Valorem Tax In Florida

Description

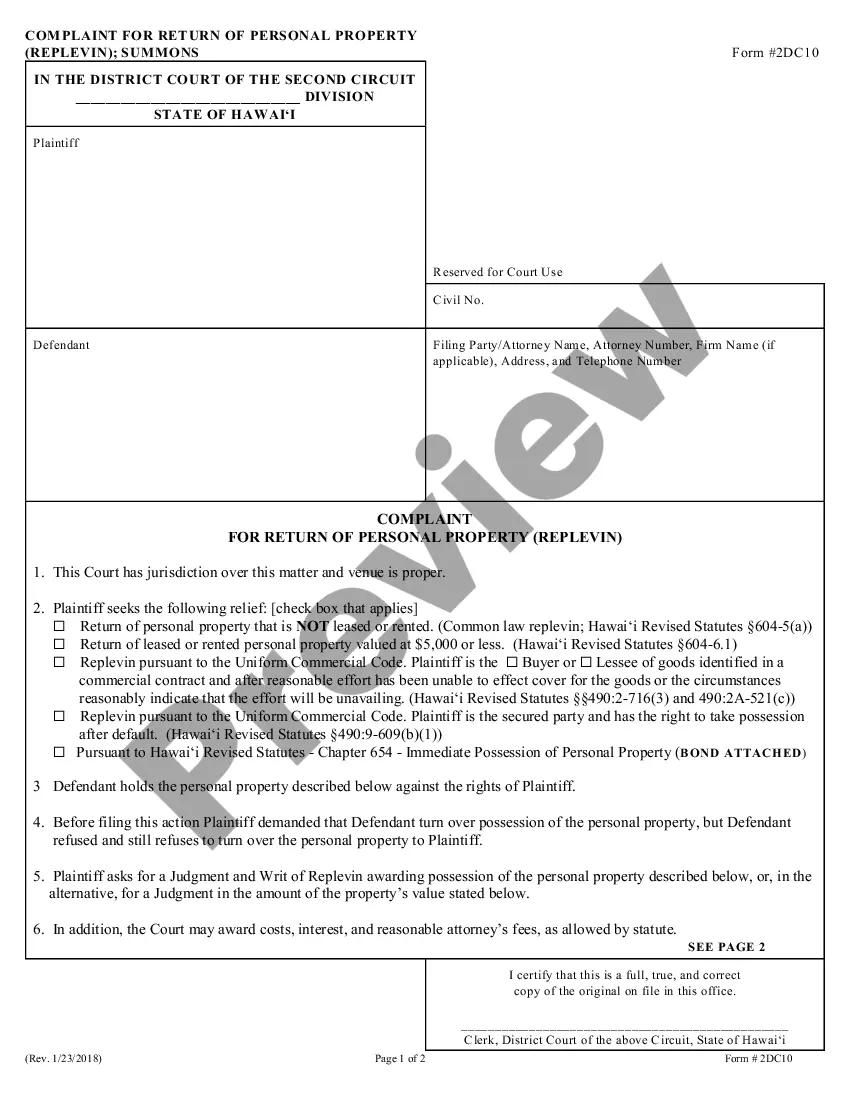

How to fill out Sample Letter For Ad Valorem Tax Exemption?

It’s clear that you cannot transform into a legal expert instantly, nor can you understand how to swiftly create Valorem Tax In Florida without a specialized background.

Assembling legal documents is a lengthy endeavor that demands particular education and abilities. Therefore, why not entrust the preparation of the Valorem Tax In Florida to the experts.

With US Legal Forms, one of the most comprehensive legal template collections, you can discover anything from court documents to templates for internal communication.

You can regain entry to your documents from the My documents section at any time. If you’re a current customer, you can simply Log In, and locate and download the template from the same section.

Regardless of the intent of your documents—be it financial, legal, or personal—our website has you supported. Try US Legal Forms today!

- Locate the document you require by utilizing the search bar at the top of the page.

- View it (if this option is available) and examine the accompanying description to determine if Valorem Tax In Florida is what you need.

- Initiate your search again if you require a different template.

- Sign up for a free account and select a subscription plan to acquire the template.

- Select Buy now. Once the payment is completed, you can download the Valorem Tax In Florida, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

The Latin phrase ad valorem means "ing to value." So all ad valorem taxes are based on the assessed value of the item being taxed. Property ad valorem taxes (property taxes) are usually levied by local jurisdictions, such as counties or school districts.

How is ad valorem tax calculated? It is calculated by multiplying the property's assessed value with the tax rates applied. For example, if A buys a car worth $1000 and the rate applied is 4%, the tax applicable is 1000*4/100 = 1000*0.04 = $40.

Ad valorem taxes are paid in arrears (at the end of the year) and are based on the calendar year from January 1 ? December 31. The Property Appraiser assesses the value of a property and the Board of County Commissioners, School Board, Cities, and other levying bodies set the millage rates.

The main types of ad valorem taxes include property taxes and sales tax. An ad valorem tax is a tax that is calculated based on an assessed value and a tax rate.

Ad Valorem (Property) Tax If you own property in Florida, that property is assessed annually by the county property appraiser. This assessment determines the amount of ad valorem taxes owed each year on your property. Ad valorem or property taxes are collected annually by the county tax collector.