A Notice of Intent to File Lien form is a legal document used in Colorado to indicate the intent to file a lien against someone's property. This form is typically submitted by contractors, suppliers, or subcontractors who have not been paid for their services or materials provided for a construction project. By filing this notice, the claimant notifies the property owner and other interested parties that they may file a lien if the outstanding payment is not resolved. In Colorado, there are different types of Notice of Intent to File Lien forms depending on the specific circumstances. These include: 1. Preliminary Notice of Intent to File Lien: This form is used by contractors, subcontractors, and suppliers to provide preliminary notice to the property owner regarding the potential filing of a lien. It serves as a formal declaration of the intent to assert a lien if payment issues are not resolved. 2. Notice of Intent to File Mechanics' Lien: This form is used to formally notify the property owner that the claimant intends to file a mechanics' lien. It outlines the details of the unpaid services or materials, including the amount owed, project description, and other relevant information required for the lien filing process. 3. Notice of Intent to File Lien (Non-Residential): This specific form is designed for non-residential properties, typically commercial or industrial projects. It follows the same purpose as other notice forms but includes additional information required for non-residential lien claims. 4. Notice of Intent to File Lien (Residential): This form is specific to residential properties and is used to notify the property owner of an impending lien. It includes pertinent details related to the residential project, such as property address, contractor information, and unpaid amounts. These various Notice of Intent to File Lien forms are crucial documentation for the claimant as they initiate the lien process in Colorado. It is essential to ensure accurate completion of the forms, adherence to specific deadlines, and compliance with Colorado's lien laws. Filing the correct form, based on the type of property and project, is crucial for claimants seeking to protect their rights and secure payment for their work or materials provided.

Notice Of Intent To File Lien Form For Colorado

Description

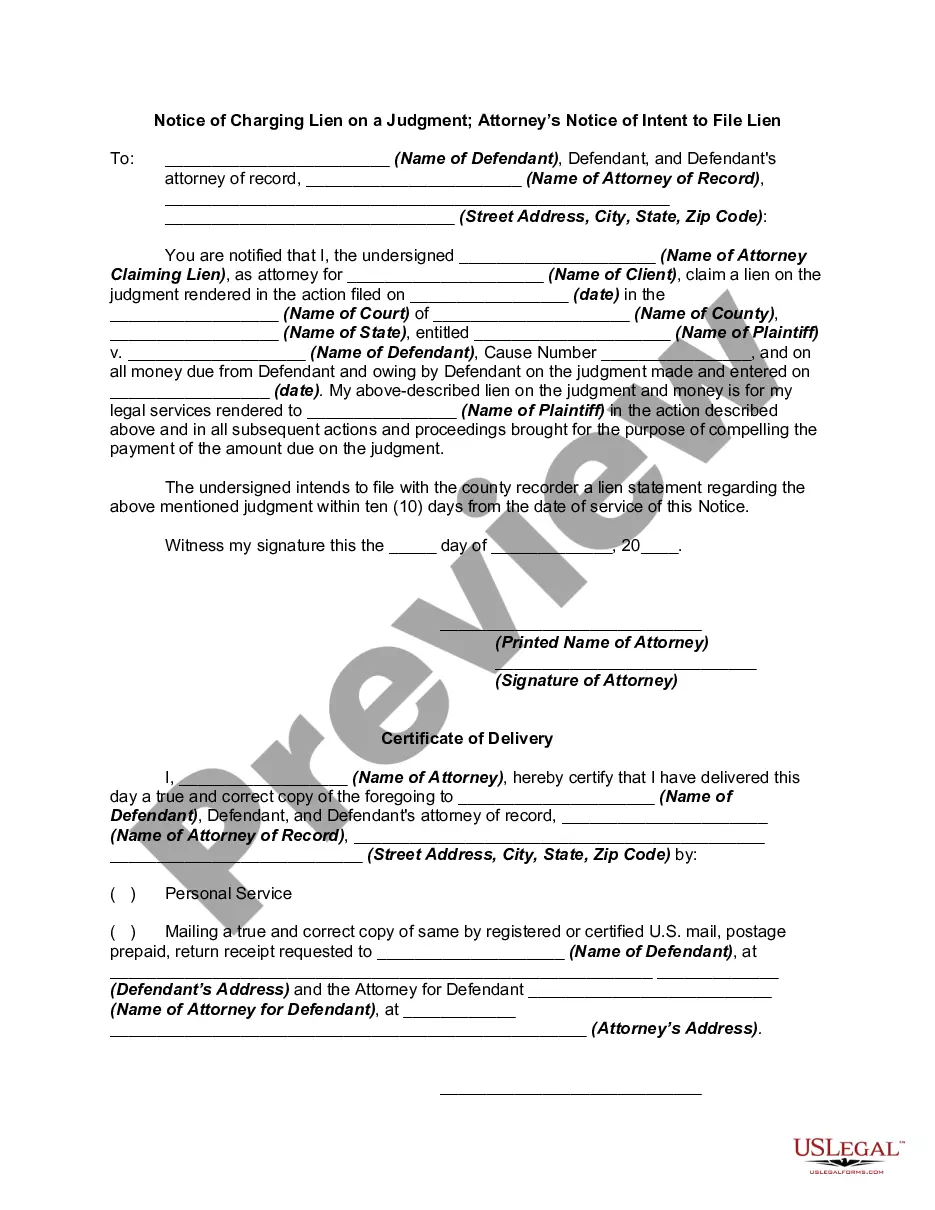

How to fill out Notice Of Charging Lien On A Judgment - Attorney's Notice Of Intent To File Lien?

Whether for commercial reasons or personal affairs, everyone must handle legal issues at some point in their life.

Completing legal documents requires meticulous attention, starting from selecting the correct form template.

With an extensive US Legal Forms catalog available, you do not need to waste time searching for the suitable template online. Utilize the library’s easy navigation to find the right template for any circumstance.

- Locate the template you require using the search box or catalog navigation.

- Review the form’s description to confirm it fits your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search function to find the Notice Of Intent To File Lien Form For Colorado sample you need.

- Obtain the template if it aligns with your specifications.

- If you already possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the account registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the file format you prefer and download the Notice Of Intent To File Lien Form For Colorado.

- Once it is downloaded, you can complete the form with editing software or print it and fill it out by hand.

Form popularity

FAQ

In Connecticut, the statute of limitation for fraudulent nondisclosure is three years from the act or omission. Disclosure laws cover these major home systems and conditions: Property drainage issues. Plumbing and swage problems.

A seller has no legal obligation to remove asbestos from the house he is selling. He is generally not even required by state law to disclose that asbestos is present in the home. The home buyer can and should inspect the home prior to buying it.

CT Property Condition Disclosure Exemptions The property is being transferred to a spouse, parent, grandparent, child, or sibling of the transferor without consideration of payment. The federal government, a political corporation, institution, or quasi-government agent is making the property transfer.

Steps for Making a Financial Power of Attorney in Connecticut Create the POA Using a Statutory Form, Software, or Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Land Records Office.

(b) The following shall be exempt from the provisions of this section: (1) Any transfer from one or more co-owners solely to one or more of the co-owners; (2) transfers made to the spouse, mother, father, brother, sister, child, grandparent or grandchild of the transferor where no consideration is paid; (3) transfers ...

A Connecticut tax power of attorney (LGL-001) designates an agent to represent the principal in front of the Connecticut Department of Revenue Services. The agent, usually a trusted accountant or tax advisor, can file returns, obtain information, or ask the agency representatives for answers on behalf of the principal.

The Uniform Property Condition Disclosure Act (Connecticut General Statutes Section 20-327b) requires the seller of residential property to provide this disclosure to the prospective purchaser prior to the prospective purchaser's execution of any binder, contract to purchase, option or lease containing a purchase ...

In adherence to the law, sellers must complete a Residential Property Condition Disclosure Report, which asks them to honestly disclose: The age of the property. The length of their occupancy in the property. Whether their property is in an inland wet area or flood hazard.