Answer To Petition For Special Relief

Description

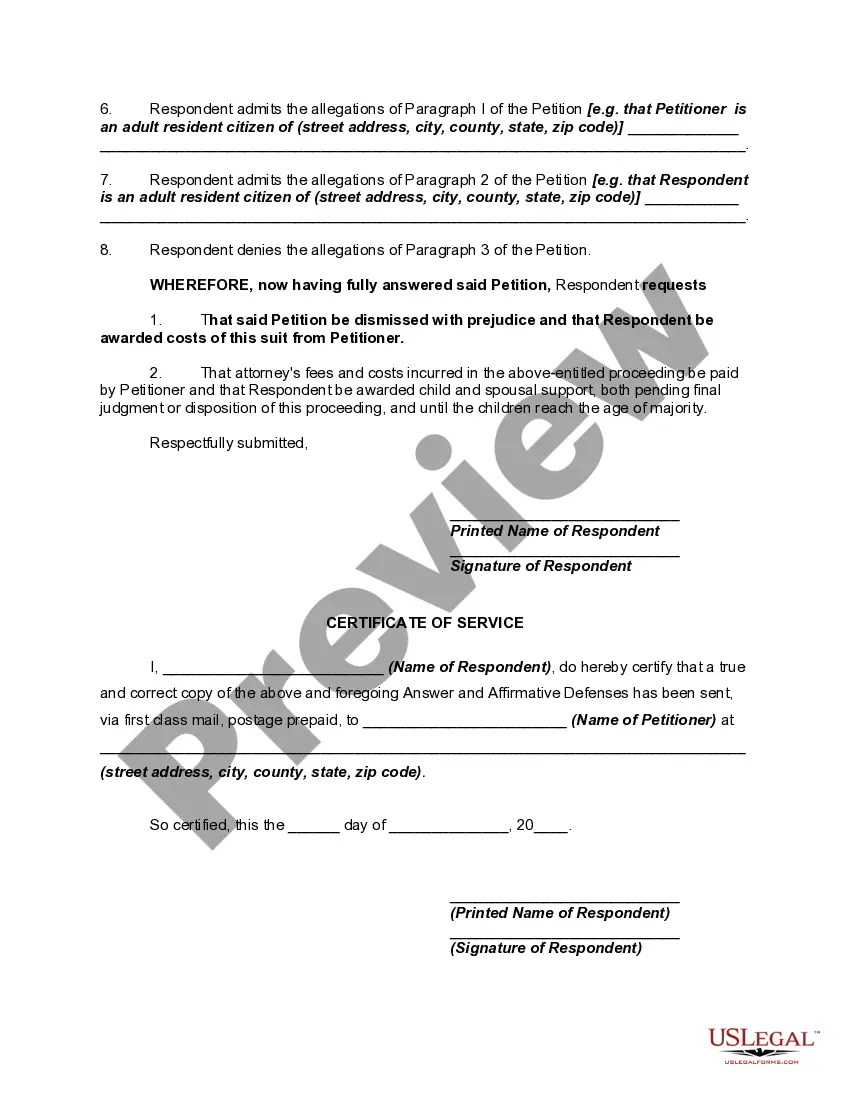

How to fill out Answer Or Response To Petition Or Complaint For Dissolution Of Marriage Or Divorce?

Handling legal paperwork and processes can be a lengthy addition to your routine.

Responses to Requests for Special Assistance and similar forms typically necessitate finding them and figuring out the best method to fill them out accurately.

Therefore, whether you are managing financial, legal, or personal affairs, utilizing a thorough and accessible online repository of forms at your disposal will significantly help.

US Legal Forms is the premier online site for legal documents, boasting over 85,000 state-specific forms and various tools to help you complete your paperwork smoothly.

Simply Log In to your account, search for Response to Request for Special Assistance, and download it instantly from the My documents section. You can also access previously downloaded documents.

- Explore the repository of relevant documents available to you with just a single click.

- US Legal Forms provides state- and county-specific forms accessible anytime for download.

- Protect your document management processes with a high-quality service that allows you to create any form within minutes without additional or hidden fees.

Form popularity

FAQ

An example of a petition could be a request for a stay of deportation for an individual facing removal from the country. In this petition, the applicant would detail their circumstances and provide a compelling explanation for why an answer to petition for special relief is necessary. Clear examples, such as this one, help frame your arguments and enhance your case.

Business Forms & Fees Domestic CorporationsCharter For-profit Corporation (PDF, 357.3KB)SS-4417$100Articles of Amendment to the Charter for-Profit Corporation (PDF, 837.2KB)SS-4421$20Articles of Correction (PDF, 95.6KB)SS-4438$20Change of Mailing Address (PDF, 307.8KB)SS-4800No Fee24 more rows

To officially start your LLC in Tennessee, you must file Articles of Organization with the Tennessee Secretary of State, Business Services Division. It costs a minimum of $300 (for LLCs with six members or fewer). After that, it costs $50 for each additional member.

Due Date. Your $300 Annual Report filing fee is due at the same time every year. It must be paid by the 1st day of the 4th month after the end of your LLC's fiscal year.

Tennessee requires LLCs to file an annual report and pay a franchise tax. The annual report is due on or before the first day of the fourth month following the close of the LLC's fiscal year. The filing fee is $50 per member, with a minimum fee of $300 and a maximum fee of $3000.

The annual report fee for LLCs is $300 minimum up to a maximum of $3000. The fee increases by an additional $50 per member for every member over 6 members up to a maximum of $3,000. An officer is not listed. If the business is a Tennessee for-profit corporation, the corporation must list at least one officer.

If you're looking for a copy of an Articles of Organization that you already filed for your LLC, you can get one for $20. The request for copies must be sent via mail to the Secretary of State. Download the Request for Copy of Documents Form (Form SS-4461) from the Tennessee Secretary of State.

To officially start your LLC in Tennessee, you must file Articles of Organization with the Tennessee Secretary of State, Business Services Division. It costs a minimum of $300 (for LLCs with six members or fewer). After that, it costs $50 for each additional member.

Tennessee requires LLCs to file an annual report every year. You can submit your report online or print and mail your report to the Secretary of State. To complete the annual report, you'll need to provide some basic information, such as: Thanks !