A Miller Trust With Arizona

Description

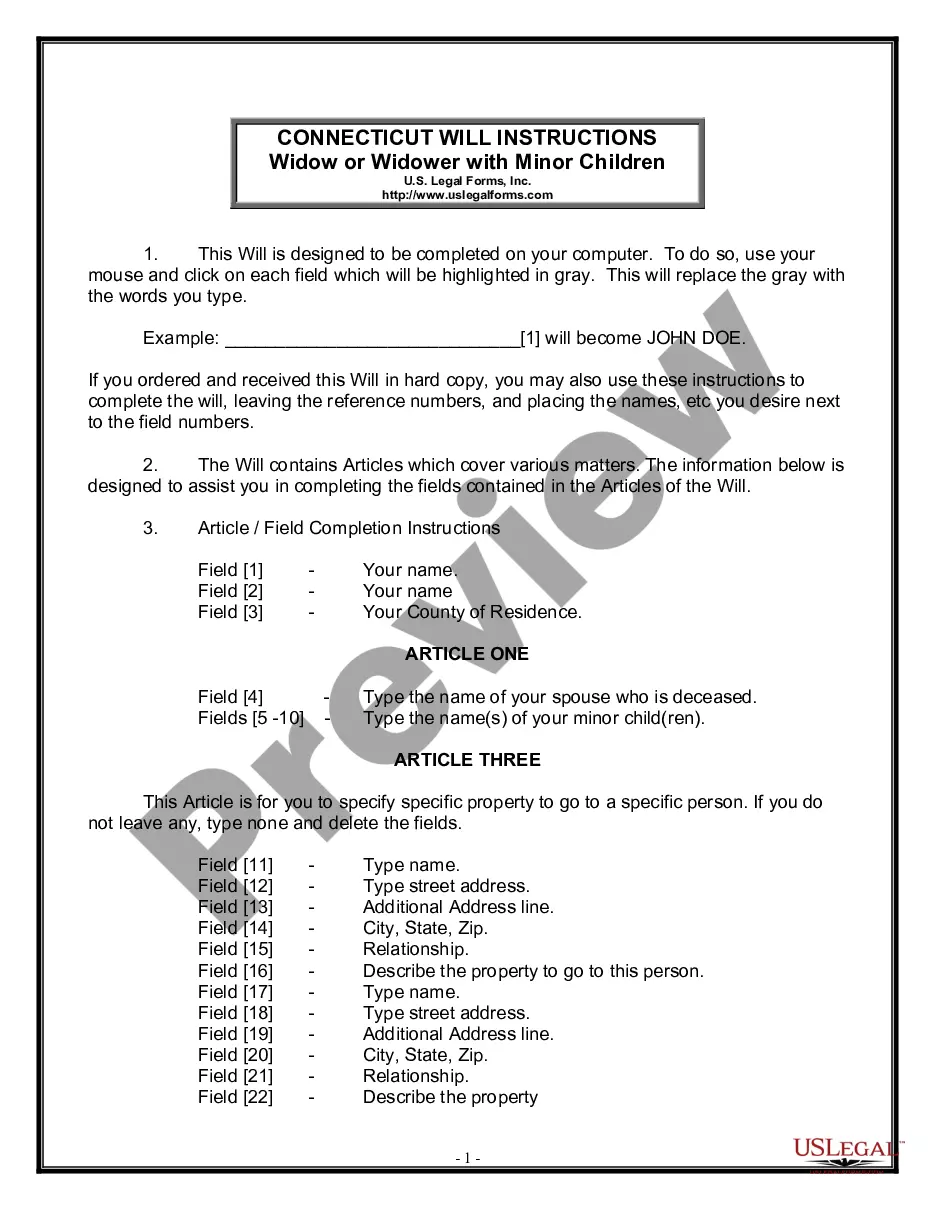

How to fill out Qualified Income Miller Trust?

Acquiring legal templates that align with federal and state regulations is essential, and the web provides numerous choices to select from.

However, what is the use of squandering time searching for the appropriate A Miller Trust With Arizona example online if the US Legal Forms digital library has already compiled such templates in one location.

US Legal Forms is the premier online legal repository with over 85,000 fillable templates created by attorneys for various professional and personal circumstances. They are straightforward to navigate, with all documents organized by state and intended use.

- Our experts stay updated with legislative modifications, ensuring your documents are always current and compliant when acquiring a A Miller Trust With Arizona from our site.

- Obtaining a A Miller Trust With Arizona is straightforward and fast for both existing and new users.

- If you possess an account with an active subscription, Log In and save the document sample you need in your desired format.

- If you're new to our site, follow the steps outlined below.

- Review the template using the Preview feature or the text description to confirm it satisfies your requirements.

Form popularity

FAQ

You might need a Miller trust with Arizona to help you qualify for Medicaid benefits while managing your income effectively. This type of trust allows individuals to set aside excess income that would otherwise disqualify them from receiving assistance. By placing your income into a Miller trust, you can meet eligibility criteria, ensuring you receive the medical care you need. It’s essential to navigate the requirements accurately, and US Legal Forms offers resources to simplify this process.

To quickly search registered businesses in Michigan, visit the Department of Licensing and Regulatory Affairs' business entity search. Our ratings take into account a product's cost, features, ease of use, customer service and other category-specific attributes.

In this lesson, we will walk you through filing your LLC Articles of Organization with the Michigan Department of Licensing and Regulatory Affairs (LARA). This is the document that officially forms your Michigan LLC. You can file the Michigan Articles of Organization online or by mail.

Visit the Michigan Business Entity Search page: Type your desired LLC name in the ?Search by Entity Name? field. For the ?Search type? dropdown menu, leave it on ?Begins With?.

You can find information on any corporation or business entity in Michigan or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, phone, or in person, but we recommend faxing. Normal processing takes up to 10 days, plus additional time for mailing, and costs $16.00 for up to 7 pages, and $1.00 per additional page.

You can use the Michigan Taxable Entity Search tool to check if your business name is available. You may also contact the Michigan Secretary of State Business Services Division via phone at (517) 241-6470 or email at CorpsMail@michigan.gov for assistance conducting a Michigan LLC name search.

The availability of a name for a limited partnership, a limited liability company, or a corporation may be checked by visiting the website, contacting the Business Services Section of the Corporations Division by mail, telephone or in person at our office.

Just use the Michigan Business Name Search Tool above and enter your proposed MI LLC or corporation name. We'll search the business name database of the Michigan Department of Licensing and Regulatory Affairs and tell you if there are any matches.