Probate Estate Forms Michigan For Wayne County

Description

How to fill out Petition For Representation Of A Probate Estate's Insolvency And Request?

Locating a reliable source to obtain the latest and suitable legal templates is part of the challenge of navigating bureaucracy.

Identifying the correct legal documents necessitates accuracy and carefulness, which is why it is crucial to source Probate Estate Forms Michigan For Wayne County exclusively from trustworthy providers, such as US Legal Forms. An incorrect template can squander your time and prolong your current predicament. With US Legal Forms, you have minimal worries. You can access and review all details concerning the document’s application and significance for your situation and in your jurisdiction.

Once you have the form on your device, you can modify it using the editor or print it out and fill it in by hand. Eliminate the hassle associated with your legal paperwork. Browse the extensive US Legal Forms library to discover legal templates, evaluate their relevance to your circumstances, and download them instantly.

- Utilize the catalog navigation or search bar to locate your template.

- Examine the form’s details to determine if it meets the stipulations of your jurisdiction.

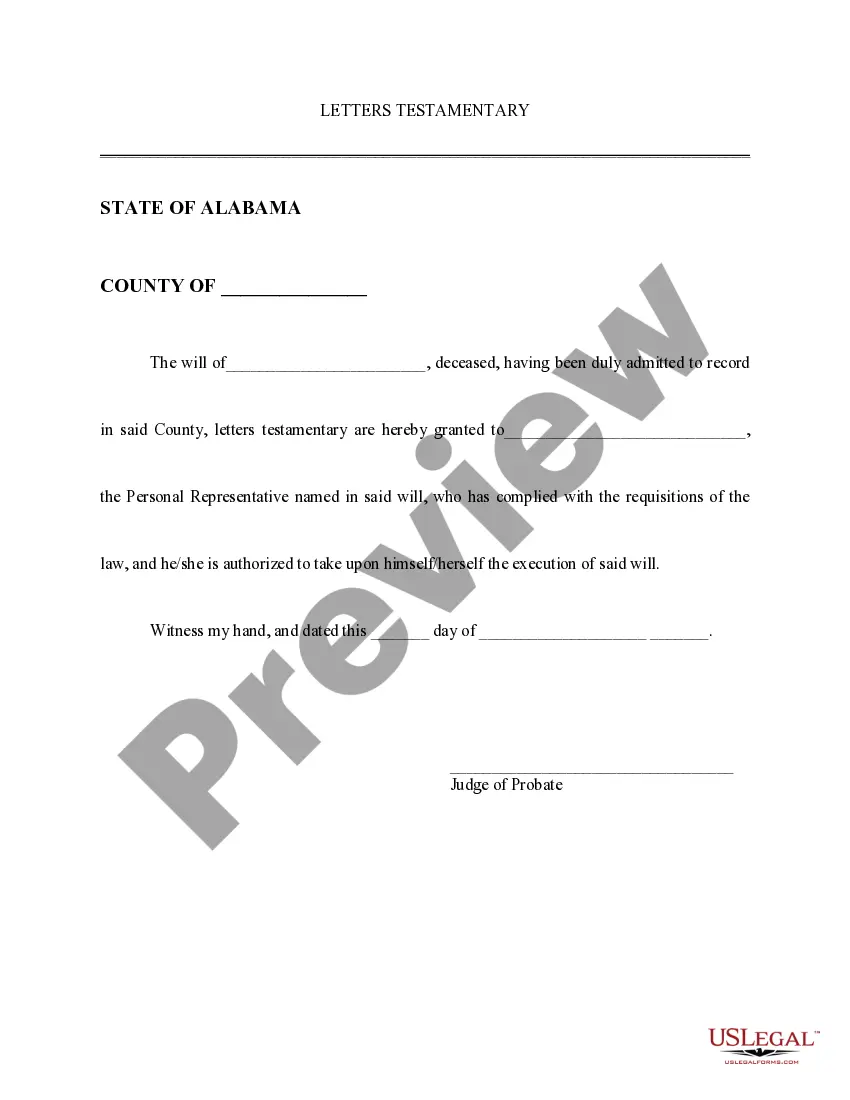

- Check the form preview, if available, to confirm the template is what you need.

- Return to the search to locate the correct template if the Probate Estate Forms Michigan For Wayne County does not fulfill your requirements.

- When you are certain about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not possess an account yet, click Buy now to acquire the form.

- Select the pricing option that aligns with your preferences.

- Proceed with the registration to complete your purchase.

- Finalize your purchase by choosing a payment method (credit card or PayPal).

- Choose the file format for downloading Probate Estate Forms Michigan For Wayne County.

Form popularity

FAQ

The personal representative must: Prepare an Inventory. Pay the Inventory fee. Give notice to known creditors and publish a notice to unknown creditors. Pay the taxes and file the final tax return for the decedent. Pay the bills of the estate and claims against the estate. Distribute the remaining assets as appropriate, and.

Michigan law requires almost all estates to go through probate. However, there are a few exceptions. If an estate is worth less than $24,000 after funerary costs and contains no real estate, it can almost entirely bypass probate.

If the estate's value is under the ?small estates? limit in Michigan, you can use a simplified probate procedure, called a ?summary probate.? You don't need a court hearing in front of a judge ? you only need to file simple forms and wait a certain amount of time before distributing the assets.

Examples of assets that don't need to go through this process include: Assets that are held within a trust (i.e Revocable Living Trust) Life insurance policies that are listed as payable to a certain beneficiary. Retirement Accounts and other bank accounts that have a designated beneficiary payable-on-death (P.O.D)

Generally, property exceeding $15,000 has to go through probate, but the limit could change depending on the year the property owner died, as the dollar limit tends to fluctuate yearly. In 2023, property valued at $27,000 or less is considered a small estate.