Nondisclosure Confidentiality Agreement With Contractor

Description

How to fill out Secrecy, Nondisclosure And Confidentiality Agreement By Employee Or Consultant To Owner?

When you are required to present a Nondisclosure Confidentiality Agreement With Contractor that adheres to your regional state's laws, you may have various choices to select from.

There is no necessity to review every document to ensure it meets all the legal requirements if you are a US Legal Forms member.

It is a dependable service that can assist you in acquiring a reusable and current template on any topic.

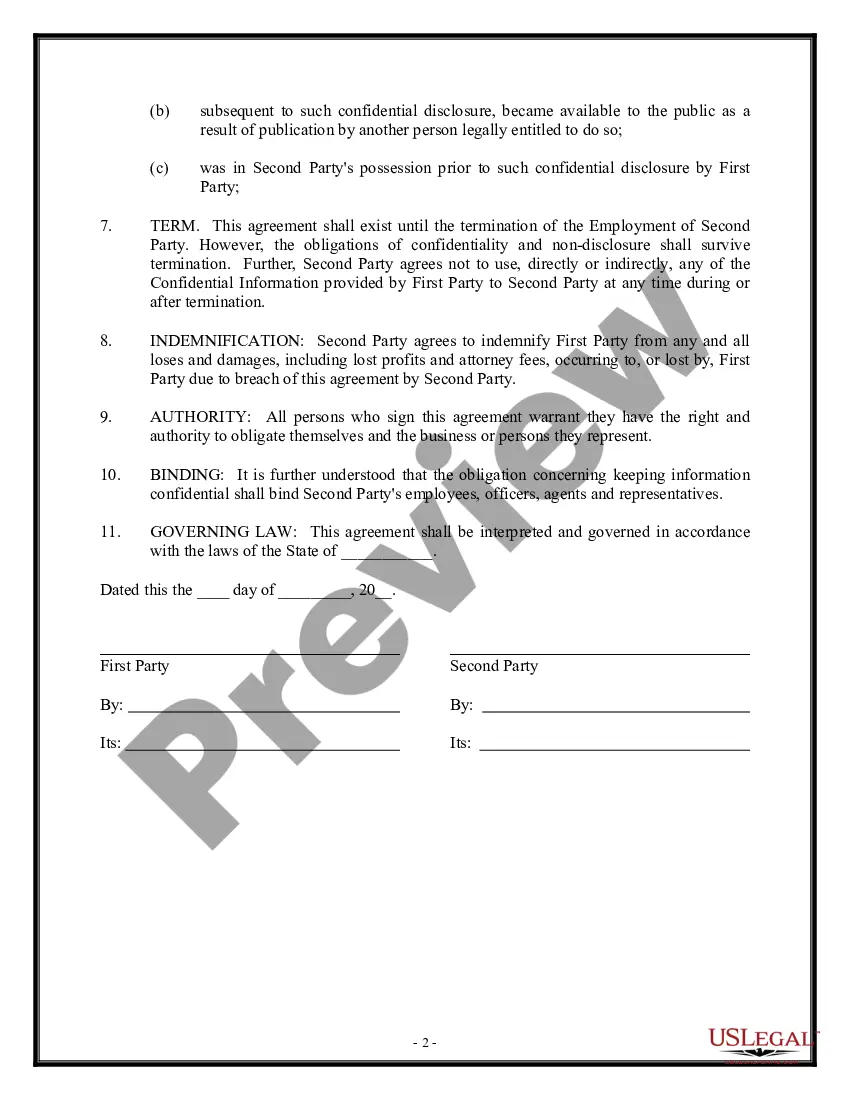

Utilize the Preview mode to view the form description if available.

- US Legal Forms is the most extensive online directory with a collection of over 85k ready-to-use documents for business and personal legal situations.

- All templates are verified to comply with each state's regulations.

- Thus, when obtaining the Nondisclosure Confidentiality Agreement With Contractor from our site, you can be confident that you possess a valid and up-to-date document.

- Acquiring the necessary template from our platform is incredibly simple.

- If you already have an account, just Log In to the system, ensure your subscription is active, and save the chosen file.

- Later, you can navigate to the My documents section in your profile and access the Nondisclosure Confidentiality Agreement With Contractor whenever needed.

- If this is your first time using our library, kindly follow the instructions below.

- Browse the recommended page and verify it aligns with your needs.

Form popularity

FAQ

Can an independent contractor sign an NDA? Not only can you have your independent contractors sign an NDA, but it's also recommended. The NDA should be a regular part of your agreements with independent contractors every time the projects require you to share sensitive information with the person you're hiring.

The NDA is common before discussions between businesses about potential joint ventures. Employees are often required to sign NDAs to protect an employer's confidential business information. An NDA may also be referred to as a confidentiality agreement.

Cons of Independent Contracting Employers like contractors because they can avoid paying for taxes and benefits, and that means those costs fall entirely on independent contractors. Contractors must withhold their own federal, state, and local taxes. They may also have to submit quarterly estimated taxes to the IRS.

The Contracting Parties and their respective counsel represent and agree that, except for matters of public record as of the date of this Agreement, they will keep the terms and contents of this Agreement confidential, and that they will not hereinafter disclose the terms of this Agreement to other persons except as

Writing the Confidentiality Agreement. Start with the basic information. This will include the title of your contract and the parties making the agreement. You may also want to include a general introduction that states the purpose of the contract.