Trust Caps

Description

How to fill out Qualified Income Miller Trust?

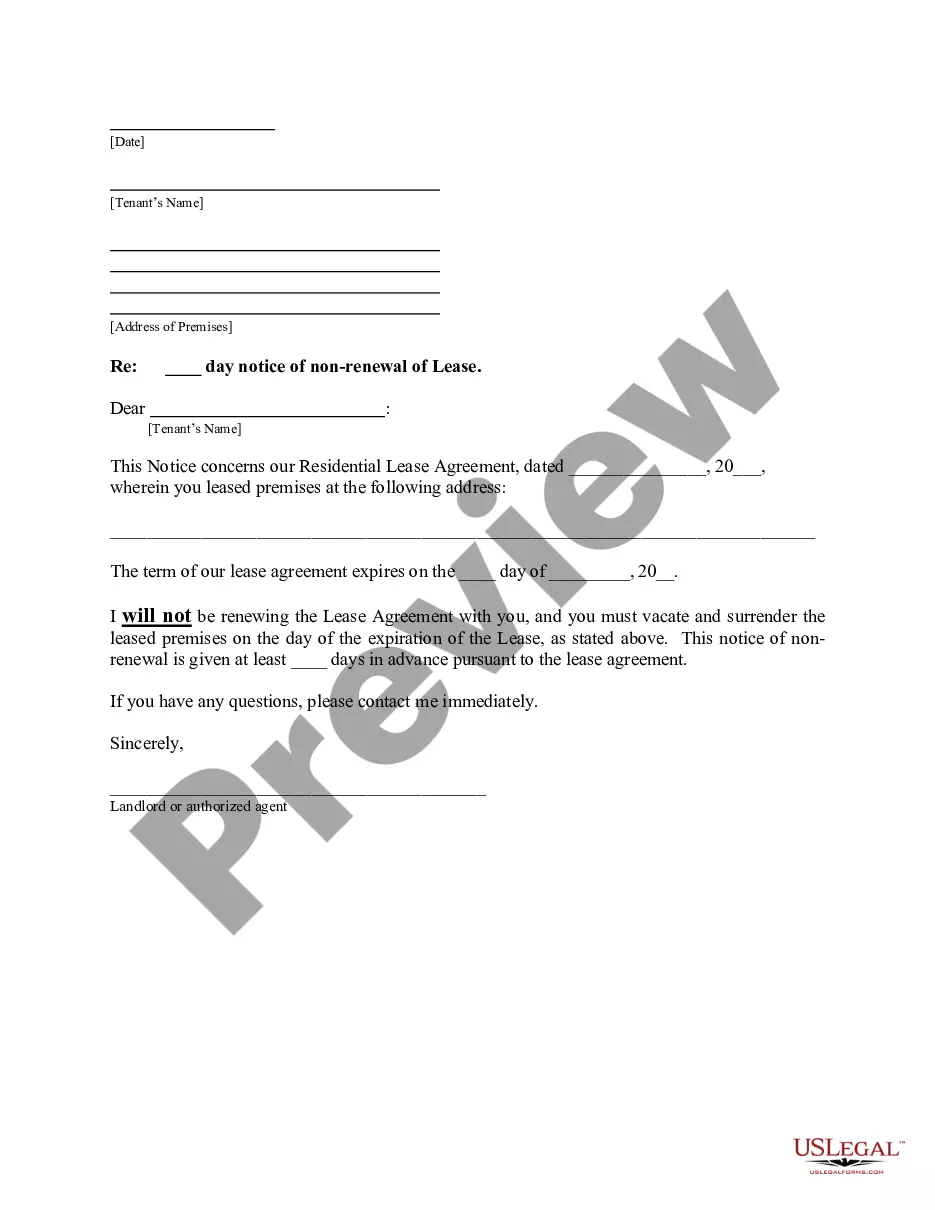

- Log in to your US Legal Forms account if you're an existing user. Verify that your subscription is active; if not, renew it based on your payment plan.

- For first-time users, start by checking the preview mode and form descriptions to select the right document that meets your requirements.

- If necessary, utilize the search feature to find alternate templates that may better suit your needs.

- Once you've found the right form, click on the 'Buy Now' button and choose your preferred subscription plan.

- Complete your purchase by entering your credit card information or using your PayPal account.

- Finally, download your form and save it to your device to easily access it anytime through the 'My Forms' section.

Obtaining legal documents doesn't have to be a daunting task. With US Legal Forms, users can experience the convenience of a vast library of legal templates backed by expert assistance.

Take advantage of this user-friendly service today and ensure your legal documents are precise and compliant with the law. Start your journey with US Legal Forms now!

Form popularity

FAQ

Yes, in VRChat, it is possible to lose your trust rank if you engage in negative behavior or violate community standards. Trust ranks can decrease if you have too many negative interactions or reports against you. It’s crucial to maintain a positive presence in the community to avoid running afoul of those trust caps. Stay mindful of your interactions to preserve your standing.

The number of hours required for trust ranks in VRChat varies as it depends on your level of engagement. On average, dedicating several hours weekly while maintaining consistent interactions could see your rank improve over time. Remember, how you interact during those hours matters more than the total time spent. Aim for quality engagement to maximize your achievements.

To achieve a higher trust rank in VRChat, focus on regularly participating in social events and group activities. Your interactions with others and how you contribute to the environment make a huge difference. Building friendships and reciprocating support within the community can help break through those trust caps. Keep in mind that patience is key.

You can elevate your trust rank by participating actively in communities and fostering positive interactions. Consistent communication and engagement with other users help in building trust. Moreover, completing tasks that promote collaboration can further elevate your rank. Aim to be a helpful member and respect the community guidelines for best outcomes.

To boost your trust cap in Stellaris, ensure you maintain friendly relationships with other empires. Engage in diplomatic actions like alliances, trade agreements, and giving gifts. Managing your diplomatic reputation efficiently also influences your trust cap. Always consider the needs and preferences of other empires for best results.

In VRChat, increasing your trust rank involves actively participating in the community and engaging positively with others. Completing quests, attending events, and using voice chat can enhance your standing. Consistent interactions help you build relationships, making it easier to reach those trust caps. The trust rank system rewards positive community involvement.

To quickly gain trust in Universal Paperclips, focus on generating more paperclips and maximizing your actions. You can achieve this by investing in upgrades that increase your efficiency. Engaging with other players and sharing your strategies can also help. Remember, trust caps are determined by your total production and your interactions.

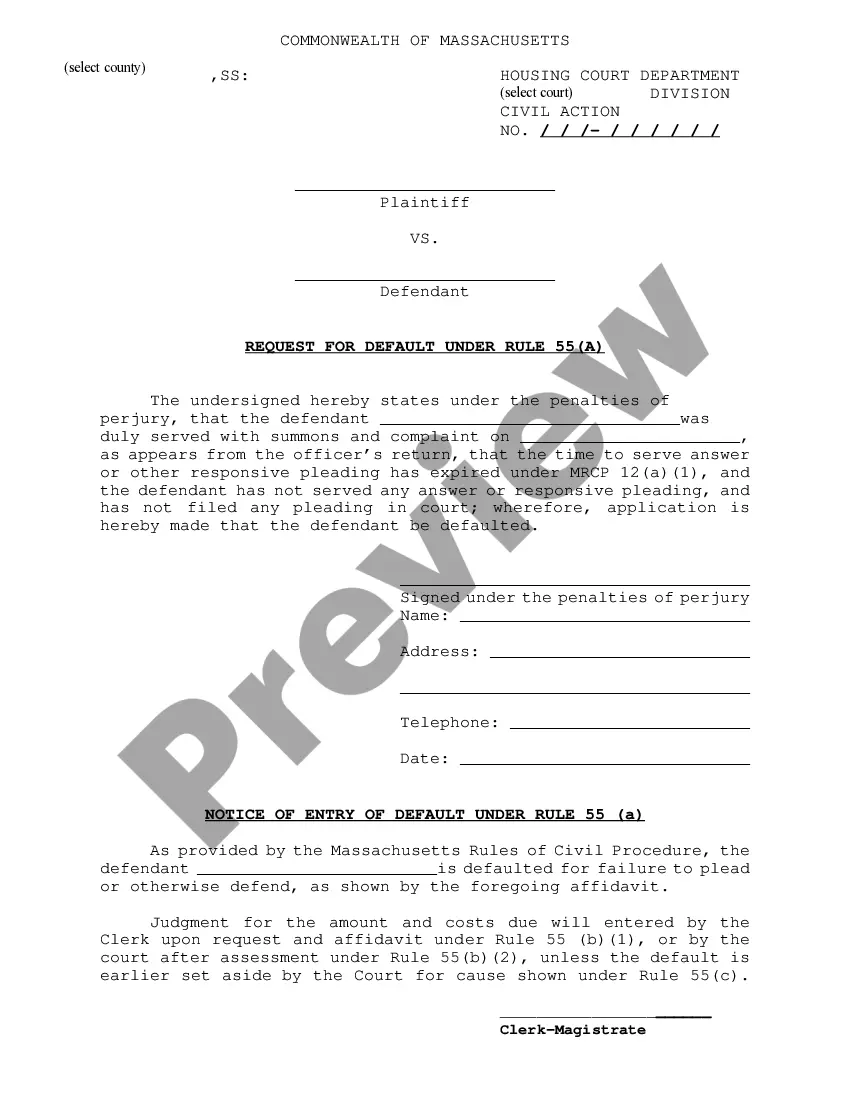

Form 56 should be filed with the IRS at the address specified for your particular tax situation. This form notifies the IRS of your fiduciary relationship concerning a trust. Having complete and accurate filings, including those related to trust caps, ensures you maintain compliance. US Legal Forms can assist you in obtaining the correct forms and instructions to file appropriately.

Yes, capital gains from a trust are typically taxed to the beneficiary if the gains are distributed. This means that beneficiaries need to report these gains on their personal tax returns. Being aware of how trust caps might affect taxation is vital for effective tax planning. The US Legal Forms platform can provide valuable insights and helpful documents.

Typically, trust income is reported on a Schedule K-1, rather than a 1099 form. Beneficiaries of the trust will receive this form detailing their share of the trust's income. Understanding the relationship between these forms and trust caps can help beneficiaries prepare for tax implications. Consider using US Legal Forms to access relevant resources for your circumstances.