Finders Fee Definition

Description

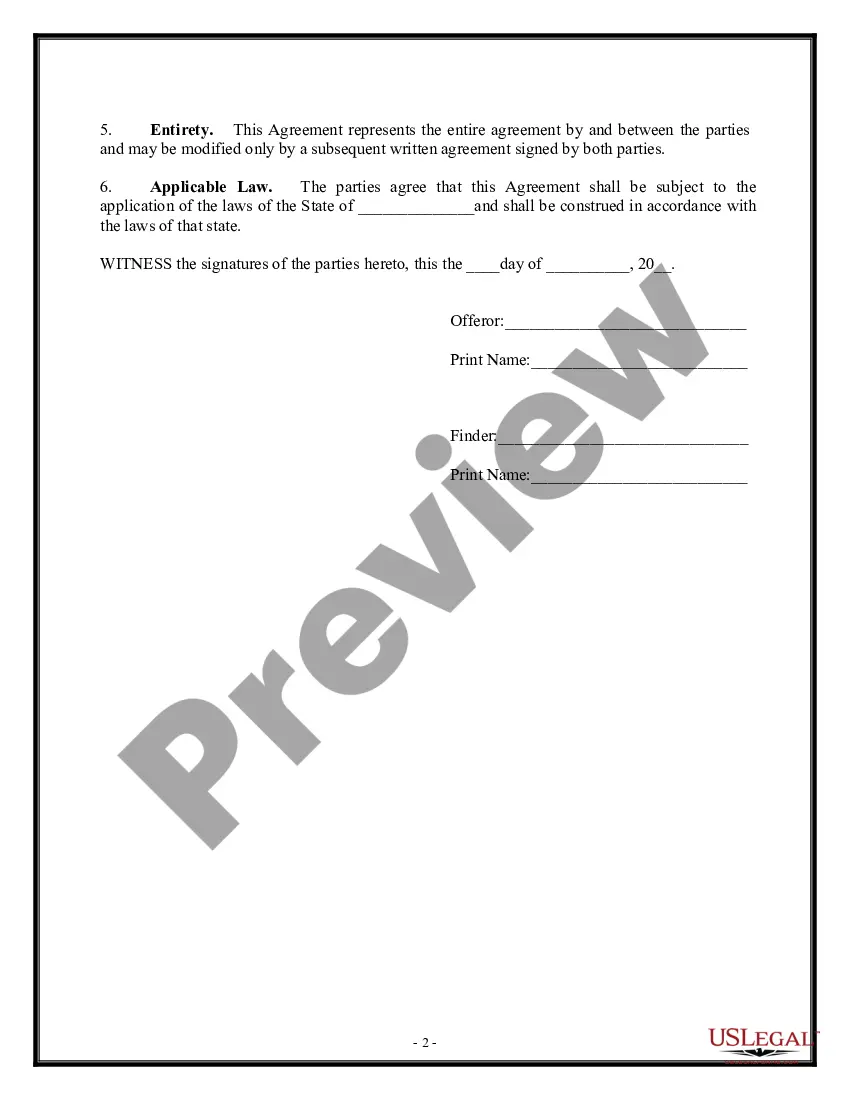

How to fill out Finders Fee Agreement?

The Finders Fee Explanation presented on this page is a reusable legal document crafted by expert attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, organizations, and lawyers with more than 85,000 validated, state-specific forms for any business and personal situation. It's the fastest, easiest, and most reliable method to obtain the documents you require, as the service ensures the utmost level of data protection and anti-malware safeguards.

Select the format you wish for your Finders Fee Explanation (PDF, DOCX, RTF) and download the sample to your device. Complete and sign the document. Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately complete and sign your form online.

- Search for the document you require and examine it.

- Browse through the sample you searched and preview it or review the form description to ensure it meets your needs. If it doesn’t, utilize the search feature to find the right one. Click Buy Now when you have found the template you require.

- Register and Log In.

- Choose the pricing plan that best fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

What Is a Typical Finder's Fee? A finder's fee need not be excessive ? the most common structure is between 5-15% of the deal value (agreed upon by both parties ahead of time).

Collecting finder's fees could be lucrative. But this isn't always free money; individuals and businesses that receive finder's fees may have to report them as taxable income to the IRS. Finder's fees, referral fees, and referral bonuses can all be reported on Form 1099-MISC or 1099-NEC.

A finder's fee isn't legally binding, so it is often simply a gift from one party to another. This is commonly seen in real estate deals. If someone is selling their home and their friend connects them with a potential buyer, the seller might give their friend a small portion of the sale when the deal is finalized.

What are referral fees? Referral fees, also known as a 'spotter fee', are a fee charged by a third party or external person when they recommend your business to potential clients.

A finder's fee (also known as "referral income" or "referral fee") is a commission paid to an intermediary or the facilitator of a transaction. The finder's fee is rewarded because the intermediary discovered the deal and brought it to the attention of interested parties.