Michigan Application For Expungement

Description

How to fill out Petition For Expungement Of Record In Case Of Acquittal And Release Without Conviction?

Creating legal documents from the ground up can frequently be daunting. Some situations might require extensive research and a significant financial investment.

If you’re looking for a more straightforward and economical method of completing the Michigan Application For Expungement or other forms without unnecessary hassle, US Legal Forms is readily available to you.

Our digital library comprises over 85,000 current legal forms that cover nearly every facet of your financial, legal, and personal matters. With merely a few clicks, you can quickly obtain state- and county-specific templates carefully crafted by our legal experts.

Utilize our service whenever you require a dependable and trustworthy means through which you can effortlessly locate and download the Michigan Application For Expungement. If you’re familiar with our website and have set up an account in the past, just Log In to your account, choose the template, and download it or access it again at any time in the My documents section.

US Legal Forms enjoys a solid reputation and boasts over 25 years of experience. Join us today and simplify your form completion process!

- Not registered yet? No issue. It hardly takes a moment to create your account and investigate the library.

- Before you rush into downloading the Michigan Application For Expungement, consider these suggestions.

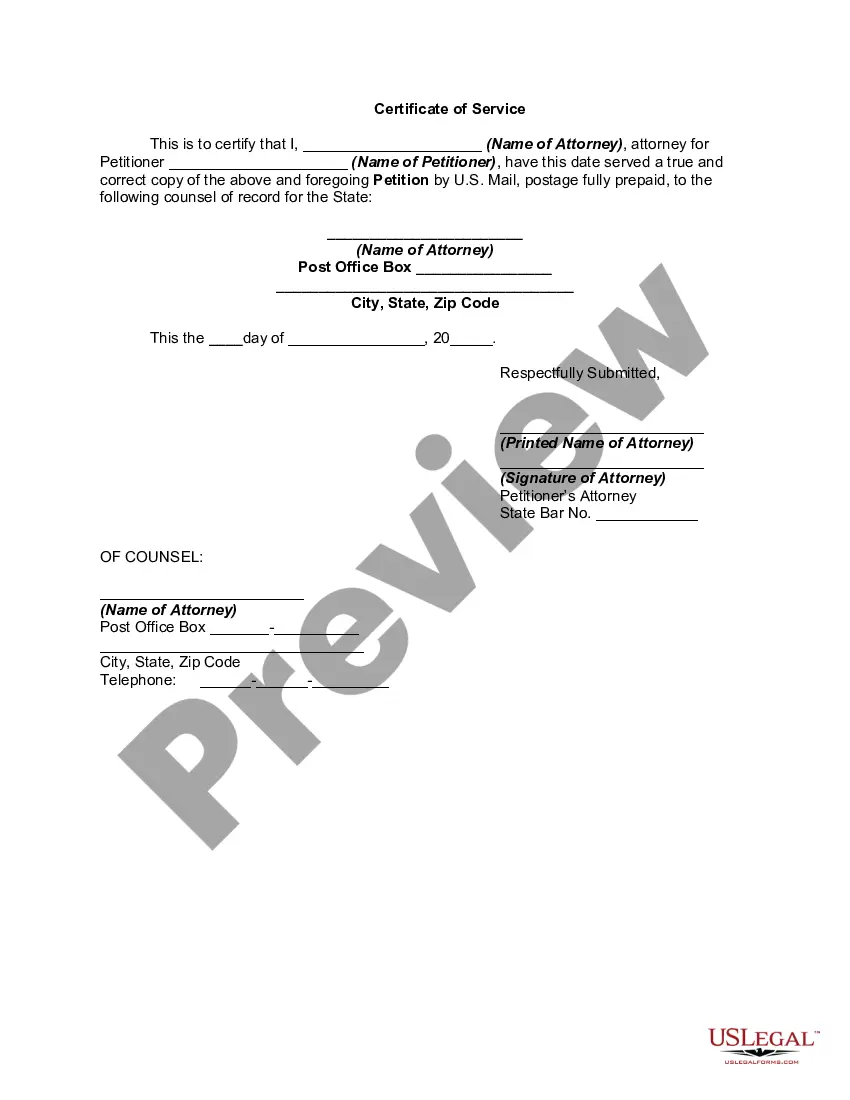

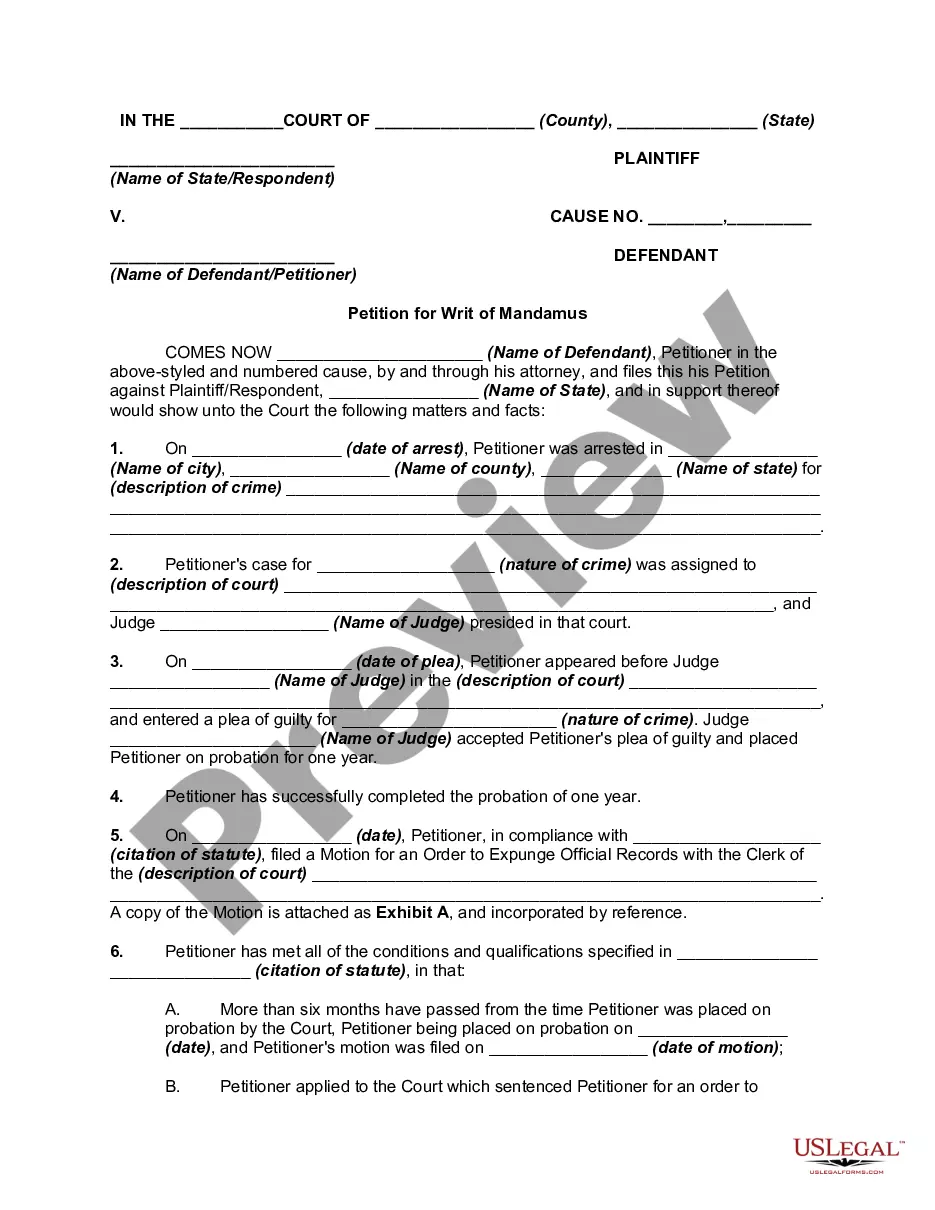

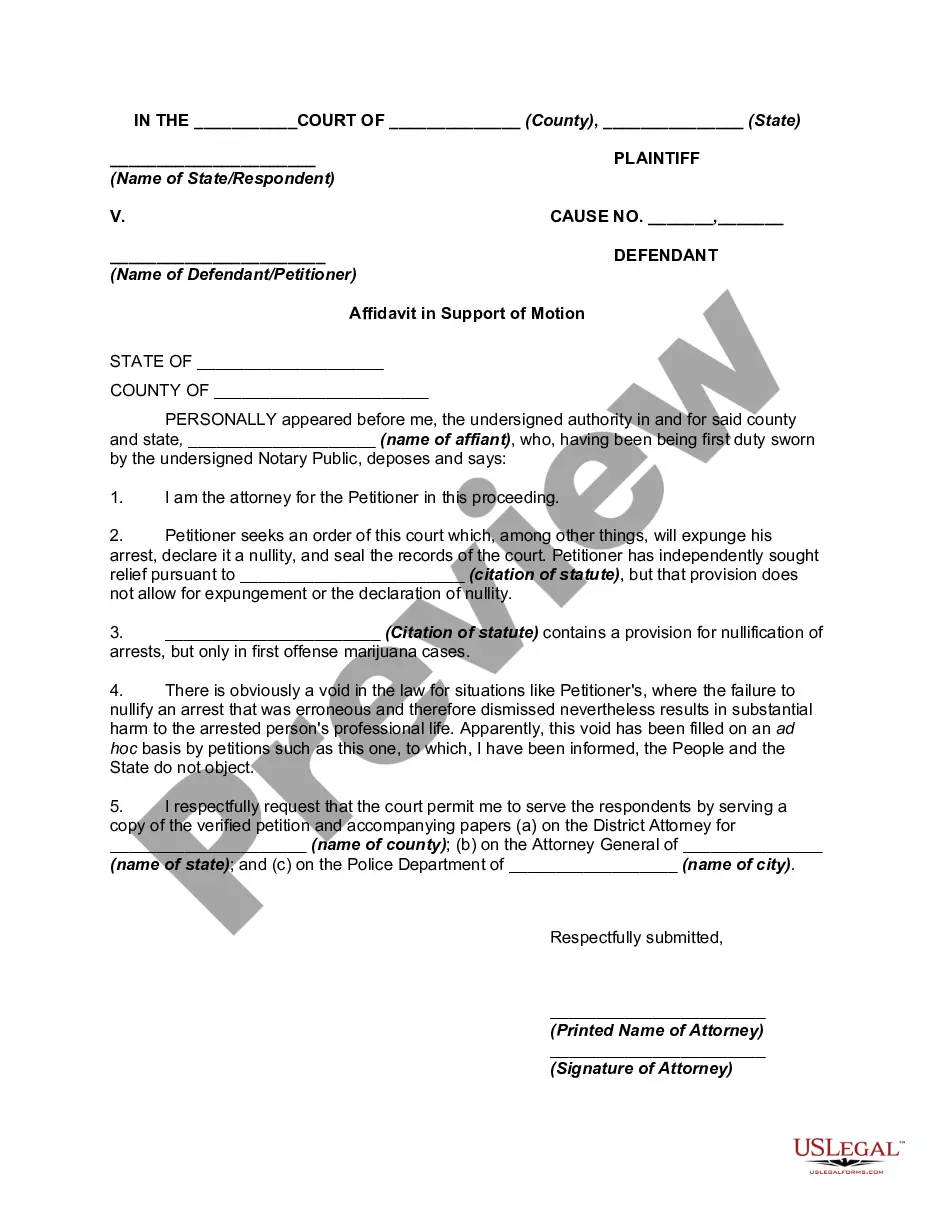

- Examine the document preview and details to confirm you have located the document you need.

- Ensure the template you choose meets the specifications of your state and county.

- Select the appropriate subscription plan to acquire the Michigan Application For Expungement.

Form popularity

FAQ

Refund Returns: Virginia Department of Taxation, P.O. Box 1498, Richmond, VA 23218-1498. Tax Due Returns: Virginia Department of Taxation, P.O. Box 760, Richmond, VA 23218-0760.

The Internal Revenue Service (IRS) can provide you with copies of your tax return from the most recent seven tax years. You can request copies by preparing Form 4506 and attaching payment of $43 for each one. Once the IRS receives your request, it can take up to 60 days for the agency to process it.

What do you attach to VA 760? REQUIRED ATTACHMENTS TO FORM 760 Forms W-2, 1099 VK-1 showing Virginia withholding. Schedule ADJ. Schedule VAC.

You can file for a late S Corp election up to 3 years and 75 days after its proposed effective date!

S Corporations, Partnerships, and Limited Liability Companies. Every pass-through entity (PTE) that does business in Virginia or receives income from Virginia sources must file an annual Virginia income tax return on Form 502 or Form 502PTET.

VA 760 CG: Out-of-state income included in total AGI for VA tax in ATX?. Full-year residents of Virginia must include income earned in other states to compute total Adjusted Gross Income for the appropriate tax year. Credit for taxes paid to another state may be claimed by filing Virginia Schedule OSC.

All Virginia state taxpayers can qualify for an automatic six month extension for filing income tax returns. No application for an extension is required. You must pay at least 90% of your tax due by the original due date using a voucher, Form 760IP.

File Form 760PY to report the income attributable to your period of Virginia residency. File Form 763, the nonresident return, to report the Virginia source income received as a nonresident.