Custodial Parent Under Withholding Child

Description

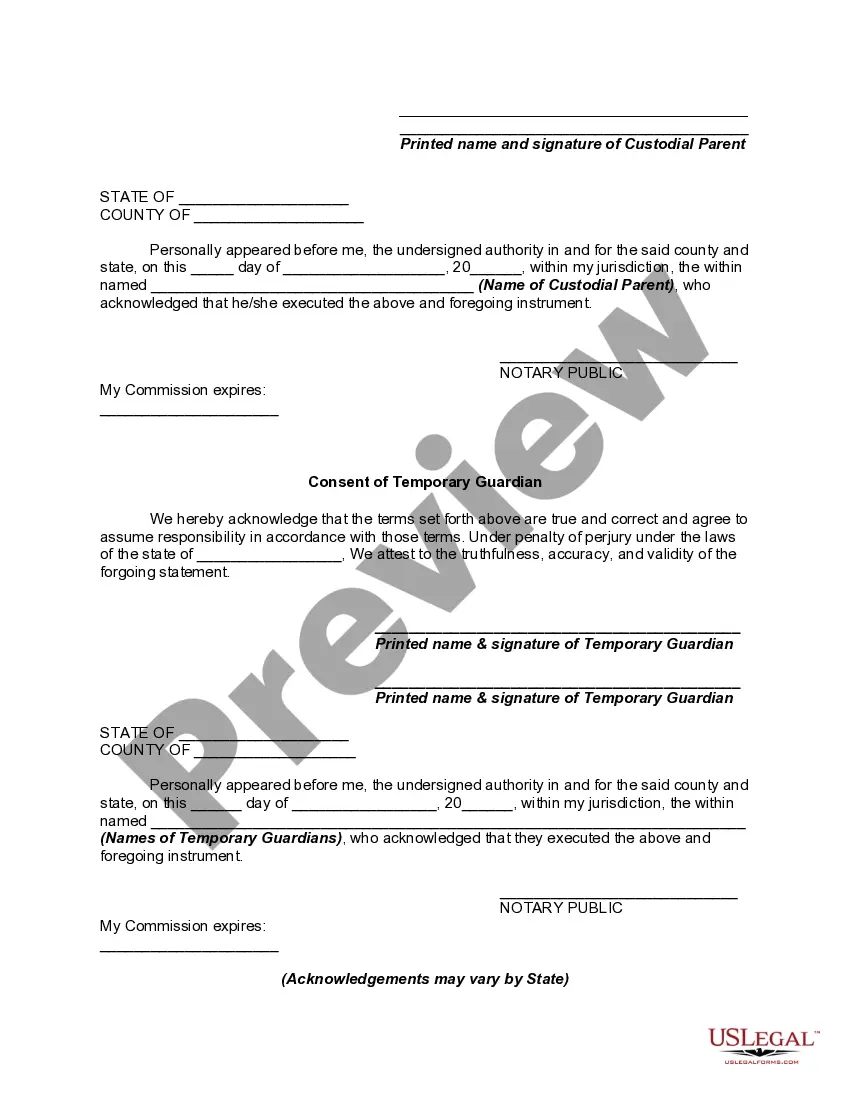

How to fill out Temporary Guardianship Agreement With Detailed Authorization Regarding The Acquiring Of Medical Care For Minor Children - Including Consent Of Temporary Guardians?

Obtaining a primary location to secure the most up-to-date and applicable legal samples is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents requires precision and meticulousness, which is why it is essential to draw samples of Custodial Parent Under Withholding Child exclusively from trustworthy sources like US Legal Forms. A faulty template could squander your time and delay your current situation. With US Legal Forms, your concerns are minimal. You can access and review all information pertaining to the document’s application and importance for your scenario and in your jurisdiction.

Eliminate the hassle associated with your legal documentation. Browse through the comprehensive US Legal Forms catalog to discover legal samples, verify their applicability to your situation, and download them instantly.

- Utilize the library navigation or search function to find your sample.

- Examine the form’s description to determine if it meets the standards of your jurisdiction.

- Preview the form, if an option, to confirm it is the document you need.

- Return to the search to find the correct template if the Custodial Parent Under Withholding Child does not fulfill your requirements.

- Once you are certain about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not have an account yet, click Buy now to procure the template.

- Select the pricing plan that best accommodates your needs.

- Proceed with the registration to finalize your purchase.

- Conclude your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Custodial Parent Under Withholding Child.

- Once you have the form on your device, you can modify it using the editor or print it to complete it manually.

Form popularity

FAQ

Malicious Parent Syndrome (MPS) is a type of vengeful behavior exhibited by some divorcing or separated parents. It occurs when a parent deliberately tries to place the other bad parent in a bad light and harm their child's relationship with them.

But if we over-parent and smother them, it can backfire big time. A collection of research in recent years shows a connection between helicopter parenting and mental health issues like anxiety and depression as children get older and try to make it on their own.

Keeping a child away from the other parent can backfire in serious and permanent ways. If the other parent feels that the situation will not resolve itself, they have the legal right to bring the matter before the court to enforce the existing court order regarding the parenting plan and their visitation rights.

If a parent fails to follow custody arrangement by refusing to allow the other parent to have custody of the child for a scheduled visit or by failing to return a child after visitation, that parent could face a charge of custodial interference.

The custodial parent is the parent with whom the child lived for the greater number of nights during the year. The other parent is the noncustodial parent. In most cases, because of the residency test, the custodial parent claims the child on their tax return.