Settlement distributions Santa Ana withholding refers to the process of withholding a portion of a settlement or judgment award in Santa Ana, California, for various purposes. This withholding is typically done to meet legal requirements, address tax obligations, or satisfy outstanding debts or liens. It is important to understand the different types of settlement distributions Santa Ana withholding to ensure compliance with relevant regulations and fulfill all financial responsibilities. 1. Tax Withholding: One major type of settlement distribution Santa Ana withholding is for tax purposes. When a settlement or judgment award is received, the recipient may be required to pay income taxes on the amount received. The Santa Ana withholding process helps ensure that the appropriate taxes are paid to the Internal Revenue Service (IRS) and the California Franchise Tax Board (FT). The withheld amount is typically based on the tax obligations associated with the settlement or award. 2. Child Support or Spousal Support Withholding: In cases where the recipient owes child support or spousal support, a portion of the settlement or judgment award may be withheld to address these obligations. Santa Ana withholding ensures that the required support payments are made to the appropriate parties, such as the custodial parent or a former spouse. This type of withholding safeguards the financial interests of dependents and helps enforce court-ordered financial support. 3. Outstanding Debts or Liens: In some instances, a portion of the settlement or judgment award may be withheld to pay off outstanding debts or satisfy liens against the recipient. This can include unpaid taxes, medical bills, or other obligations. The Santa Ana withholding process ensures that these debt payments are made promptly, preventing any potential legal complications or further financial burdens. 4. Attorney's Fees and Expenses: Another form of settlement distribution Santa Ana withholding is for attorney's fees and related expenses. When an attorney represents a client in a legal matter, they may be entitled to a portion of the settlement or judgment award as compensation for their services. The withholding process ensures that the attorney receives their rightful share while protecting the recipient from any potential disputes or unpaid fees. 5. Structured Settlement Payments: In certain cases, the settlement distribution may be structured to provide periodic payments over an extended period of time rather than a lump-sum amount. In these instances, Santa Ana withholding may be implemented to facilitate these scheduled payments and ensure that they are made according to the agreed-upon terms. Overall, settlement distributions Santa Ana withholding encompasses various factors such as tax obligations, child support or spousal support payments, outstanding debts or liens, attorney's fees, and structured settlement arrangements. It is crucial for individuals involved in settlement or judgment awards to be aware of these withholding requirements to comply with legal obligations and properly manage their financial responsibilities.

Settlement Distributions Santa Ana Withholding

Description

How to fill out Settlement Distributions Santa Ana Withholding?

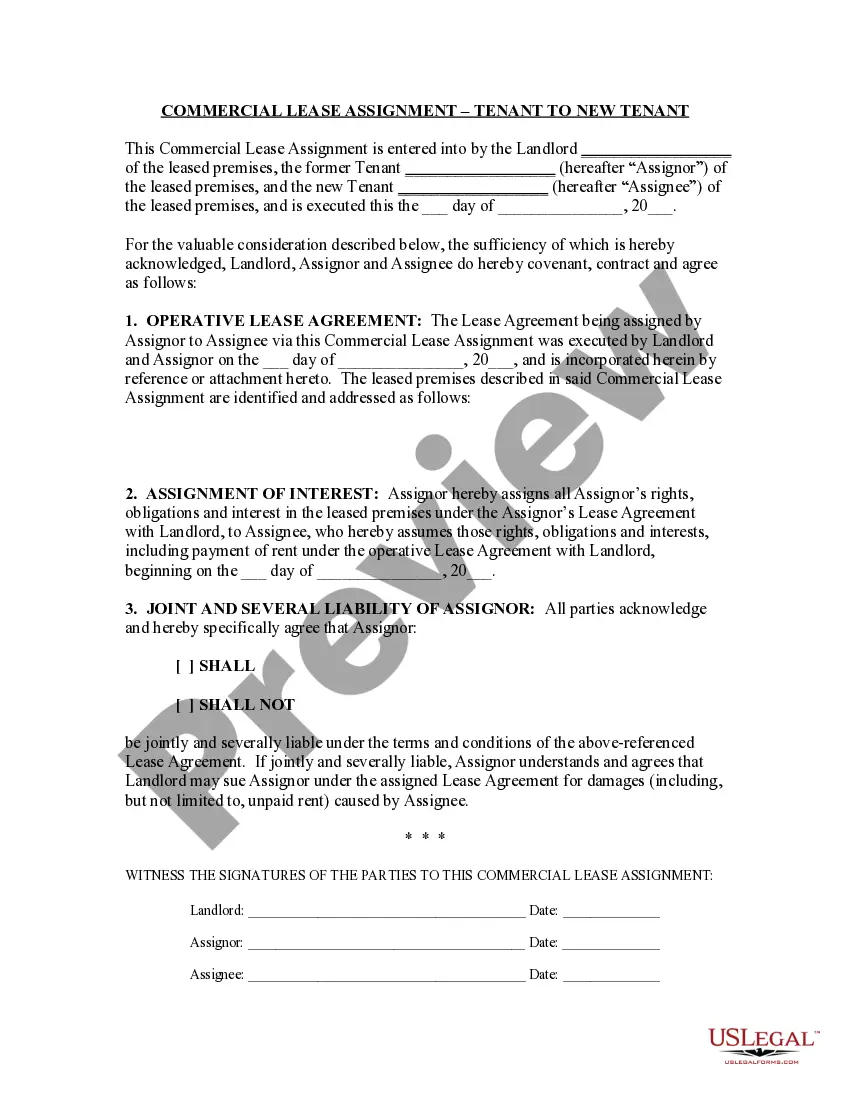

Using legal document samples that comply with federal and state laws is crucial, and the internet offers a lot of options to pick from. But what’s the point in wasting time searching for the right Settlement Distributions Santa Ana Withholding sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and life situation. They are simple to browse with all documents collected by state and purpose of use. Our professionals stay up with legislative updates, so you can always be sure your paperwork is up to date and compliant when acquiring a Settlement Distributions Santa Ana Withholding from our website.

Obtaining a Settlement Distributions Santa Ana Withholding is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, adhere to the instructions below:

- Take a look at the template using the Preview option or via the text outline to make certain it meets your requirements.

- Locate a different sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the suitable form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Settlement Distributions Santa Ana Withholding and download it.

All documents you find through US Legal Forms are reusable. To re-download and fill out previously saved forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

The Settlement Fund is $32,000,000.

The Distributor Settlement Agreement is a binding document that protects the interests of both the distributor and the company and sets clear expectations for their business relationship.

In most cases, there's little downside to joining these lawsuits, which combine many legal claims ? often thousands ? into one claim against a single defendant, reducing fees for each claimant and potentially earning a much larger payout.

Most settlement agreements involve divorce and marital issues, property disputes, personal injury cases, and employment disputes. It keeps disputes out of court and prevents parties from having to pay expensive legal fees for continued litigation and trial.

Settlement Distribution or ?Settlement Distribution Plan? means the plan for allocation of the Net Settlement Amount prepared by the Special Master setting the Settlement Sum for each Participating Class Member.