Record Expungement In Ohio

Description

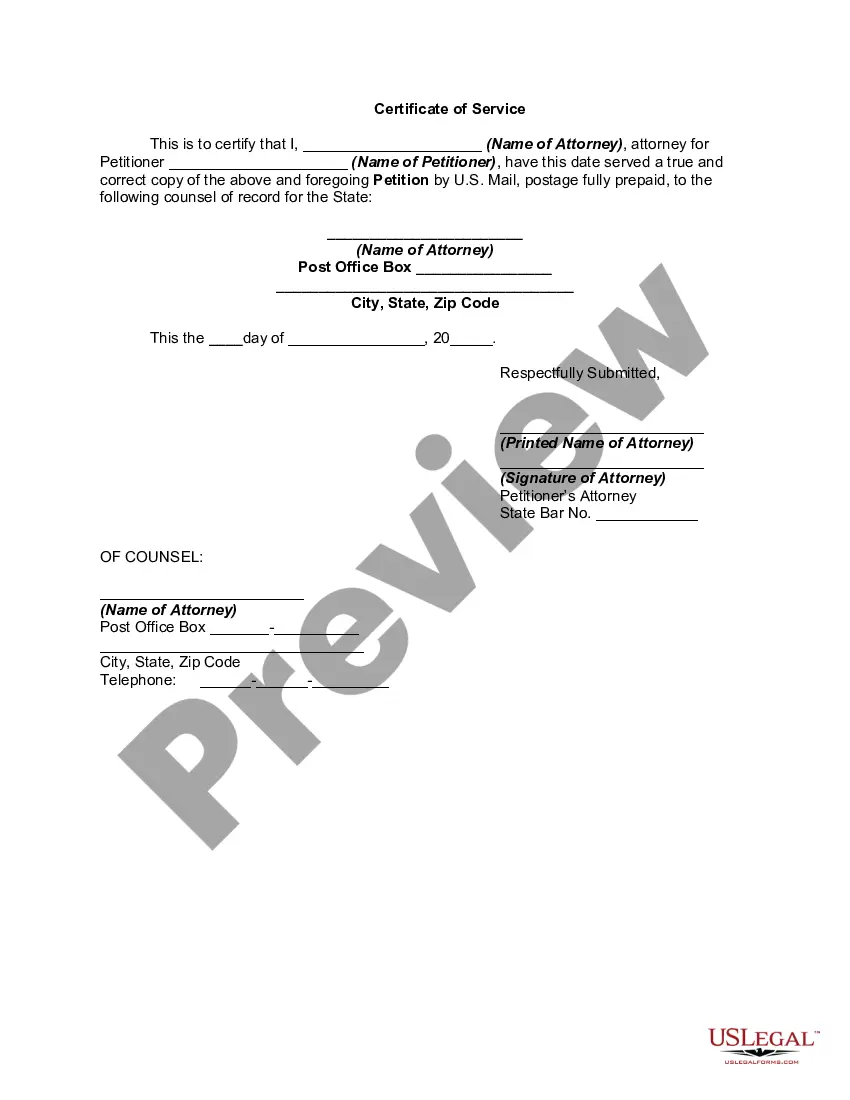

How to fill out Petition For Expungement Of Record In Case Of Acquittal And Release Without Conviction?

Handling legal documents and processes can be a lengthy addition to your day.

Record Expungement In Ohio and similar forms generally necessitate that you search for them and comprehend the most effective method to fill them out correctly.

For this reason, whether you are managing financial, legal, or personal affairs, utilizing a thorough and useful online repository of forms when needed will considerably assist.

US Legal Forms is the leading online service for legal templates, offering more than 85,000 state-specific forms and an array of resources to help you complete your documents with ease.

Simply Log In to your account, find Record Expungement In Ohio and download it directly in the My documents tab. You can also retrieve previously downloaded forms. Would this be your first time using US Legal Forms? Sign up and create a free account in just a few minutes, and you’ll gain access to the form repository and Record Expungement In Ohio. Following that, adhere to the steps outlined below to complete your form: Ensure you’ve located the correct form using the Preview option and reviewing the form description. Choose Buy Now when ready and select the subscription plan that suits you best. Click Download then complete, sign, and print the form. US Legal Forms has twenty-five years of experience aiding clients manage their legal documents. Locate the form you need today and simplify any task effortlessly.

- Explore the collection of suitable forms accessible with merely a single click.

- US Legal Forms provides you with state- and county-specific forms available at any time for download.

- Secure your document management processes with a premium service that allows you to prepare any form in minutes without extra or concealed fees.

Form popularity

FAQ

Qualifying to Use Form 540 2EZ Check the table below to make sure you qualify to use Form 540 2EZ. Be 65 years of age or older and claim the senior exemption. If your (or your spouse's/RDP's) 65th birthday is on January 1, 2023, you are considered to be age 65 on December 31, 2022.

Accepted forms Forms you can e-file for an individual: California Resident Income Tax Return (Form 540) California Resident Income Tax Return (Form 540 2EZ)

If you have a tax liability for 2022 or owe any of the following taxes for 2022, you must file Form 540. Tax on a lump-sum distribution. Tax on a qualified retirement plan including an Individual Retirement Arrangement (IRA) or an Archer Medical Savings Account (MSA).

Use Form 540NR if either you or your spouse/RDP were a nonresident or part-year resident in tax year 2022. If you and your spouse/RDP were California residents during the entire tax year 2022, use Form 540, California Resident Income Tax Return, or 540 2EZ, California Resident Income Tax Return.

The most common California income tax form is the CA 540. This form is used by California residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

A California LLC, like all entities in California, must pay the state's annual Franchise Tax. This tax is $800 for all California LLCs. The annual Franchise Tax is due the 15th day of the fourth month after the beginning of the tax year. You must file Form 3522 (LLC Tax Voucher).

CEB offers hundreds of California Judicial Council Forms at no charge.

If you have an LLC, here's how to fill in the California Form 568: Line 1?Total income from Schedule IW. Enter the total income. Line 2?Limited liability company fee. Enter the amount of the LLC fee. The LLC must pay a fee if the total California income is equal to or greater than $250,000.