Certification Completion Form Template For School

Description

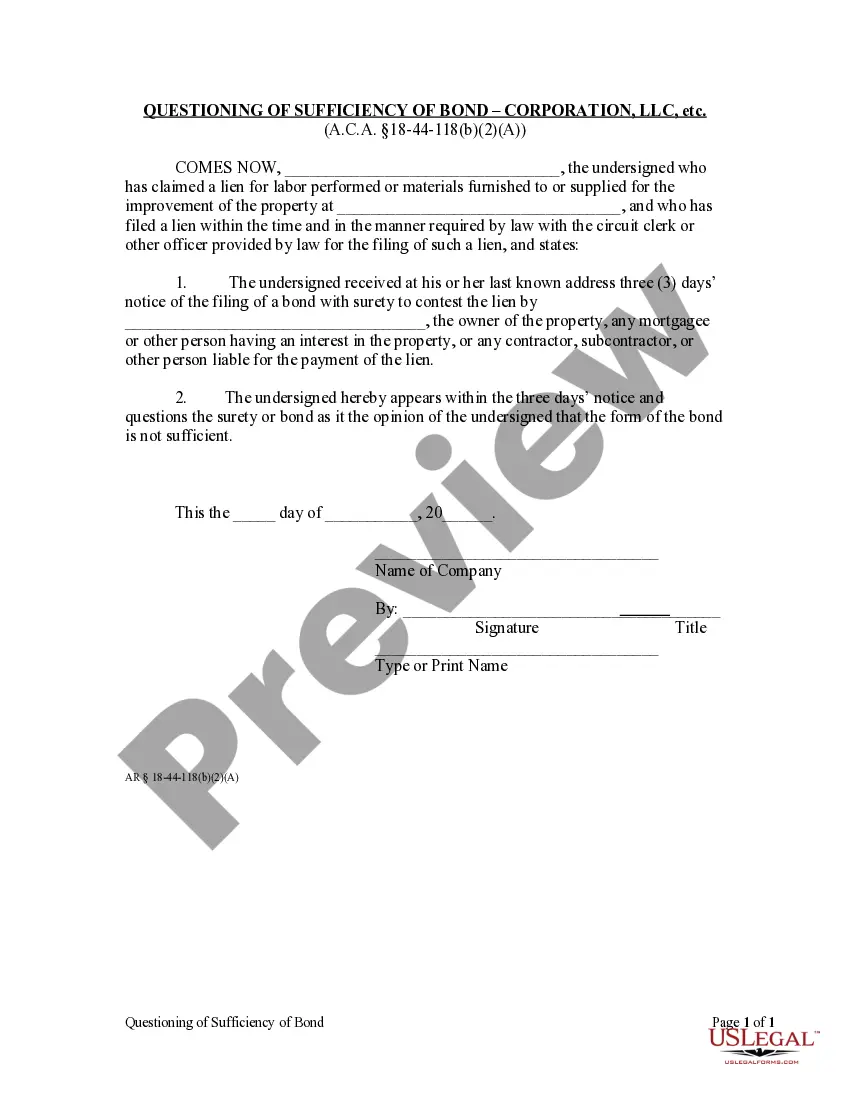

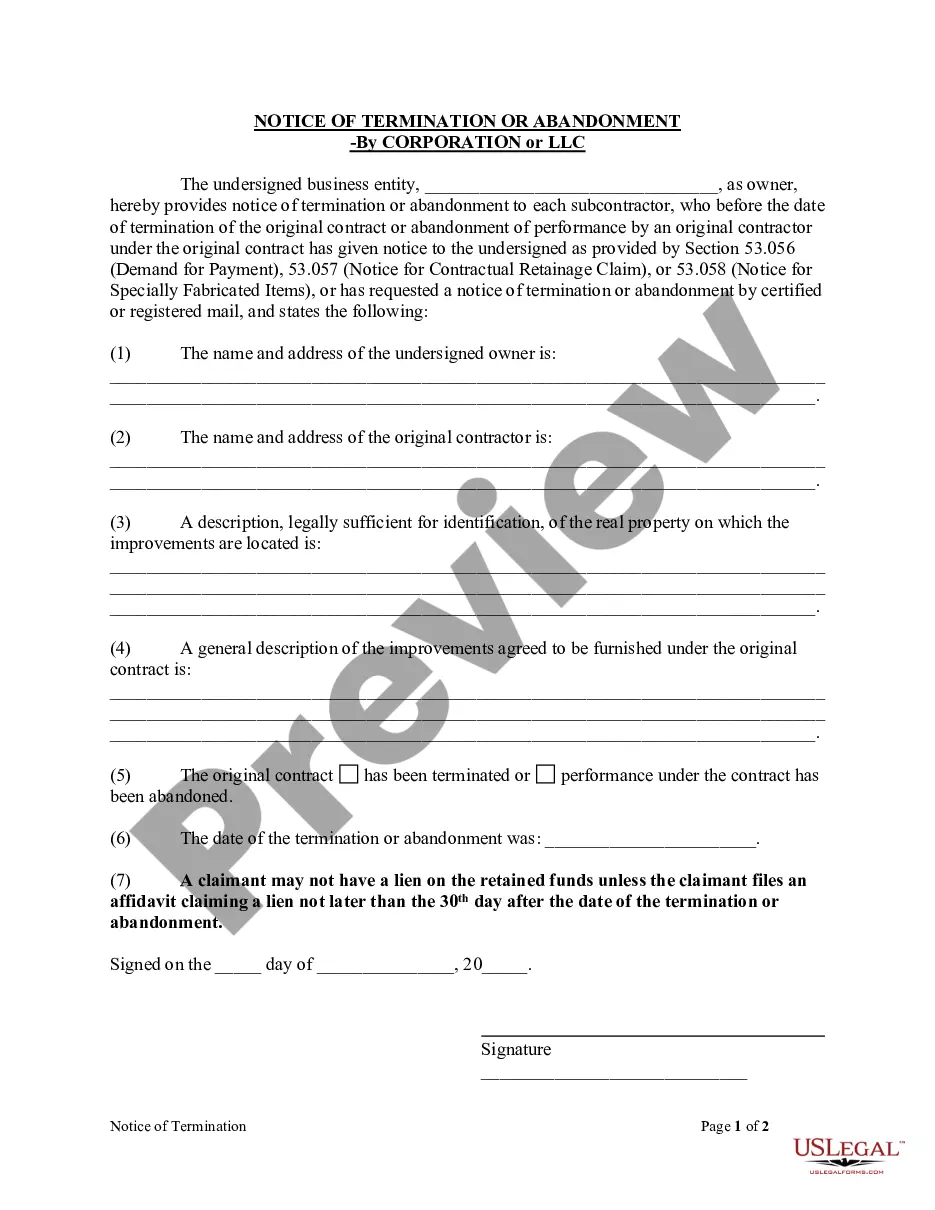

How to fill out Certification Of Completion By Contractor?

Managing legal documents can be exasperating, even for experienced professionals.

If you seek a Certification Completion Form Template For School and lack the time to search for the correct and current version, the process may be challenging.

For those with a monthly subscription, Log In to your US Legal Forms account, look for the desired form, and download it.

Check your My documents tab to review the documents you have previously downloaded and manage your folders as you deem appropriate.

Experience the US Legal Forms online library, backed by 25 years of experience and reliability. Transform your daily document management into a streamlined and user-friendly process today.

- Verify that this is the correct form by previewing it and reviewing its details.

- Ensure that the template is approved in your state or county.

- Select Buy Now when you are ready.

- Choose a subscription plan.

- Locate the format you need, and Download, complete, sign, print, and send your documents.

- Utilize advanced tools to fill out and manage your Certification Completion Form Template For School.

- Access a collection of articles, guides, manuals, and resources pertinent to your circumstances and requirements.

- Save time and effort searching for the forms you need by using US Legal Forms’ sophisticated search and Review tool to find and download the Certification Completion Form Template For School.

Form popularity

FAQ

North Carolina Resident Debt Relief. InCharge provides free, nonprofit credit counseling and debt management programs to North Carolina residents.

If your creditors want to sue you over unpaid debts, they have three years from when you defaulted on the debt . Therefore, any lawsuit filed more than three years after that date is not legally valid and should be rejected by the courts. A bankruptcy lawyer can explain more about how this impacts your rights.

This means that a creditor or debt collector only has three years to sue someone for a date, starting from the date of the first missed payment made on the account. So, the NC statute of limitations on credit card debt is just three years. Likewise, the statute of limitations on medical debt in NC is three years too.

Debt relief qualifications To qualify for National Debt Relief's settlement program, there are a few factors at play. You must owe at least $7,500 in debt and be at least several months behind on payments. You must also be able to make monthly payments to National Debt Relief at an agreed-upon rate.

After a debt is canceled, the creditor may send you a Form 1099-C, Cancellation of Debt showing the amount canceled and date of cancellation. Contact the creditor if you receive a 1099-C reflecting incorrect information.

The North Carolina Offer In Compromise program allows qualifying, financially distressed taxpayers the opportunity to put overwhelming tax liabilities behind them by paying a lump sum amount in exchange for the liability being settled in full.

About Form 1099-C, Cancellation of Debt | Internal Revenue Service.

Cancellation of debt (COD), sometimes referred to simply as debt cancellation, occurs when a creditor relieves a borrower from a debt obligation. Debtors may be able to negotiate with a creditor directly for debt forgiveness.