Certificate Of Directors Remuneration

Description

How to fill out Certificate Of Directors As To Contents Of The Bylaws Of The Corporation?

How to locate professional legal documents adhering to your state regulations and draft the Certificate Of Directors Remuneration without consulting a lawyer.

Numerous online services provide templates to address various legal matters and formalities.

However, it might require time to determine which of the available samples meet both your use case and legal criteria.

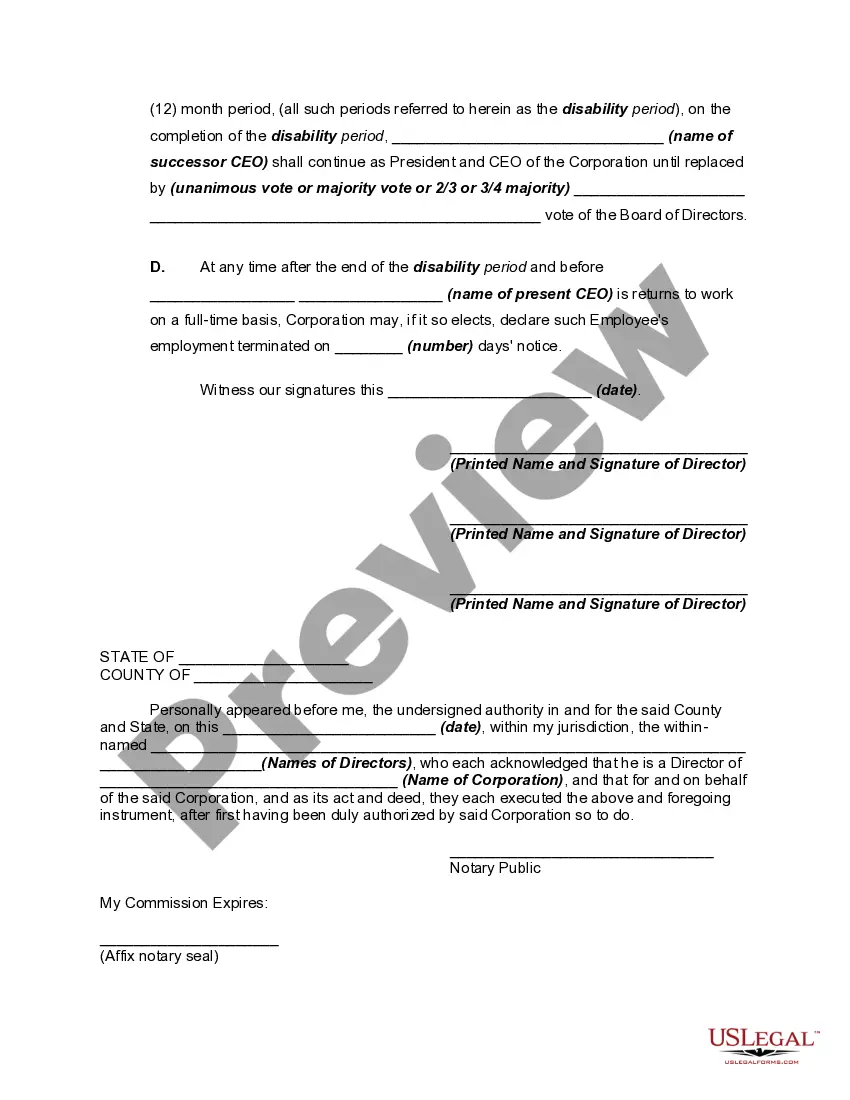

Download the Certificate Of Directors Remuneration using the associated button next to the file name. If you do not have an account with US Legal Forms, then follow the instructions below: Browse through the opened webpage and confirm if the form meets your requirements. Utilize the form description and preview options if available. Search for another sample in the header selecting your state if necessary. Click the Buy Now button once you find the appropriate document. Choose the most suitable pricing plan, then Log In or pre-register for an account. Select the payment method (by credit card or via PayPal). Decide on the file format for your Certificate Of Directors Remuneration and click Download. The obtained templates remain yours: you can always revisit them in the My documents section of your profile. Join our library and create legal documents independently like a seasoned legal expert!

- US Legal Forms is a distinguished service that assists you in locating official documents crafted in line with the most recent state law updates and aids in minimizing legal expenses.

- US Legal Forms is not an ordinary web directory.

- It consists of over 85k validated templates for different business and personal scenarios.

- All documents are categorized by industry and state to streamline your search process.

- It also collaborates with advanced solutions for PDF editing and e-signature, allowing users with a Premium subscription to conveniently complete their paperwork online.

- It requires minimal effort and time to obtain the necessary documents.

- If you already possess an account, Log In and verify that your subscription is current.

Form popularity

FAQ

Director's remuneration includes various components such as base salary, performance bonuses, equity awards, and additional perks. It can also involve contributions to pension plans and health benefits. A well-prepared Certificate of directors remuneration should detail these elements to prevent any misunderstandings.

Remuneration for directors is usually determined by the board of directors, often with the assistance of a compensation committee. This committee reviews market trends and benchmarks to ensure the payments align with industry standards. Utilizing a Certificate of directors remuneration can provide a formal record of these decisions, enhancing governance.

Director's remuneration typically comprises salary, bonuses, stock options, and other benefits such as retirement plans and healthcare. Additionally, it can include perks like company cars or allowances for travel. It is essential to document these details in a Certificate of directors remuneration to maintain transparency and compliance.

Directors remuneration typically includes several components such as base salary, bonuses, benefits, and long-term incentive plans. Additionally, any share options or other financial instruments awarded should also be reported. To accurately track and manage these details, a comprehensive Certificate of directors remuneration is vital.

Rules concerning directors remuneration vary by jurisdiction, but general principles require transparency and disclosure. Companies must follow regulations which mandate that remuneration is reported annually, reflecting fairness and reasonableness in compensation practices. Failure to adhere can lead to legal implications; hence, understanding the Certificate of directors remuneration is critical.

A director's remuneration note provides insights into the specific compensation practices of a company. It includes details such as salary, bonuses, and benefits, as well as any additional perks given to directors. This note ensures clarity for shareholders and other stakeholders, and is often a key component of the Certificate of directors remuneration.

A director's remuneration encompasses all forms of compensation provided to a company director for their services. This compensation typically includes base salary, bonuses, stock options, and other financial rewards granted for their contributions to the company. Understanding the concept of a 'Certificate of directors remuneration' can help ensure compliance with legal standards and accurate reporting.

To record director remuneration, you should enter the amounts in your accounting system as an expense. This includes salaries, benefits, and any additional form of compensation. Accurate entries ensure that your financial records and the certificate of directors remuneration reflect true figures.

Directors' remuneration should be placed within your company's financial documentation, specifically in the notes to the accounts. This section provides detailed insights into compensation packages and regulatory compliance. Include all relevant information in your certificate of directors remuneration for a comprehensive overview.

Directors' remuneration should be prominently displayed in the financial statements of your organization. Typically, this information is included in the notes, allowing stakeholders to review it easily. Your certificate of directors remuneration will also serve as a formal document highlighting these disclosures.