Partner Withdrawal In Accounting

Description

How to fill out Withdrawal Of Partner?

It’s obvious that you can’t become a law expert overnight, nor can you grasp how to quickly prepare Partner Withdrawal In Accounting without the need of a specialized set of skills. Putting together legal documents is a long process requiring a particular education and skills. So why not leave the creation of the Partner Withdrawal In Accounting to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can access anything from court papers to templates for in-office communication. We understand how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s start off with our platform and get the document you need in mere minutes:

- Find the document you need with the search bar at the top of the page.

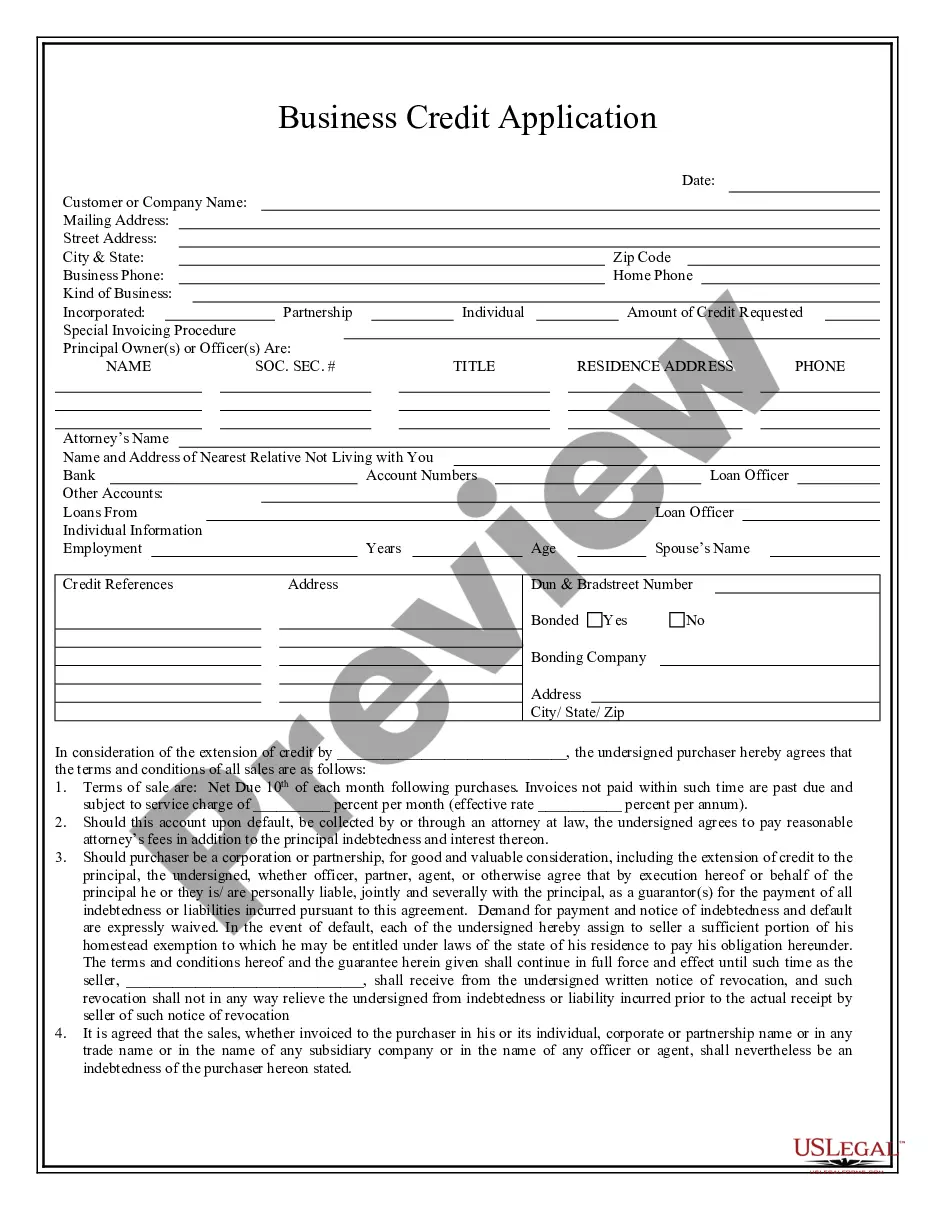

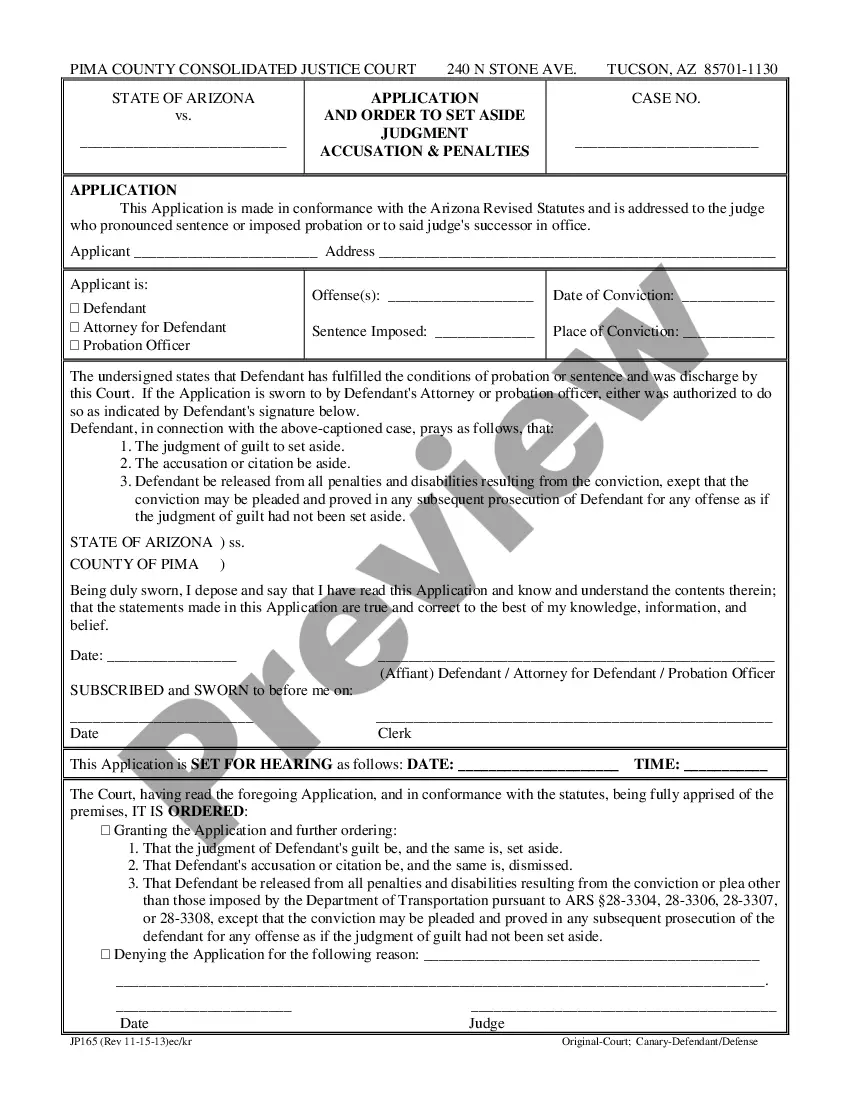

- Preview it (if this option provided) and check the supporting description to figure out whether Partner Withdrawal In Accounting is what you’re looking for.

- Start your search again if you need a different template.

- Register for a free account and select a subscription plan to purchase the template.

- Pick Buy now. As soon as the transaction is complete, you can download the Partner Withdrawal In Accounting, complete it, print it, and send or send it by post to the designated individuals or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your paperwork-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

Drawings A/c Dr. When the proprietor or partner withdraws cash from the business for personal use, the amount is debited to the drawings account and credited to the cash account. At the end of the accounting period, an adjustment entry is passed to transfer the balance of the drawings account to the capital account.

The dissolution of the partnership and distribution of the assets is a separate matter and the rules which apply would also be set out in a partnership agreement. Often if a partner leaves, the remaining one(s) will continue the business or form an LLC. The remaining partner(s) simply buy out the withdrawing one.

In accounting for the withdrawal by payment from partnership assets, the partnership should consider the difference, if any, between the agreed-upon buy-out dollar amount and the balance in the withdrawing partner's capital account. That difference is a bonus to the retiring partner.

For a Partnership Dissolution Partners, of course, can withdraw for a variety of reasons. They may simply wish to retire, or they may be facing health issues or have a family member who may need care because of a medical condition. Partners may also simply decide it's time to move on to a new pursuit.

Withdrawals from the partnership by a partner are debited to the respective drawing account. The net income for a partnership is divided between the partners as called for in the partnership agreement. The income summary account is closed to the respective partner capital accounts.