Agreement Between Two Parties For Loan

Description

How to fill out Agreement By Both Parties To The Termination Or Cancellation Of A UCC Sales Agreement?

Which service is the most dependable for obtaining the Agreement Between Two Parties For Loan along with other current versions of legal documentation? US Legal Forms is the solution! It boasts the largest collection of legal forms for every scenario.

Each template is meticulously created and verified for alignment with federal and local statutes and regulations. They are organized by area and jurisdiction, making it easy to locate the one you require.

US Legal Forms stands as an outstanding choice for anyone requiring assistance with legal documents. Premium users enjoy additional benefits, including the capability to complete and electronically sign previously saved forms at any time using the integrated PDF editing tool. Explore it today!

- Experienced users of the website just need to Log In to the platform, confirm the validity of their subscription, and click the Download button next to the Agreement Between Two Parties For Loan to retrieve it.

- Once saved, the template remains accessible for future reference under the My documents section of your account.

- If you do not have an account with us yet, here are the steps to create one.

- Form compliance assessment. Prior to acquiring any template, ensure it meets your usage specifications and is in accordance with your state or county regulations. Review the form description and utilize the Preview function if available.

Form popularity

FAQ

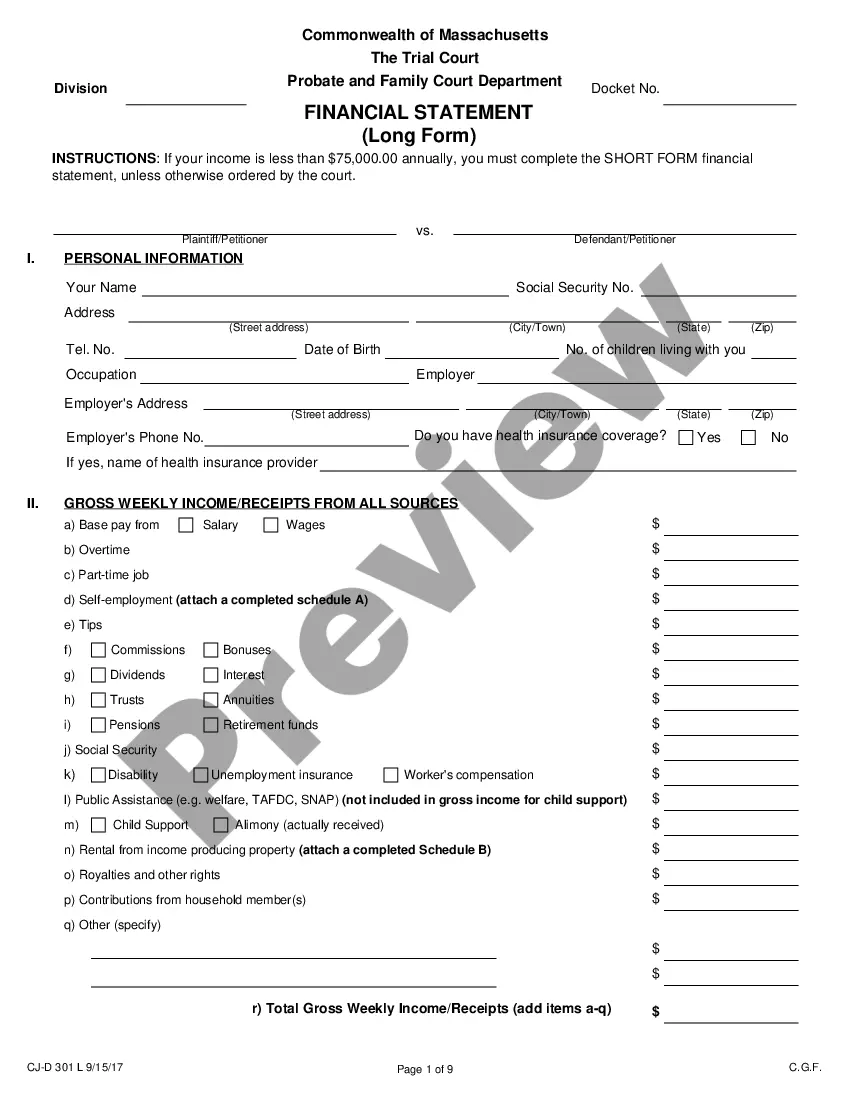

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

State the purpose for the loan. #Set forth the amount and terms of the loan. Your agreement should clearly state the amount of money you're lending your friend, the interest rate, and the total amount your friend will pay you back.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

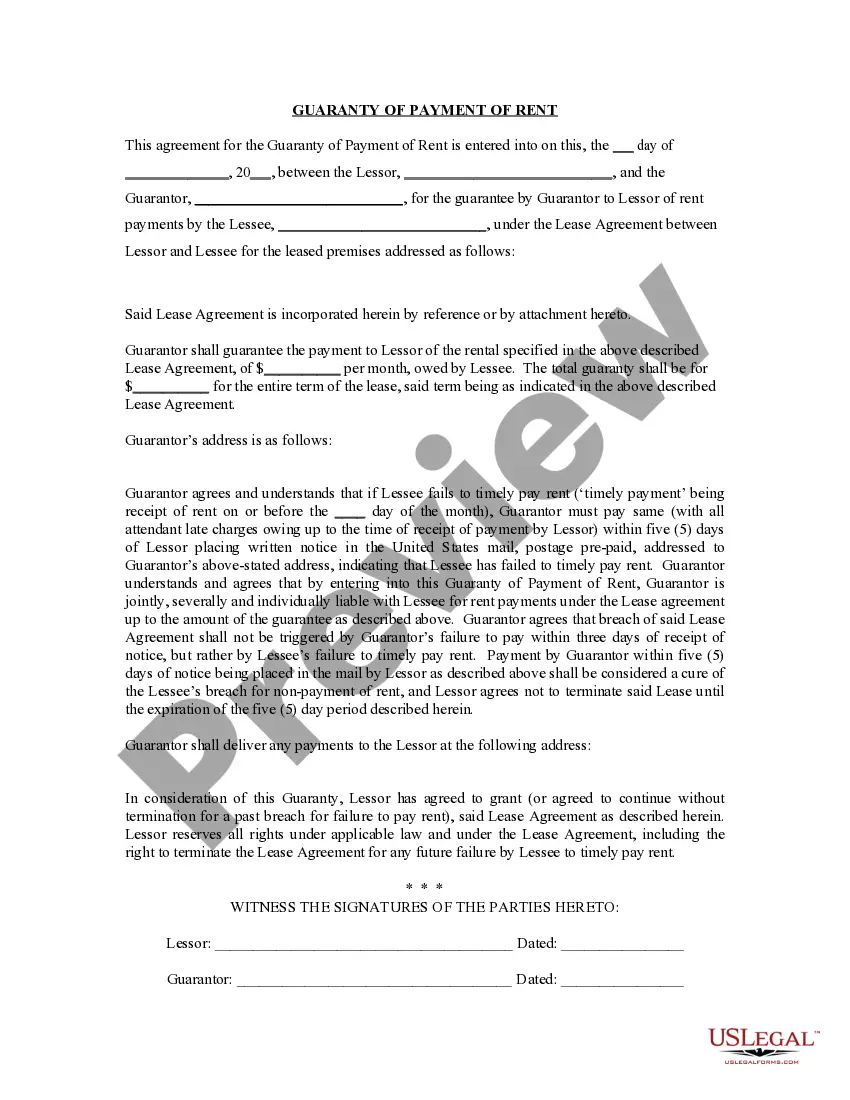

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?