Civil Complaint For Debt

Description

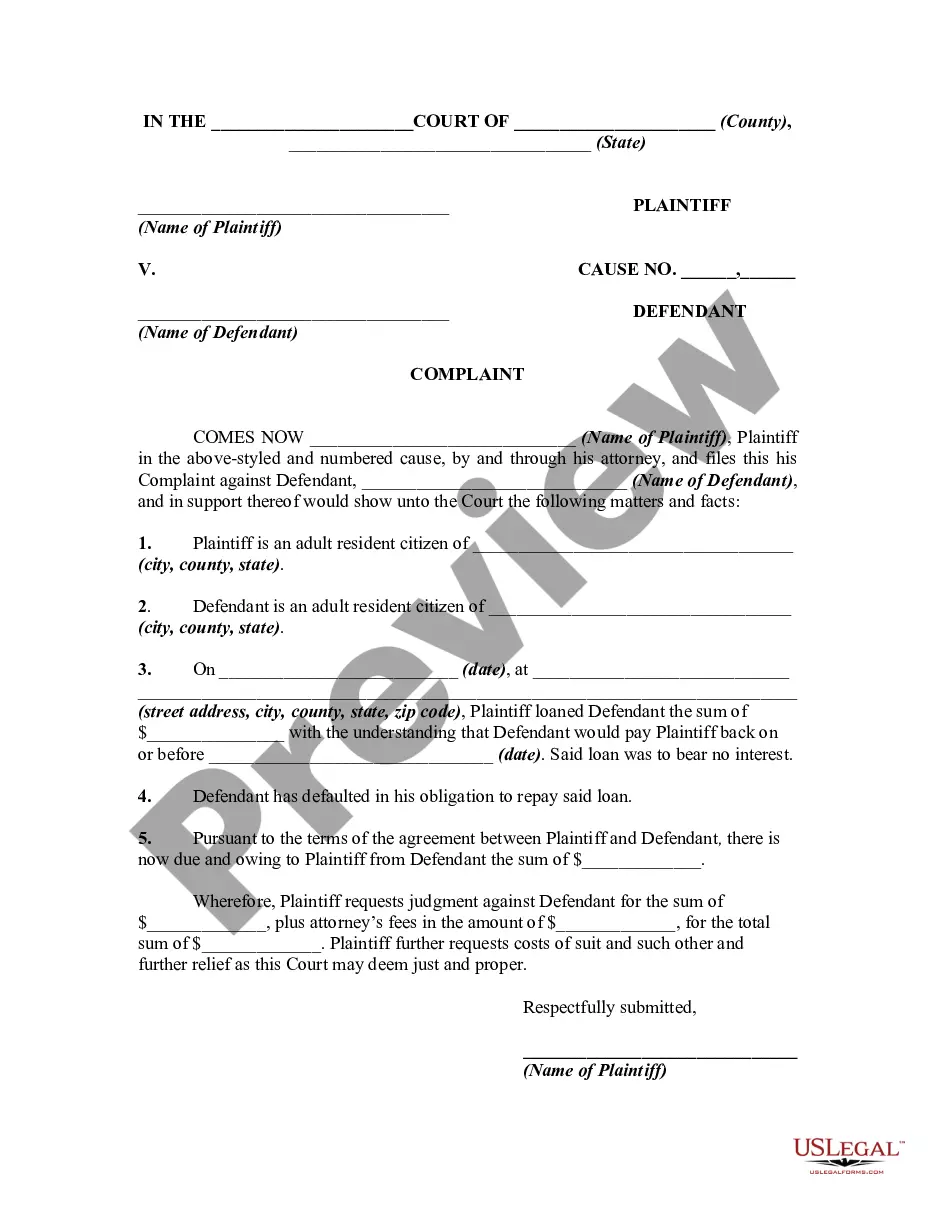

How to fill out Complaint For Refusal To Pay Debt - Breach Of Oral Or Implied Contracts?

- If you are a returning user, log in to your account to access and download the required template directly. Ensure your subscription is active; if not, please renew it accordingly.

- For first-time users, begin by accessing the US Legal Forms homepage. Search for 'civil complaint for debt' and review the form description and preview mode to ensure it suits your needs and jurisdiction.

- If the form is not suitable, utilize the search bar to find the correct template. Once you locate a matching document, proceed to the next step.

- To purchase the document, click the Buy Now button. Select your preferred subscription plan and create an account to unlock full access to the library.

- Complete your purchase by entering your payment information, using either a credit card or PayPal.

- Finally, download your civil complaint for debt template to your device. You can also find it under the My Forms section of your profile for future reference.

Using US Legal Forms offers numerous advantages, including access to an extensive collection of over 85,000 legal forms. This resource is designed to empower both individuals and attorneys in swiftly executing legal documents.

In conclusion, utilizing US Legal Forms is an efficient way to prepare your civil complaint for debt. With its comprehensive library and expert assistance options, you can ensure that your documents are accurate and legally sound. Start your process today!

Form popularity

FAQ

Settlement can often be better than going to court, especially for those seeking quick resolutions and fewer costs. A settlement reduces uncertainty and the potential for a long trial while providing an opportunity to negotiate a lower amount. If facing a civil complaint for debt, consider this option as it may offer peace of mind and closure much sooner than litigation. Every situation is different, so weigh your choices wisely.

Outsmarting a debt collector involves understanding your rights and the law surrounding debt collection. Always request verification of the debt and keep a detailed record of all communications. When responding to a civil complaint for debt, ensure your answer is well-supported and assertive. Educating yourself on collection practices can give you a significant advantage.

The choice between settling your debt or going to court depends on your unique circumstances. If you feel confident in your case and believe the debt is incorrect, you might opt to contest the civil complaint for debt in court. Conversely, if a settlement offer seems reasonable and it relieves your financial burden, that could be the wiser choice. Evaluating the pros and cons of each option will help guide your decision.

Deciding whether to settle a debt or go to court often depends on your financial situation and the details of the debt. Settling can provide a quicker resolution and reduce stress, while going to court can lead to a more formal resolution. However, if the civil complaint for debt is unjustified, fighting it in court might be the better choice. Consider your options carefully before making a decision.

Winning a court case against a debt collector requires strong evidence and a clear strategy. Start by gathering all relevant documentation, including payment records and correspondences. Focus on the details when drafting your answer to the civil complaint for debt, as the more organized your defense, the stronger your position will be in court. It may also be advisable to consult an attorney with experience in debt collection cases.

Debt collectors win cases in court frequently, but this is not guaranteed. The outcome greatly depends on factors such as documentation, evidence, and the validity of the debt. If you believe the debt is erroneous, contesting through an official answer can help you in the civil complaint for debt process. Knowledge and representation are key to your success.

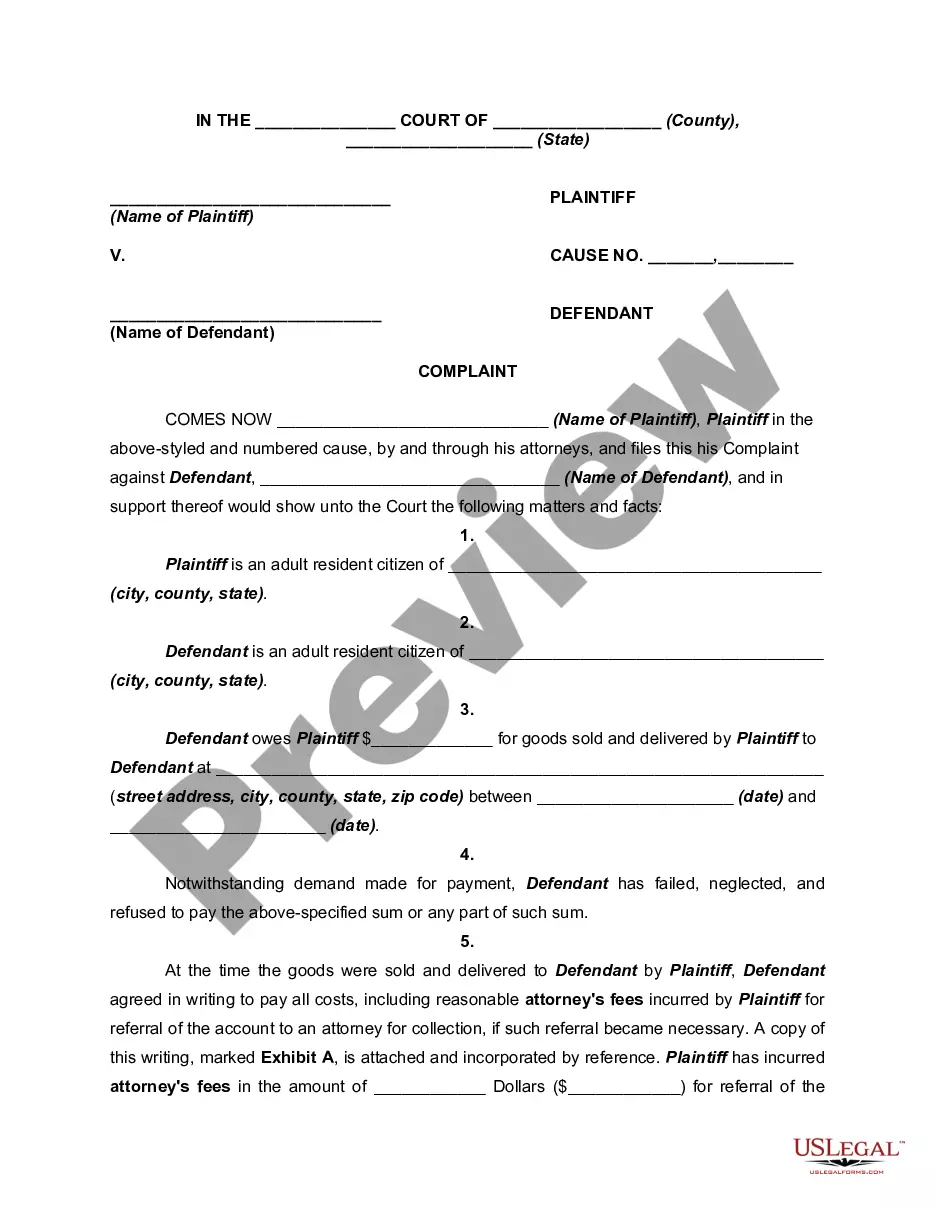

When writing a civil complaint, you should begin by clearly stating the facts that support your claim. Include the parties involved, the legal basis for your complaint, and what you seek as a remedy. Make sure to format the document according to your jurisdiction's rules, and detail every relevant event leading to the civil complaint for debt. Seeking guidance from resources like US Legal Forms can simplify this process.

To write an answer to a summons for debt, start by reading the summons carefully to understand the claims against you. Your response must address each point made in the complaint, including any defenses you wish to raise. It's crucial to file your answer with the court and serve a copy to the plaintiff as soon as possible. Remember, responding to the civil complaint for debt promptly can affect the outcome of your case.

The largest amount you can claim in small claims court typically ranges from $5,000 to $10,000, varying by state. This limit applies to cases including civil complaints for debt, making it essential to ensure your claim falls within these parameters. If your debt exceeds this limit, considering a civil suit may be necessary, where you can potentially recover more substantial amounts.

The maximum amount you can sue for varies by state and court type. In general civil courts, you can often seek compensation in excess of $100,000 for civil complaints for debt, depending on losses incurred. However, if your case falls under small claims jurisdiction, you will face limits around $5,000, so it’s vital to evaluate which court fits your claim.