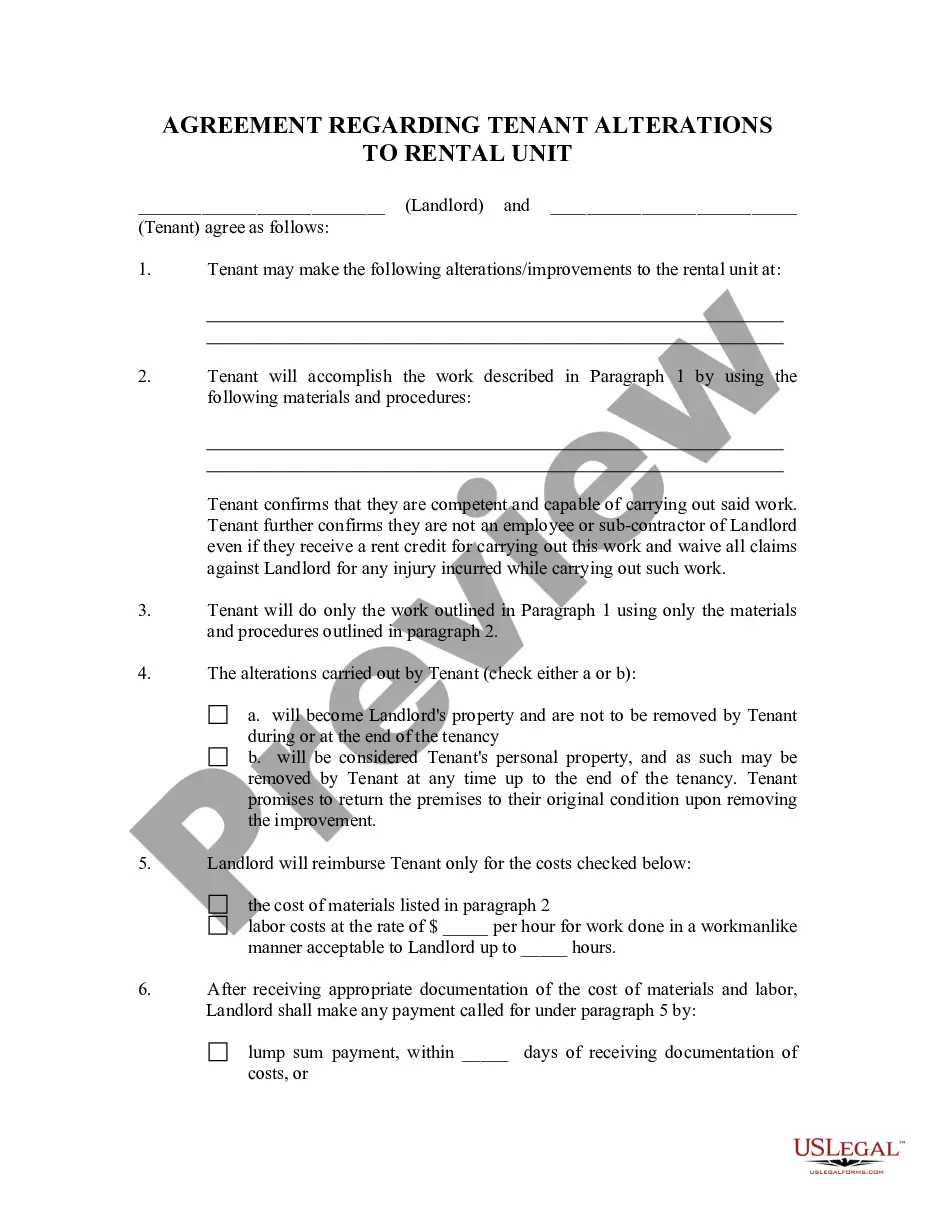

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?

A security agreement is a legal document that provides a lender a security interest in property or an asset that is promised as collateral. It gives the legal claim to the collateral to the creditor in case of a default by the borrower.

How To Create a Collateral Contract YourselfNames, contact information, and addresses of all parties.Terms and conditions of the collateral contract.Indication of a promissory note.Duties and responsibilities assigned to each party.The effective date of the agreement.More items...

A vehicle security agreement is used when a customer purchases a vehicle that the buyer requires collateral for. Car dealers often require this agreement when a buyer's credit rating is not high enough or when the buyer has no money for a down payment.