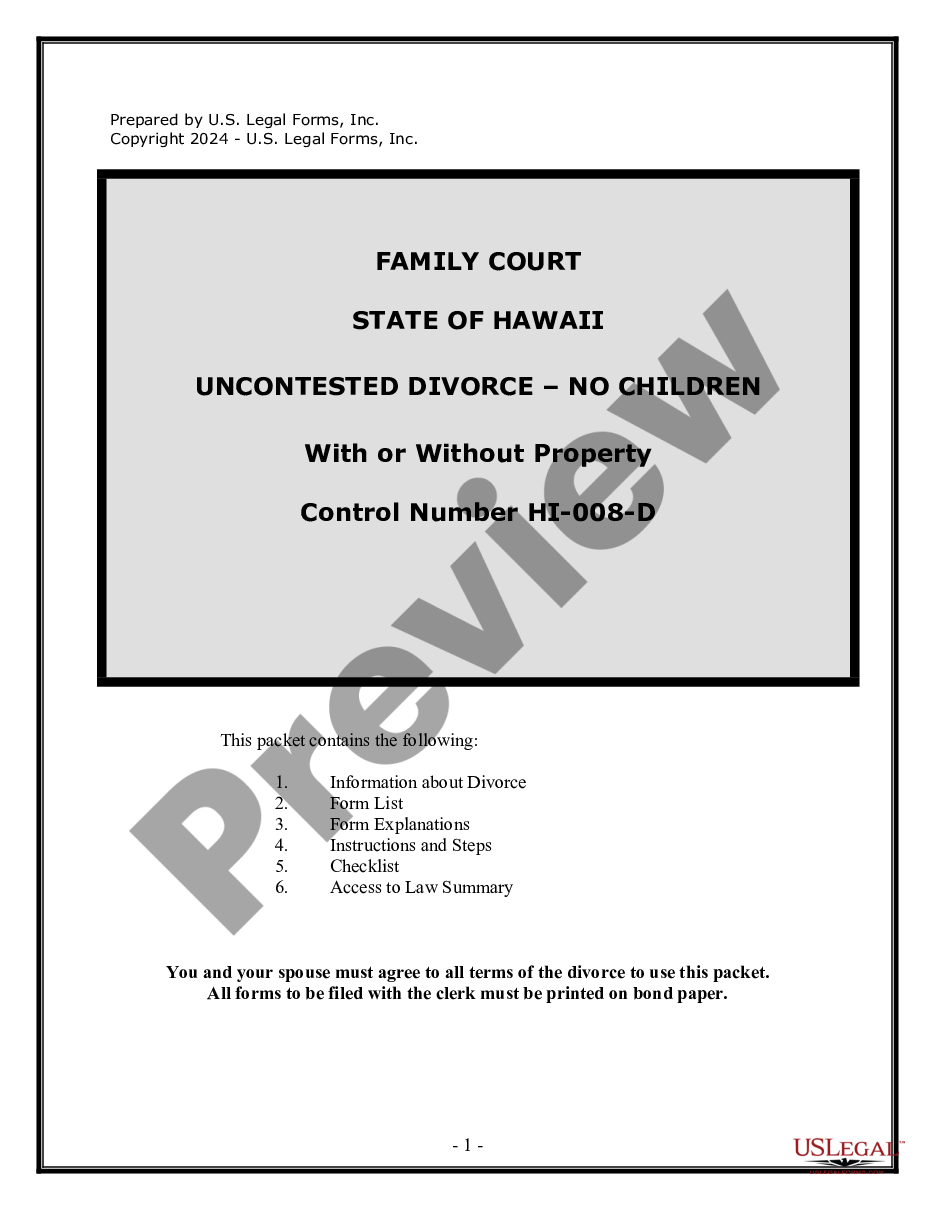

Asset And Liabilities Worksheet

Description

How to fill out Affidavit Or Proof Of Income And Property - Assets And Liabilities?

- Log in to your US Legal Forms account. If you're a returning user, simply access your account and ensure your subscription is current to continue using the service.

- Review the available templates. Check the preview mode and ensure the selected asset and liabilities worksheet fits your local jurisdiction and specific needs.

- Search for alternatives if necessary. If your requirements aren't met, utilize the search feature to find an appropriate template.

- Complete your purchase. Once you've selected the right document, click the Buy Now button, choose a suitable subscription plan, and create an account if you haven't done so already.

- Finalize your payment. Enter your payment details using a credit card or PayPal, and proceed to complete the transaction.

- Download your worksheet. Save the finished template to your device and access it anytime from the My Forms section in your profile.

US Legal Forms provides a robust collection of legal documents, offering over 85,000 forms that are easy to fill out and customize. The platform also connects users with legal experts to ensure all documents are accurate and compliant.

Take control of your financial planning today! Visit US Legal Forms and generate your asset and liabilities worksheet effortlessly.

Form popularity

FAQ

Filling out an asset and liability form is straightforward with the right guidance. Begin by entering your assets in one section, noting valuables and their respective worth. Then, move to the liability section, where you should record any debts or financial obligations you have. For a streamlined approach, consider using USLegalForms to access templates and resources tailored to assist you in completing your asset and liabilities worksheet efficiently.

An asset and liabilities worksheet is specifically designed to display your financial standing comprehensively. This sheet contains sections for listing various assets on one side and liabilities on the other. A clearly structured worksheet allows you to visualize your financial situation effectively, making it easier to manage your finances and set future goals.

To calculate your assets and liabilities, begin by listing all your assets and their current values. Then, total these amounts to determine your total assets. Next, list all liabilities and sum those values. Subtract the total liabilities from the total assets to find your net worth, utilizing an asset and liabilities worksheet for accurate calculations.

Filling out an asset and liability form requires attention to detail. Begin by listing all assets along with their respective values, such as real estate and savings. Next, document your liabilities, being honest about what you owe. Utilizing an asset and liabilities worksheet can guide you through this process, ensuring completeness and accuracy.

Making entries in a balance sheet requires accurate data entry and organization. First, categorize your assets and liabilities by type to enhance clarity. Then, ensure that each entry is factual and up-to-date, enabling a true representation of your financial status. To streamline this process, consider using an asset and liabilities worksheet from US Legal Forms for accuracy and ease.

To fill out a balance sheet step by step, start with drafting a clear header that includes your business name and date. Then, create two columns, one for assets and one for liabilities and equity. In the assets section, list everything you own, categorized by liquidity. Next, input all your obligations in the liabilities section, and finally calculate your equity. Using an asset and liabilities worksheet simplifies this process significantly.

To populate a balance sheet, start by gathering information about your assets and liabilities. Use an asset and liabilities worksheet to clearly list all your assets on one side and your liabilities on the other. Ensure that every asset is assigned a value and that you include long-term and short-term liabilities for clarity. This organized approach gives you a clear picture of your financial position.