Estate Creditor For Real

Description

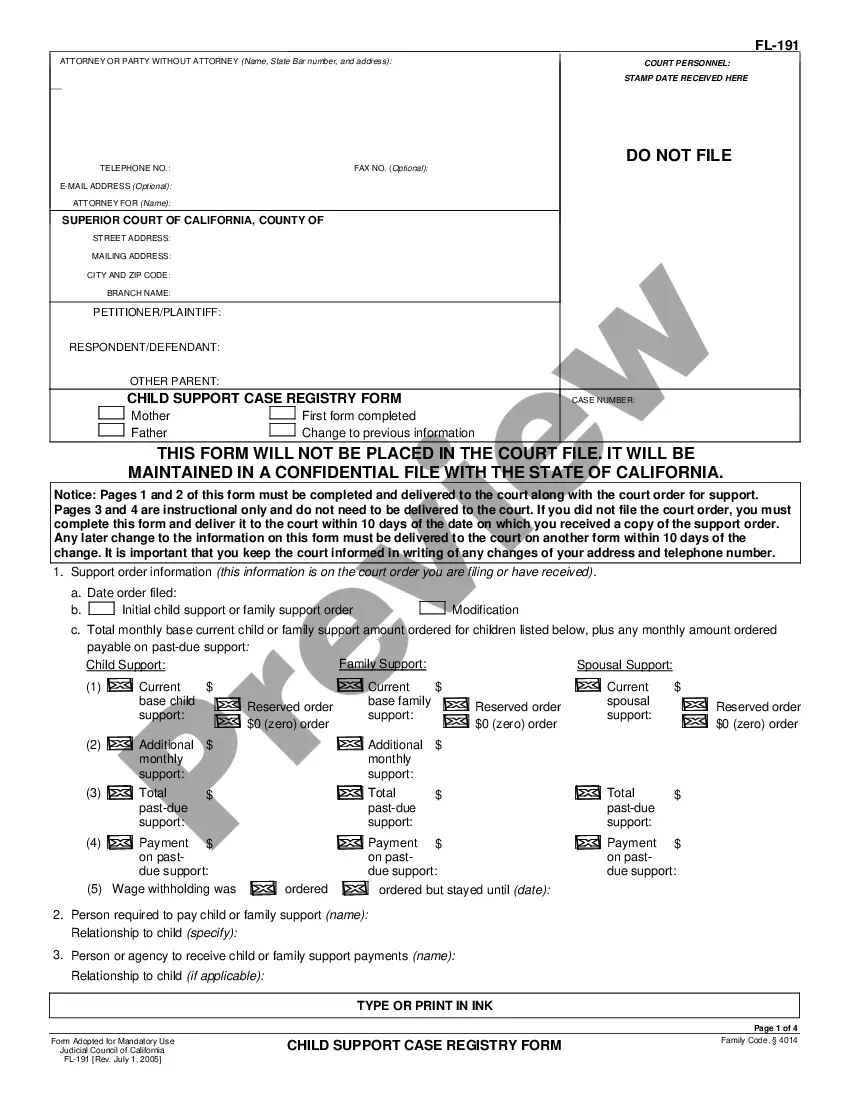

How to fill out Release Of Claims Against Estate By Creditor?

The Estate Creditor For Real that you observe on this page is a reusable official template crafted by expert attorneys in accordance with federal and state statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 validated, state-specific documents for any corporate and personal occasion. It’s the quickest, easiest, and most dependable method to secure the paperwork you require, as the service ensures the utmost level of data protection and anti-malware security.

Subscribe to US Legal Forms to have authenticated legal templates for every aspect of life readily available.

- Search for the document you require and examine it.

- Choose the pricing plan that fits you and create an account.

- Select the format you desire for your Estate Creditor For Real (PDF, DOCX, RTF) and download the example to your device.

- Print out the template to fill it out manually.

- Utilize the same document again whenever necessary.

Form popularity

FAQ

Filling out a creditor's claim involves providing detailed information about the debt owed to you by the deceased’s estate. Start by including your name, the amount owed, and a description of the debt. Be sure to attach any supporting documents that validate your claim, such as invoices or contracts. Using US Legal Forms can help simplify this process, ensuring that your claim is complete and aligns with the requirements for estate creditors for real.

Proving an executor of an estate without a will can be challenging, but it is possible. Typically, you would need to show that the deceased appointed you as the executor through other means, such as a verbal agreement or a prior document. You may need to provide evidence of your relationship to the deceased and any actions you have taken on behalf of the estate. Consider using US Legal Forms to access templates that can help you navigate this process as an estate creditor for real.

To fill out a statement of claim, you start by gathering the necessary information about the estate and the debts owed. Include details such as the names of the deceased, the creditor, and the amount claimed. Make sure to follow the specific format required by your local court, as this can vary by jurisdiction. Using resources like US Legal Forms can streamline this process and ensure you include all necessary information for your estate creditor for real.

A creditor of an estate refers to an individual or organization that has a legitimate claim against the assets of a deceased person's estate. This may include outstanding debts, loans, or unpaid bills that must be settled before distributing the estate's assets to beneficiaries. Understanding the concept of an estate creditor for real is vital for ensuring that all obligations are met during the probate process. US Legal Forms can guide you through the necessary steps to address these creditor claims efficiently.

A creditor in real estate is an individual or entity that holds a legal claim against a property owner due to an unpaid debt. This can include mortgage lenders, tax authorities, or contractors who provided services to the property. Understanding the role of an estate creditor for real is crucial, as they can influence the transfer of property ownership and the distribution of assets. If you're navigating these complexities, US Legal Forms provides resources to help you manage creditor claims effectively.

The three-year rule for a deceased estate typically refers to the time limit for creditors to make claims against the estate. After the death of an individual, creditors usually have three years to file their claims, ensuring that debts are settled before the distribution of assets. Understanding this rule is essential for estate administrators and beneficiaries. Utilizing resources from US Legal Forms can help you navigate these regulations effectively.

To find hidden assets of a deceased person, start by reviewing their financial records, including bank statements, tax returns, and investment accounts. You can also check for unclaimed property through state databases. Engaging an estate creditor for real may provide insights and resources to uncover these hidden assets. If needed, consider using platforms like US Legal Forms to streamline the estate investigation process.

Yes, credit card companies can file a claim against an estate if the deceased had outstanding debts. They must follow the same procedures as other creditors, submitting a formal claim during the probate process. It’s important for executors to review these claims carefully, as they can affect the distribution of the estate's assets. For guidance on handling such claims, US Legal Forms provides valuable resources.

The time allowed to make a claim against a deceased estate varies by state, but it is generally between three to six months from the date of the estate's notice to creditors. It’s crucial to be aware of these deadlines, as late claims may not be considered. To ensure you meet these timelines, consider consulting US Legal Forms for accurate information and resources tailored to your state's requirements.

A creditor makes a claim against an estate by filing a written claim with the estate's executor or administrator, typically including details of the debt. This claim should be submitted within the timeframe specified by state laws to ensure consideration. Creditors must also be prepared to provide supporting evidence of their claims. Using US Legal Forms can simplify the documentation needed for this process.