State Garnishment Garnishee With A Case

Description

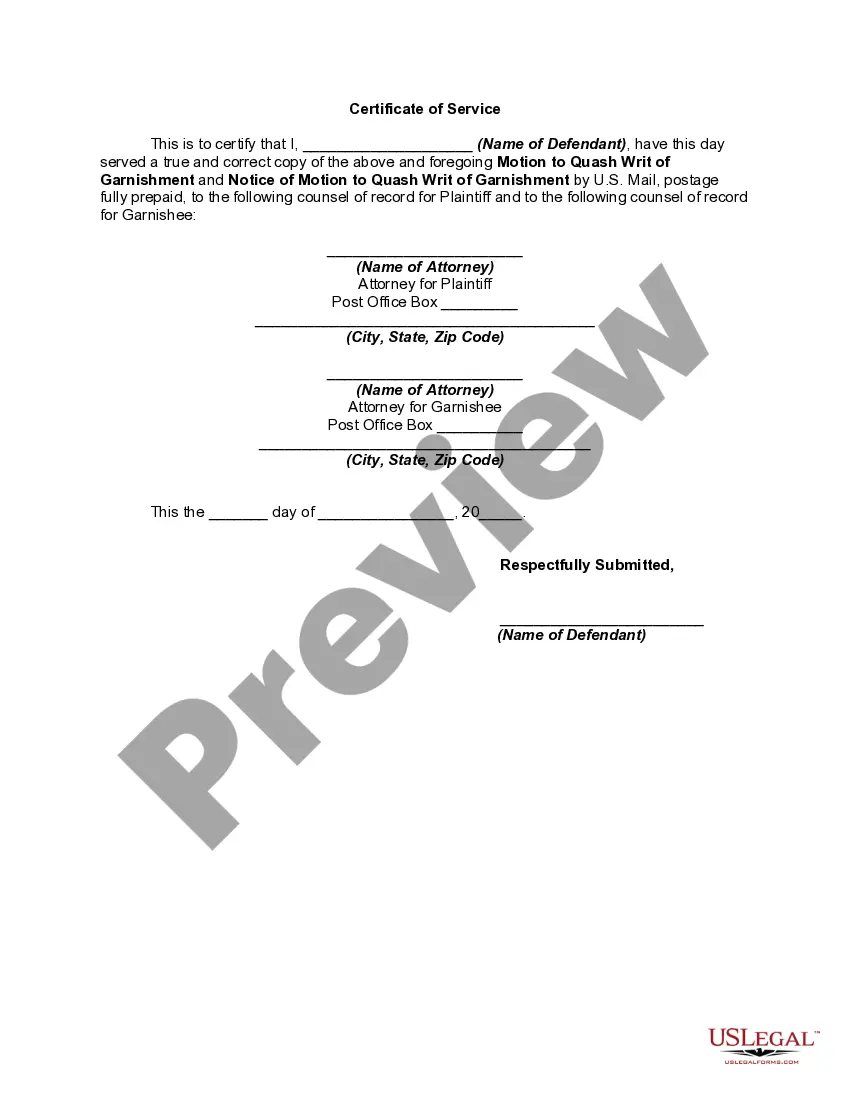

How to fill out Motion Of Defendant To Discharge Or Quash Writ Of Garnishment For Failure To Serve Copy Of Writ On Defendant And Notice Of Motion?

- Review your existing US Legal Forms account. If you already have an account, log in and check your subscription status to ensure it's active.

- If this is your first time, start by searching for the needed document in the extensive library. Use the Preview mode to assess if it meets your specifications.

- If the form isn't quite right, utilize the Search tab to find alternative templates that suit your unique needs.

- Once you've found the perfect document, click on the Buy Now button and choose a subscription plan that works best for you.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Now, download the form directly to your device. You can access it anytime from the My Forms section in your profile.

In conclusion, US Legal Forms simplifies the process of obtaining legal documents for garnishment cases. With an extensive library and the option to consult premium experts, you can ensure your documents are correct and legally sound.

Get started today and take the first step towards resolving your garnishment issues efficiently!

Form popularity

FAQ

A few states have laws that completely prevent bank account garnishments for certain types of accounts or income. For example, states like Texas and Florida provide absolute protections for specific bank accounts, such as retirement or disability accounts. Understanding your state’s rules regarding state garnishment garnishee with a case can save you from unexpected financial problems. Resources like USLegalForms can guide you through this complex subject.

Certain states offer stronger protections against garnishment than others. States like Texas and Florida have laws that protect a significant portion of income and assets from being garnished. If you live in one of these states, it's crucial to understand your protections regarding state garnishment garnishee with a case. Consulting legal resources like USLegalForms can help you identify your rights.

The maximum amount that can be garnished from your paycheck typically depends on both federal and state law. Generally, under federal law, up to 25% of your disposable earnings can be garnished. However, some states may impose stricter limits. If you're unsure about how much can be legally taken, using resources like USLegalForms can provide clarity regarding state garnishment garnishee with a case.

Yes, it is possible to face garnishment from a different state. If you have debts from creditors who are based in another state, they may seek garnishment through your local courts. This process involves recognizing the state garnishment garnishee with a case across state lines. To ensure your rights are protected, consider using USLegalForms for accurate legal documentation.

Some states have laws that restrict wage garnishment significantly. For instance, North Carolina and South Carolina impose strict limits on the garnishment process, often preventing it altogether in many situations. Therefore, if you're facing a potential state garnishment garnishee with a case, it's essential to know your state's specific regulations. Consulting resources like USLegalForms can help clarify these laws.

Negotiating a garnishment settlement involves communicating directly with the creditor or their attorney. You can propose a repayment plan or a reduced amount to settle the debt. Being proactive and knowing your rights can significantly impact the results of your negotiations in state garnishment garnishee with a case.

Yes, you can appeal a garnishee order if you believe the decision was unjust. The appeal usually involves filing the proper documents with the court and demonstrating grounds for your appeal. Understanding the appeal process is critical when facing state garnishment garnishee with a case and can lead to positive outcomes.

To file an appeal for a garnishment, you must submit a notice of appeal to the court that issued the garnishment order. This process often requires strict adherence to deadlines and procedural rules. Consulting with a legal expert can help ensure you navigate the complexities of state garnishment garnishee with a case effectively.

Yes, garnishments can occur without your prior knowledge, particularly if the creditor obtains a court order without notifying you first. However, you should receive a notice soon after the garnishment begins. Staying informed about your rights can be crucial when dealing with state garnishment garnishee with a case.

To request a hearing on a garnishment, you typically need to file a motion with the court. This motion should detail your reasons for contesting the garnishment and any relevant supporting documents. A well-prepared motion can lead to a favorable outcome, especially in cases of state garnishment garnishee with a case.